# ThredUp IPO: 5 things to know about the secondhand e-commerce site before it goes public

Table of Contents

“#

ThredUp IPO: 5 things to know about the secondhand e-commerce site before it goes public

”

Oakland, Calif.-based online resale company ThredUp Inc.

TDUP,

which has filed its initial public offering prospectus with the Securities and Exchange Commission after first filing to go public confidentially in January, says it will offer 12 million shares when it begins trading. Pricing is expected to be in the range of $12 to $14.

ThredUp plans to trade on the Nasdaq Global Select Market under the ticker “TDUP.” There are nine banks underwriting the deal, led by Goldman Sachs, Morgan Stanley and Barclays.

Employee headcount has also grown. ThredUp had 1,862 staff members and contractors as of December 31, 2020, up from 1,076 employees and professional contractors as of December 31, 2018.

The company was founded by James Reinhart, who is now chief executive, and Christopher Homer, who is now chief operating officer. Reinhart is also the co-founder of a charter management group that serves low-income children in California. And Homer was a midmarket adviser at Microsoft Corp.

MSFT,

from July 2005 to August 2007.

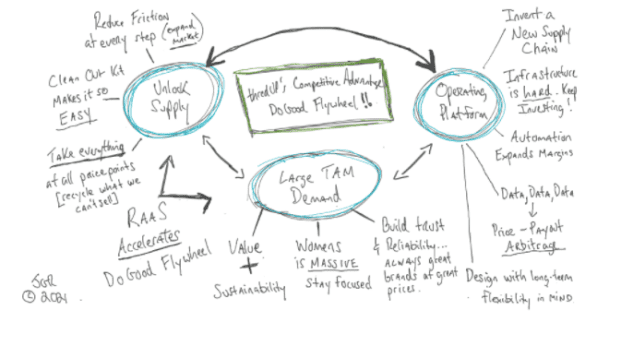

ThredUp Chief Executive James Reinhart included his “Do Good Flywheel” in the CEO letter included in the company’s prospectus

“In my view, not since the advent of off-price stores has a new model so structurally disruptive come to pass in retail,” wrote Reinhart in his letter, included in the ThredUp prospectus.

Read: Ross Stores to open 60 new stores in fiscal 2021

ThredUp had revenue of $186.02 million in 2020, up from $163.81 million the year before. But the company recorded a net loss of $47.8 million in 2020, wider than the $38.2 million loss posted in 2019.

ThredUp is classified as an “emerging growth company,” which means it does not have to make the same disclosures required of bigger public companies. A business remains an emerging growth company until it reaches a number of milestones, including annual revenue of more than $1.07 billion.

One of the risk factors ThredUp lists is its history of losses: “We expect to continue to incur net losses for the foreseeable future and we may not achieve or maintain profitability in the future,” the company says in its filing documents.

“Because the market for secondhand items is evolving, particularly the online resale of secondhand items, it is difficult for us to predict our future results of operations or the limits of our market opportunity. We expect our operating expenses to significantly increase as we expand our operations and infrastructure, make significant investments in our marketing initiatives, develop and introduce new technologies and automation and hire additional personnel.”

ThredUp is one of a number of online retailers riding a wave of accelerated digital shopping during COVID-19. Other online retailers that have recently gone public include Wish parent ContextLogic Inc.

WISH,

Poshmark Inc.

POSH,

and European luxury retailer Mytheresa

MYTE,

ThredUp is also part of the thriving secondhand sector, which is experiencing a surge as customers look for eco-friendly and budget-conscious options for filling their closets.

ThredUp’s prospectus quotes GlobalData Market Survey data, which estimates resale market growth to $36 billion by 2024 from $7 billion in 2019.

ThredUp’s own 2020 Resale Report estimates 69% growth in online resale between 2019 and 2021. And in 2019, 40% of resale shoppers were Gen Z, the largest demographic group to shop the category.

Also: Yeezy Gap collection is coming in the first half of 2021

“As these consumers mature, generate more disposable income and become a larger portion of consumer wallet share, we expect that secondhand will benefit,” the prospectus says.

ThredUp calls the fashion industry “one of the most environmentally damaging sectors in the global economy,” and aims to reduce energy and water usage by selling pre-owned items and garments.

The company offers items at a variety of price points and across thousands of brands. Sellers can send items to ThredUp using one of the site’s “Clean Out Kits” and the company will prepare the items for resale. In 2018, the company extended its marketplace to brands and retailers. ThredUp’s proprietary operations systems can process up to 100,000 items per day, and the company has created a real-time database to categorize and value items.

Here are five other things to know about ThredUp before it goes public:

The company may use some of the proceeds from the IPO to invest in or acquire other businesses

Primarily, ThredUp will use the proceeds of the deal to grow the company and for general business purposes.

“We have not entered into any agreements or commitments with respect to any acquisitions or investments at this time,” the prospectus says.

The company will also use $500,000 to launch an environmental policy function.

Like many companies when they first to public, ThredUp does not intend to offer a dividend at this time.

ThredUp’s software can help make photos effective

ThredUp says it has developed software that can choose the best photo to drive engagement with buyers, one of the largest expenses for selling items online.

“This specialized photo selection capability enables us to produce hundreds of thousands of high-quality photos a day without a professional photographer,” the prospectus says. “We can automatically sharpen, color correct and enhance photos as needed, before uploading to our marketplace in a continuous flow, 24 hours a day, 7 days a week.”

Growth was hurt by the pandemic

ThredUp warns that its growth has been crimped by the uncertainty created by the pandemic and that may continue for some time. In March 2020, the company suffered a 10% reduction in average monthly orders through compared to February 2020,” which we attribute to the general economic uncertainty at the beginning of the COVID-19 pandemic,” the prospectus said.

“While average monthly orders have generally returned to pre-COVID-19 pandemic levels, we have not seen sustained growth in orders in recent periods, which we believe is primarily due to the impacts of the COVID-19 pandemic. As a result, we have experienced an overall reduction in revenue growth rates during the second, third and fourth quarters of 2020, and that reduction in our revenue growth rates may continue in light of the ongoing impacts of COVID-19.”

During 2020, the company put a number of cost-saving measures in place, including 20% wage reductions for most corporate employees, and in June the company laid off the staff at its three small shops when it closed them for good.

Moreover, the company is evolving just as the online resale industry is developing, which makes forecasting difficult.

ThredUp is operating in a highly competitive market

Among the competitors ThredUp lists in its prospectus are RealReal Inc.

REAL,

eBay Inc.

EBAY,

and other secondhand online retailers; large e-commerce companies like Amazon.com Inc.

AMZN,

Walmart Inc.

WMT,

and Kohl’s Corp.

KSS,

; and off-price retailers like TJ Maxx parent TJX Cos.

TJX,

and Burlington Stores Inc.

BURL,

Read: Kohl’s activist investor group ‘skeptical’ that the Amazon returns program is good for earnings

And: Kohl’s says it added 2 million new customers in 2020 due to the Amazon returns program

The company is dependent on prices set by national brands and retailers

“Promotional pricing by these parties may adversely affect the relative value of secondhand items offered for resale with us, and, in turn, our revenue, results of operations and financial condition,” the prospectus said.

That means that in an effort to remain competitive, ThredUp may have to lower its prices.

“We have experienced a reduction in our revenue in the past due to reductions and fluctuations in the price of new retail items sold by national retailers and brands, and we anticipate similar reductions and fluctuations could occur in the future, such as due to a decrease in the price of new retail items in light of the economic downturn caused by the COVID-19 pandemic,” says the prospectus.

By

Tonya Garcia

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.

![#NBA suspends Draymond Green indefinitely for swinging at Suns C Jusuf Nurkić [Video]](https://s.yimg.com/ny/api/res/1.2/tkM1yskkx0gyFNsZ2whKcg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/aol_yahoo_sports_800/9d9422390c08c7d0cb885b412914f3d7)