# Here’s the $4.5 trillion ‘firepower’ that will drive stocks higher in April, says top strategist

Table of Contents

“#

Here’s the $4.5 trillion ‘firepower’ that will drive stocks higher in April, says top strategist

”

Critical information for the U.S. trading day

A new month is off to a bullish start, or so it seems, as stock futures climb following Friday’s better-than-expected, 916,000 gain in March jobs, which underpins investor hopes for a strong post-COVID-19 rebound.

As for the data, there’s a lot to like, according to Tim Duy, chief U.S. economist at SGH Macro Advisors.

Hence, watch for those “we can’t hire worker” stories, to come, he says.

Onto our call of the day from Fundstrat Global Advisors’s founder Thomas Lee, who says the “face ripper” rally he recently predicted shows no signs of easing up. And there’s a $4.5 trillion reason to believe gains will carry into April, he told clients.

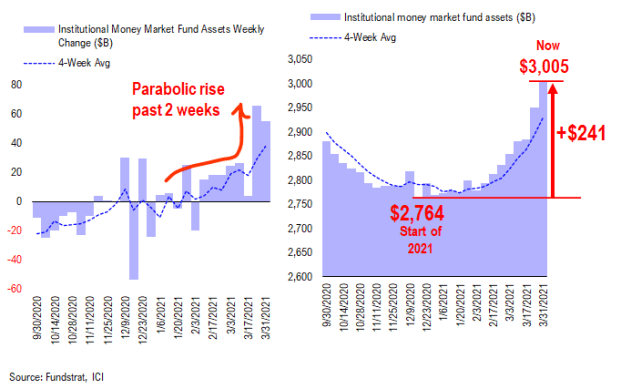

Aside from the positives out there already for this market — a strong economy and vaccine rollout — Lee points to a pile of institutional money on the sidelines, with cash balances at $3 trillion, the highest since June 2020. That’s against $2.764 trillion at the start of 2021, a “dramatic” gain of 9% or $241 billion, said Lee.

A cautious stance by institutions that went “parabolic” in the last half of March, adds to the $1.5 trillion in retail money market cash.

“Total cash on the sidelines is $4.5 trillion = tons and tons of firepower on the sidelines. This bodes well for April equity gains,” said Lee.

Lee expects small-caps, energy and cyclical stocks — geared toward an economic recovery — to continue leading into the second quarter.

“Recall that cyclicals are only 33% of the S&P 500

SPX,

overall weight and more than 60% of the Russell 2000 index

RUT,

So if Cyclicals, aka Epicenter, work, small-cap stocks will outperform,” he said.

Watch this chart

Adam Kobeissi, founder and editor in chief of The Kobeissi Letter, expects the bullish jobs report to send the S&P 500 to 4,035 to 4,050 in the near term, but from there he’d like to see it pull back to 3,950 to 4,000, to set up for another higher low before a move toward 4,100.

The Kobeissi Letter

“Therefore, we are remaining on the sidelines to start this week, as stepping in front of a market this strong is not a stance we want to take, and will maintain a medium term bullish outlook with the intention of getting back into our bullish positions in the wake of a drop in the market,” Kobeissi told subscribers.

Heading into the open, Dow Jones Industrial Average

YM00,

futures are up 200 points and S&P 500

ES00,

and Nasdaq-100 futures

NQ00,

were up 0.5% and 0.4%, respectively. European markets are closed for an extended Easter break, and most of Asia was also shut. The yield on the 10-year

TMUBMUSD10Y,

note was steady at 1.72%. Data ahead includes the Institute for Supply Management’s March services index and February factory orders.

Oil prices

CL00,

are sliding after last week’s decision by the Organization of the Petroleum Exporting Countries and allies to boost production, and after Saudi Arabia reportedly boosted prices for Asian customers.

Shares of electric-car maker Tesla

TSLA,

are up 6% in premarket. Tesla said Friday that first-quarter deliveries totaled 185,000 cars, beating Wall Street forecasts. Wedbush upgraded Tesla to outperform from neutral, and set a new price target of $1,000, from a prior $950.

GameStop

GME,

shares are down 10% after the games retailer and one of the year’s popular meme stocks said it will sell up to 3.5 million in common shares.

South Korean electronics giant LG

066570,

is exiting the smartphone market.

Delta Air Lines

DAL,

had to cancel 100 flights on Sunday due to staff shortages, and will open middle seats sooner than expected.

The U.K. government plans to offer everyone in the country two free virus tests a week. Stocks in India IN:1 tumbled 2% as daily COVID-19 cases hit 100,000, the second country to see that level of cases after the U.S.

A bitcoin revolution is under way and MarketWatch is gathering a cast of crypto experts to explain what it all means. Sign up! Bitcoin, for that matter, is holding steady at $57,422

Random reads

Redditors unleash on trends we hate

Soviet-era TV version of “Lord of the Rings,” rediscovered after 30 years: “Lord of the Rings.”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers

By

Barbara Kollmeyer

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.