# Which tech stocks can build on pandemic gains? Fund manager Ryan Jacob offers these two names.

Table of Contents

“#

Which tech stocks can build on pandemic gains? Fund manager Ryan Jacob offers these two names.

”

A shift away from the big tech names may be here to stay, says the manager

Investors learned plenty of lessons from the worst pandemic in more than a century. One of the biggest was that technology companies wouldn’t only survive, but thrive from a chaotic upheaval to daily living and working.

What comes next for tech companies is harder to predict, however, according to Ryan Jacob, the top-performing fund manager and chairman of Jacob Funds. “Now that we’re hopefully on the tail end of this [pandemic], which companies can build on that growth and come down from a sugar high of increased spending? That’s the challenge for us,” he said in an interview on Monday.

JAMFX,

has plenty of crisis experience to draw on. Founded in 1999, the fund survived the dot-com boom and bust, followed by the 2008-09 financial crisis, with an average annual return of 21.2% for 10 years, which is 3.4% ahead of Morningstar’s “technology” fund category.

The fund’s mandate is to seek out innovative technology companies with a wide investment moat, but Jacob said while large-cap tech has been a big market driver for the last eight or nine years, the fund has veered in another direction.

He said they are focusing on small-to-midsize companies that can “give us the kind of growth that can justify somewhat elevated valuations. That’s the environment we’re in today.” So investors won’t find the likes of electric-car maker Tesla

TSLA,

exercise equipment company Peloton Interactive

PTON,

Zoom Video Communications

ZM,

or streaming platform Netflix

NFLX,

in the fund, even though social media giant Facebook

FB,

and Google parent Alphabet

GOOGL,

remain. A long-term holding of tech giant Apple

AAPL,

was sold last year, he said.

“We’re definitely bottoms-up investors, so the individual stocks, our top holdings, are a little bit more of an eclectic mix and they definitely benefited [from the pandemic], but they’re not necessarily these larger companies that a lot of our peers gravitated to,” he said.

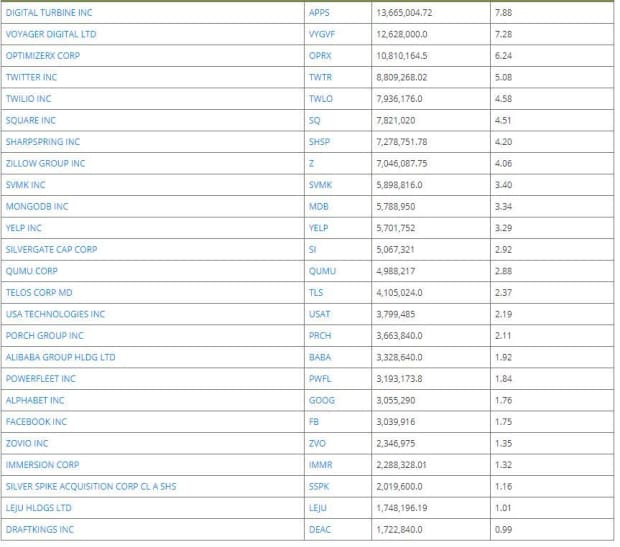

Top 10 holdings for Jacob internet Fund, as of February 28, 2021.

Jacob Funds

Jacob also worries the bigger names could be “quite dangerous,” as companies start to come down from a so-called “sugar high” from 2020. “They put such extraordinary growth up last year, it’s gonna be hard to match,” he explained.

As for the stock picks, Jacob starts with the fund’s top holding, Digital Turbine

APPS,

which pre-installs apps on phones for major U.S. wireless carriers, such as AT&T

T,

and Verizon

VZ,

but also international names such as Telefónica

TEF,

TEF,

and América Móvil

AMX,

“All of these players are trying to get a piece of the advertising pie. They feel they have valuable real estate on the phone and want to get their cut,” said Jacob, who notes the devices are run on Google’s Android system, and not Apple, which doesn’t permit the kinds of apps installed by Digital Turbine.

“It’s been a great business for them and they’ve kind of become the market leader in this market. It’ll be difficult for competitors to catch up, almost think like a Google-type scale because once you have the most advertisers, the best prices, the most relationships, it’s really hard to get that network effect, and hard for other players to get in,” he said.

Despite enjoying a huge boom in the wake of last year’s work-and-stay-at-home dominance, Digital Turbine should continue to do well because its international agreements are starting to increase, said Jacob. Shares of Digital Turbine rose nearly 700% in 2020, but are up a more modest 29% year-to-date in 2021.

Another big holding for the fund is Optimize RX

OPRX,

which provides digital health solutions for healthcare companies, doctors and patients. “What that really means is when a doctor is prescribing to a patient, they’ll get notifications on discounts, copays as options for them,” he said.

That software platform turned into a valuable asset for its target audience last year, he said, noting that in the wake of the COVID-19 pandemic, internet advertising is on everyone’s budget. And as drug companies are some of the biggest advertisers in the world, “they’re seeing much better results through digital advertising,” he added.

Shares of OptimizeRx are up 55% this year, after shooting up 203% in 2020. It is just another example of a company that has found a foothold during the pandemic to keep growing, though “there are plenty of others that will struggle,” said Jacob.

By

Barbara Kollmeyer

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.