#The Ratings Game: FedEx stock hurt as high investor expectations, labor shortages temper upbeat analyst calls

Table of Contents

“#The Ratings Game: FedEx stock hurt as high investor expectations, labor shortages temper upbeat analyst calls”

Stock paces S&P 500 decliners despite record earnings, upbeat analyst calls

Shares of FedEx Corp. sank Friday, as mostly upbeat commentary from Wall Street analysts wasn’t enough to override high investor expectations and concerns over the impact of continued labor challenges.

The package delivery company reported late Thursday that it swung to a record fiscal fourth-quarter profit and revenue that rose well above expectations, citing “exceptional” growth in U.S. domestic package services and international exports as the global economy continued to recover from COVID-19-related headwinds.

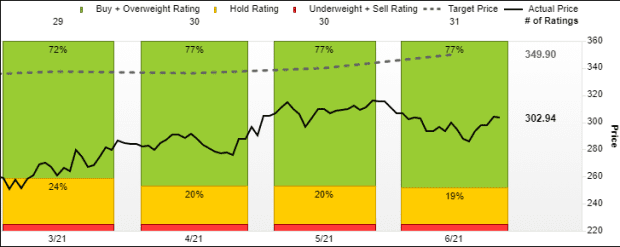

The results and outlook were good enough for no less than 14 of 31 analysts surveyed by FactSet to raise their stock price targets. That lifted the average target to $349.90, or 15.5% above Thursday’s closing price of $302.94. There are 24 analysts who are bullish on the stock, one analyst who is bearish and six who are neutral.

FactSet

Despite the strong results, the stock

FDX,

dropped 3.6% to close Friday at $291.95, enough to pace the S&P 500 index’s

SPX,

decliners.

Analyst Brian Ossenbeck at J.P. Morgan said the pressure on FedEx’s stock is likely the result of investor disappointment that the profit and revenue beats didn’t translate into a “positive surprise” with the company’s initial fiscal 2022 outlook.

“Labor cost inflation is the primary culprit,” Ossenbeck wrote in a note to clients, even as he believes those costs should peak during the current quarter.

Ossenbeck reiterated his overweight rating and $366 stock price target.

FedEx Chief Operating Officer Rajesh Subramaniam said on the post-earnings conference call with clients that “challenges with labor availability” have contributed to service levels “that do not meet our own high expectations.”

Chief Executive Frederick Smith said while the labor market shortages have begun to abate, “delivering a successful peak season when we anticipate significant year-over-year volume increases will require additional flexibility and creativity on the part of our management, staff and front-line team members while maintaining our safety-above-all culture.”

UBS’s Thomas Wadewitz said he expects labor challenges to remain a headwind for FedEx through the first half of fiscal 2022, but he believes strong pricing and volume growth are “more important factors” supporting his bullish stance on the company.

“We rate [FedEx stock] buy and we view potential weakness on labor concerns as an opportunity to reiterate our buy rating,” Wadewitz wrote in a note to clients.

He raised his stock price target to $397 from $383, which would be the highest target of the analysts surveyed by FactSet.

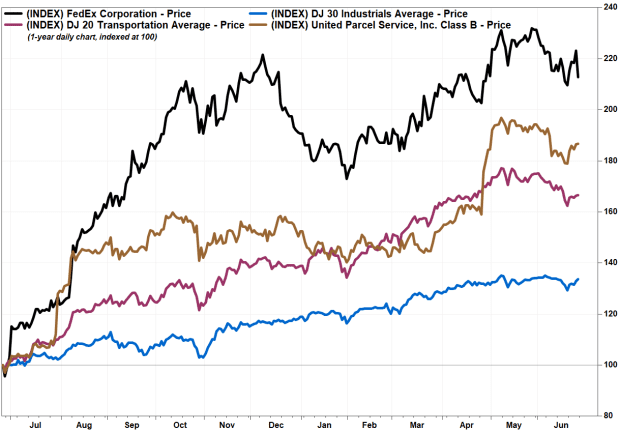

FactSet, MarketWatch

Bernstein analyst David Vernon reiterated the outperform rating he’s had on FedEx since August 2020, while boosting his price target to $368 from $346.

He said the company’s earnings beat was not as large as bullish investors had been expecting, as there were areas in Europe that were “under-earning” and as labor availability added costs and reduced productivity. While the full-year outlook was “just OK,” he said that makes it likely FedEx will raise guidance at some point.

Vernon said the stock remains “interesting” relative to other industrials as the economy can’t reopen without transport.

FedEx shares have more than doubled over the past 12 months, soaring 114.5%, while rival United Parcel Service Inc.’s stock

UPS,

has hiked up 86.0%, the Dow Jones Transportation Average

DJT,

has climbed 66.4% and the Dow Jones Industrial Average

DJIA,

has advanced 33.8%.

By

Tomi Kilgore

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.