# Weekend reads: The value proposition in the stock market

Table of Contents

“#

Weekend reads: The value proposition in the stock market

”

Also, tips for getting your $1,400 stimulus payment and the next dominant electric-vehicle maker after Tesla.

Over the past several weeks, fears of rising long-term interest rates and inflation have helped push down shares of many large technology companies. At the same time, value stocks — those of slower-growing companies — have been performing quite well. They tend to rise at the early stages of an economic recovery.

Mark Hulbert shares his method for screening value stocks and the ones that made the list.

- Here’s how far the Nasdaq could fall if bond yields reach 2%

- Don’t be fooled by the ‘value’ tag on these tech stocks. Many can provide plenty of growth too

-

The ECB just fired back against rising bond yields, catching traders off guard

Qualifying for those $1,400 stimulus payments

President Biden signed the $1.9 trillion pandemic stimulus package on Thursday and people are expected to begin receiving electronic payments from the Internal Revenue Service this weekend. Here’s who will qualify for the payments.

But what if you are over the income line that would make your payment go down or disappear completely? Andrew Keshner has tax tips to help you qualify.

More on the stimulus and its effects:

- What the $1.9 trillion COVID bill means for families with children

- Mortgage loan rates keep increasing — and the $1.9 trillion pandemic relief bill could push them even higher

- What to do if you already filed taxes but want to claim the $10,200 unemployment tax break

Time for biotech

Biotechnology stocks have been in a bear market. This means it’s time to buy them, according to Michael Brush, who shares 18 sector picks.

More from Michael Brush: Five reasons why emerging markets are a better place for investors now

What it’s like to retire in Thailand

Kamala Beach in Thailand.

Courtesy Pete Bowen

Silvia Ascarelli interviews Pete Bowen, who decided to retire to Thailand after being laid off from his job in 2009. He breaks down the costs of retiring in “paradise,” while digging into other details, such as health insurance and visa requirements.

Read about the other retirement money question: Can I afford to retire? Not before you know the answer to this big question

Some employers can’t find people to hire — here’s a solution

Bring back retirees and take advantage of their intellectual capital.

Two IPOs

The market for initial public offerings has been very strong, with scores of deals facilitated by special acquisition companies, or SPACs. But some companies are going through the traditional IPO process. Tonya Garcia looks into two new ones:

-

Joann Inc.

JOAN,

+2.08%

went public on March 12 when it was priced at $12 a share. - ThredUp is an e-commerce site for second-hand items that has filed for an IPO.

Silicon Slopes?

Utah Jazz owner Ryan Smith.

Getty Images

Ryan Smith bought the Utah Jazz late last year. He followed that purchase by helping to bring Qualtrics International Inc.

XM,

public for $1.55 billion in January. He had founded the company with his father and brother. Jon Swartz reports on Smith’s efforts to help turn the Salt Lake City are into the next Silicon Valley.

Will you get a vaccine passport?

They may help tourism recover, but there are also downsides, according to Yara M. Asi, a post-doctoral scholar in health management and informatics at the University of Central Florida in Orlando.

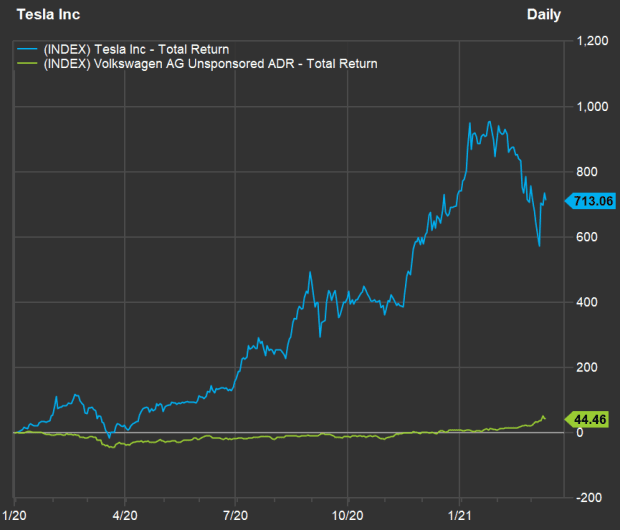

This may be the next big electric vehicle player, after Tesla

FactSet

Take a look at this stock chart, which shows total returns for shares of Tesla Inc.

TSLA,

and American depositary receipts of Volkswagen AG

VWAGY,

since the end of 2019.

- Tesla’s shares have 713% since the end of 2019.

- Tesla’s stock has pulled back 23% since hitting its all-time intraday high on Jan.25.

-

Volkswagen’s ADR line on the chart looks flat, but that return of 44.5% since the end of 2019 measures up rather well against a 25% return for the S&P 500 index

SPX,

+0.10% .

Analysts at UBS expect Volkswagen to be a dominant player in the electric-vehicle market, along with Tesla, by 2025.

Even a presidential dog can have difficulty adjusting to a new home

First Dogs Champ and Major (front center) have been sent back home to President Biden’s home in Delaware, but will return to the White House soon

The White House

President Joe Biden’s dog Major made the news when he bit a member of the White House security staff. Nicole Lyn Pesce interviews Cesar Millan, known as the “Dog Whisperer, who explains why dogs bite and how to help them adapt to new surroundings.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.

By

Philip van Doorn

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.