#The Ratings Game: Nvidia betting price hike won’t deter core gamers holding out for its next-gen chip

Table of Contents

“The Ratings Game: Nvidia betting price hike won’t deter core gamers holding out for its next-gen chip”

Price of mid-tier Lovelace gaming chip marked 29% higher than Ampere-based predecessor

Nvidia Corp. appears to be betting that a price hike during inflationary times won’t deter hardcore gamers who have been waiting to upgrade their rigs amid a slowdown in consumer demand.

On Tuesday, Nvidia

NVDA,

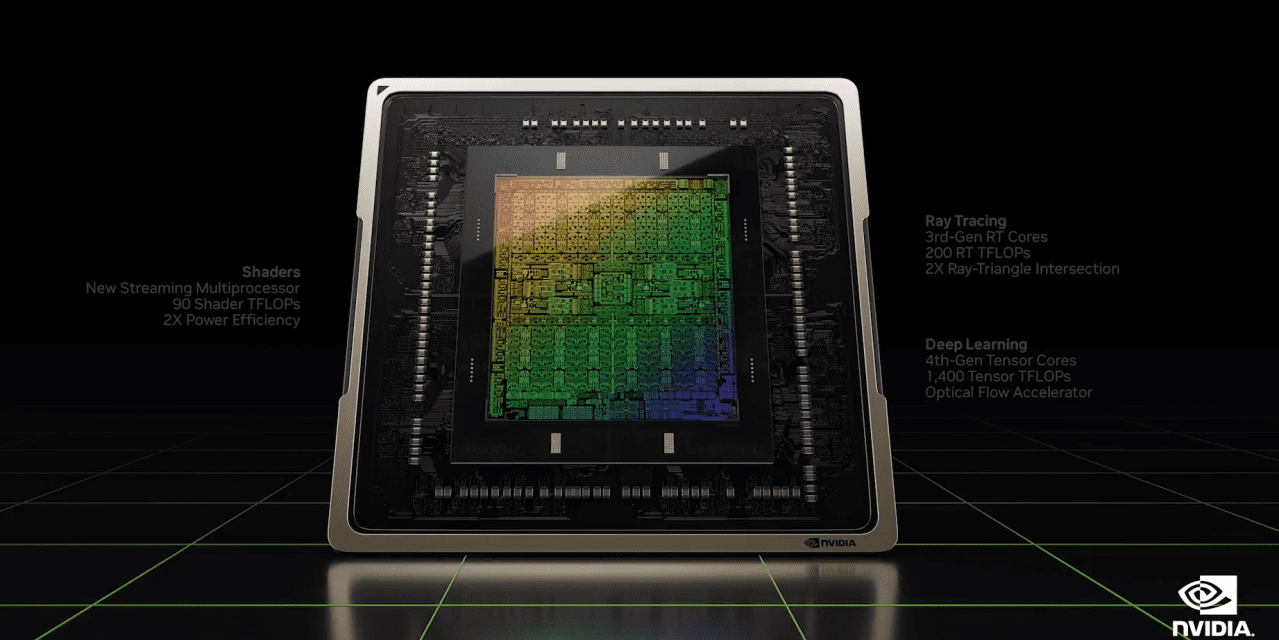

Chief Executive Jensen Huang launched the company’s next-generation “Lovelace” chip architecture, meant to power the company’s foray into the metaverse with its Omniverse platform.

“We are somewhat concerned about Nvidia raising prices into a collapsing GPU market, but see the long-term significant positives from these products,” said Susquehanna Financial Group analyst Christopher Rolland in Tuesday note immediately following the launch.

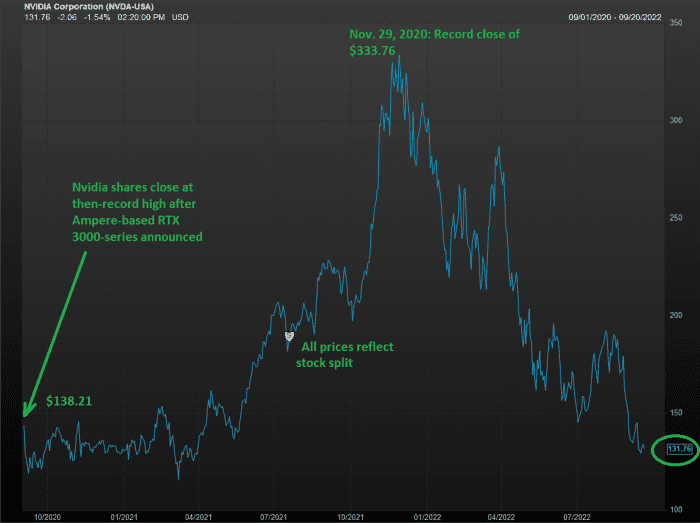

Lovelace succeeds Ampere, which was unveiled in May 2020, about two months into the COVID-19 pandemic, amid strong demand for gaming cards. When the Ampere-based gaming cards were introduced in September 2020, the top-of-the-line RTX 3090 listed for $1,499, and the mid-tier 3080 at $699.

For the respective classes of chip, that’s a 7% price hike for a top-tier chip RTX 4090 to $1,599, and a 29% hike for a mid-tier RTX 4080 to $899. As for the 3090, an upgraded version of the original was going for $1,100 at Best Buy in an advertised $900 price drop.

Read: Nvidia sales forecast falls about $1 billion short of expectations, stock falls

As a result of the short-term headwinds, Rolland, who has a positive rating of the stock, lowered his price target to $190 from $200.

Evercore ISI analyst C.J. Muse, who has a outperform rating and a $225 price target, said the unveiling was a positive event for the company, given it supported the long-term view of end-to-end platform development. That, he admits, is of little concern to near-term investors.

“Here, we would note that we are inching closer to a bottom, and while near-term gaming uncertainty persists, the company has outlined a clear path for growth elsewhere led by product cycles across Hopper, Orin and Grace,” Muse said, referring to other Nvidia product lines.

Read: Nvidia’s ‘China Syndrome’: Is the stock melting down?

“And if you believe in the underlying secular demand of the gaming industry (as we do), then the Ada Lovelace cycle should drive strong sequential growth in the April Q (we model Oct Q bottom, though model modestly below consensus revenues/EPS for both October and January),” Muse said.

Citi Research analyst Atif Malik, who has a buy rating and a $248 price target, said it was a relief that Nvidia announced that Ada Lovelace gaming cards did not need a license to bypass a U.S. technology ban to China that covers the company’s A100 and H100 data-center products.

“Ada is a bigger leap in gaming than Ampere was over Turing, and will target the enthusiasts segment and has comparable gross margins,” Malik said.

Read: Chip stocks could plunge another 25% as ‘we are entering the worst semiconductor downturn in a decade,’ analyst says

Of the 44 analysts who cover Nvidia, 35 have buy-grade ratings, eight have hold ratings, and one has a sell rating, with an average target price of $202.51.

Over the year, Nvidia shares have fallen 55%, compared with a 36% drop by the PHLX Semiconductor Index

SOX,

a 19% decline by the S&P 500 index

SPX,

and a 27% fall for the tech-heavy Nasdaq Composite Index

COMP,

As for the Ampere run, Nvidia’s stock price has declined 4.7% since Sept. 1, 2020, when Nvidia unveiled its RTX 3000 series Ampere-based gaming chips, versus a 9.3% gain by the S&P 500 over that period.

FactSet/MarketWatch

By

Wallace Witkowski

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.