# Stock market exuberance is here to stay, Credit Suisse says. Here’s why investors can be positive

Table of Contents

“#

Stock market exuberance is here to stay, Credit Suisse says. Here’s why investors can be positive

”

Critical information for the U.S. trading day

After a volatile first week of 2021, the second week of the year looks set to start in a slightly calmer fashion.

Having said that, markets are once again closely watching U.S. politics, after House Speaker Nancy Pelosi said the House would proceed with legislation to impeach President Donald Trump if the 25th Amendment isn’t invoked.

However, in our call of the day, Credit Suisse strategists said the exuberance was likely to continue, raising their target for global stocks and the S&P 500

SPX,

The investment bank’s analysts, led by Andrew Garthwaite, raised their end-year MSCI World Ex-U.S. target from 362 to 375, giving a 12.3% potential return from here. They said it was in line with the bank’s U.S. strategists, who raised the year-end S&P 500 target to 4,200.

They said three key important components — the put-call ratio, the bull-bear ratio and risk appetite — were slightly extended but “not at sell signals.”

“Bullish sentiment is high but at these levels markets continue to rise two-thirds of the time over the next month and we think the bullish sentiment is not reflected in retail or institutional position — indeed net speculative longs on the S&P are below average,” they said.

The strategists’ only worry was that 80% of stocks currently sit above their 200-day moving average, which would typically see markets fall two-thirds of the time over the next month. However, they said: “But in the very early cycle, as we are, this is not a short-term sell signal.

“We think a Democratic clean sweep and the vaccine rollout underpin 5% global GDP growth this year.”

Beyond the near term, there were a number of strategic reasons to stay positive, they said, including “ultraloose” policy and an additional U.S. fiscal boost of close to 2% of gross domestic product. They also saw the start of a bond-to-equity switch, as institutions start to realize that bonds are becoming increasingly less diversifying, return-less risk. Excess liquidity was also consistent with a further rerating and earnings revisions were supportive, the analysts added.

Finally, there was the potential for a “funds-flow squeeze,” with corporate buying of stocks accelerating and retail buying having returned, while pension funds — with low equities weightings in Europe and neutral weightings in the U.S. — wouldn’t be sellers.

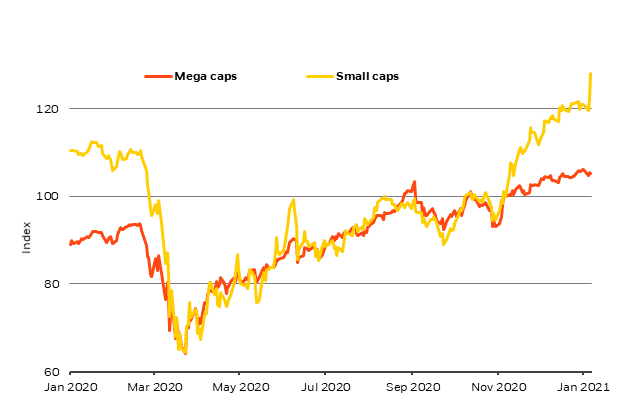

The chart

This chart from BlackRock shows the performance of U.S. megacap and small-cap stocks over the past year. Megacap stocks are represented by the S&P 100 Index, and small-cap stocks by the S&P 600. Performance is rebased at 100 on Nov. 6 — the last trading day before news organizations declared Biden had won the presidential election and U.S. drug company Pfizer

PFE,

and its German partner BioNTech

BNTX,

announced preliminary efficacy data for their COVID-19 vaccine candidate.

Source: BlackRock Investment Institute, with data from Refinitiv

The markets

U.S. stock futures

YM00,

ES00,

NQ00,

pointed lower ahead of the open on Monday, after closing at fresh all-time highs on Friday. European stocks also fell in early trading, as investors assessed surging COVID-19 cases and tough lockdowns across the continent. Bond yields

TMUBMUSD10Y,

rose on concerns the Federal Reserve will be less interested in maintaining the rate of its purchases of them.

The buzz

The price of bitcoin pulled back sharply on Sunday and again on Monday, after a bullish start to 2021. Bitcoin

BTCUSD,

was last down 10% to $34,151, according to prices quoted by CoinDesk, from nearly $41,000 on Sunday.

Twitter’s

TWTR,

stock tumbled close to 7% in premarket trading after the social-media company’s decision to permanently suspend Trump’s account.

Shares in Eli Lilly

LLY,

jumped more than 14% in premarket trading after the U.S. drugmaker said its experimental Alzheimer’s disease drug helped slow the decline of cognition and daily function in patients with early forms of the disease.

Former Republican California governor Arnold Schwarzenegger compared the events last week at the Capitol to Nazi Germany, laying the blame for the violence at the feet of the president, in a tweet that went viral on Sunday.

The Marriott International

MAR,

hotel chain said it will pause political donations to those who voted against certification of the election. Health-insurance federation Blue Cross Blue Shield and bank-holding company Commerce Bancshares also said they would be suspending donations.

Private-jet company Signature Aviation

SIG,

rose 9% to 443 pence after accepting a $4.63 billion bid from Global Infrastructure Partners that values the company at 405 pence per share. Rival private-equity groups Carlyle Investment Group and Blackstone have also indicated interest.

Random reads

Robot used for lockdown couple marriage proposal.

‘Don’t look dishevelled.’ Anger over Seoul city’s advice to pregnant women.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

By

Callum Keown

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.