# Where ESG investing is most crowded — and one area that looks ‘frothy,’ according to BofA

Table of Contents

“#

Where ESG investing is most crowded — and one area that looks ‘frothy,’ according to BofA

”

Can ‘improvement stories’ within traditional energy attract ESG investors?

Investors are pouring money into assets that satisfy their environmental, social and governance demands, “extreme” inflows that have led to some froth without constituting an ESG bubble, according to Bank of America analysts.

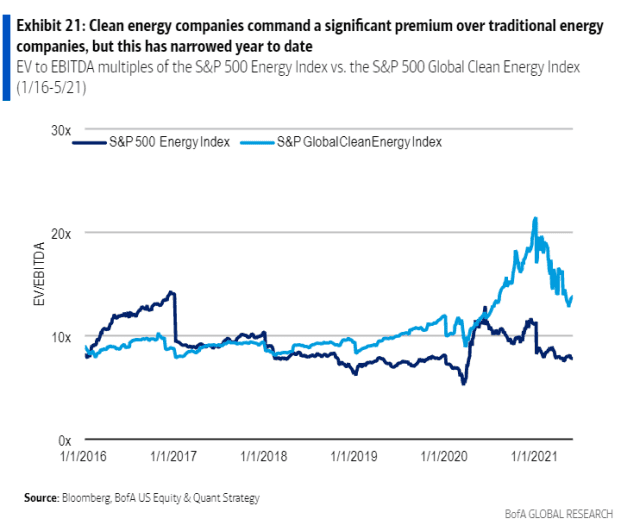

“We find no real premium for ‘good’ ESG stocks overall, though some areas like clean energy look frothy,” strategists said in a Tuesday report from BofA Global Research. “We prefer ESG improvement stories within energy, which is neglected and has seen the strongest ESG factor outperformance.”

Avoiding the crowds in ESG may pay off, the strategists said.

ESG funds — which have increased assets at nearly three times the pace of non-ESG funds over the past year— are globally overweight the industrials, technology and materials sectors, according to the report. Crowded sectors such as industrials and tech have seen some of the weakest ESG factor performance in 2021.

Meanwhile, some of the most popular U.S. stocks held by ESG funds are Microsoft Corp.

MSFT,

Visa Inc.

V,

Adobe Inc

ADBE,

, Google parent Alphabet

GOOGL,

and NVIDIA Corp.

NVDA,

as recently as May 15, the report showed.

Big multinational tech companies may be popular among ESG funds, but their large scale and global reach can make it more difficult for investors to gauge whether sustainability standards permeate their businesses, according to Matthew Tuttle, chief executive officer and chief investment officer of Tuttle Capital Management.

“In small- and midcap, you cut through a lot of that clutter,” Tuttle said in a phone interview. “Now if you’re evaluating the company, there’s typically one product, there’s one division, they’re not multinational.”

Tuttle Capital’s Trend Aggregation ESG ETF

TEGS,

an actively managed exchange-traded fund that focuses on small and midsize businesses in the U.S., has gained 8.4% this year, according to FactSet data on Wednesday. That compares with a gain of 12% for the S&P 500 index and a 16.4% return for the Russell 2000.

“The thing that is going to be the most important is our agility,” said Tuttle. The ETF’s portfolio, which is rebalanced each week, is now “skewed toward value and away from growth.”

See: Investors may be willing to sacrifice returns for ESG — but here’s where they haven’t had to, says Deutsche Bank

The more than 1,900 global ESG funds tracked by Bank of America saw assets rise to a record $1.4 trillion in April, more than double their assets under management a year ago, according to the BofA report.

“There are a lot of different ways of looking at ESG,” said Amber Fairbanks, a global equity portfolio manager with Mirova, responsible-investing focused asset manager owned by Natixis Investment Managers, in a phone interview.

“For us, oil-and-gas companies are not investable,” she said, as they’re “detrimental” with respect to climate change even if making a push into alternative energy.

Mirova’s clean energy holdings include Ørsted and NextEra Energy Inc.

NEE,

said Fairbanks.

Solar company Enphase Energy Inc. ENPH and water technology provider Xylem Inc. XYL, are among the most overweighted U.S. stocks by U.S.-based ESG funds relative to the S&P 500 index on May 15, the BofA report found.

As for big tech companies finding their way into ESG funds, Fairbanks suggested that some managers may see them unexposed to a lot of ESG-related risk or view their “technology as not creating harm.” On the environmental side, “companies like Microsoft have really positioned themselves to use green energy in their data centers,” she said.

By

Christine Idzelis

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.