Investors scrambled for reasons to explain a sharp stock-market surge Tuesday that saw the Dow Jones Industrial Average jump nearly 500 points as major indexes turned in their best performance in a month. A look at the calendar may offer the best explanation, argued Fundstrat co-founder Tom Lee.

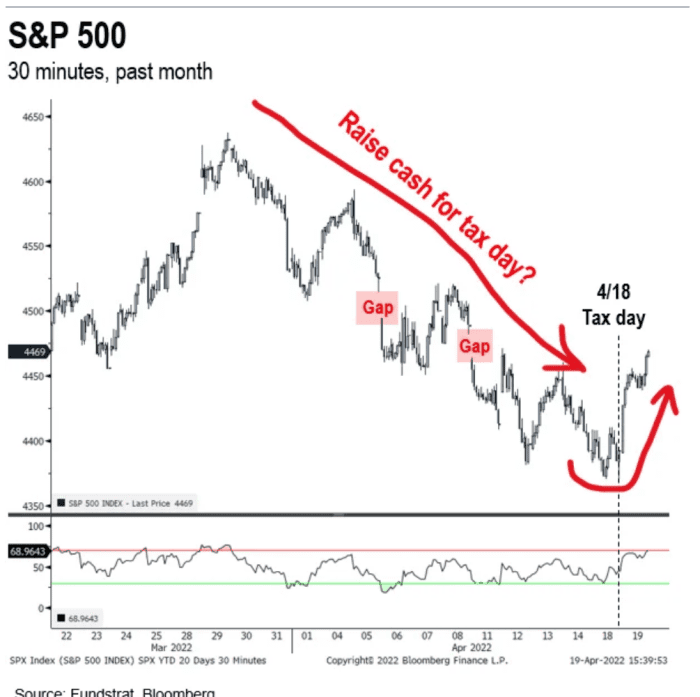

“Equities have fallen in a straight line since late March (13 trading sessions) and the decline continued into April 18th,” the deadline for filing federal income tax returns, Lee said in a Tuesday note.

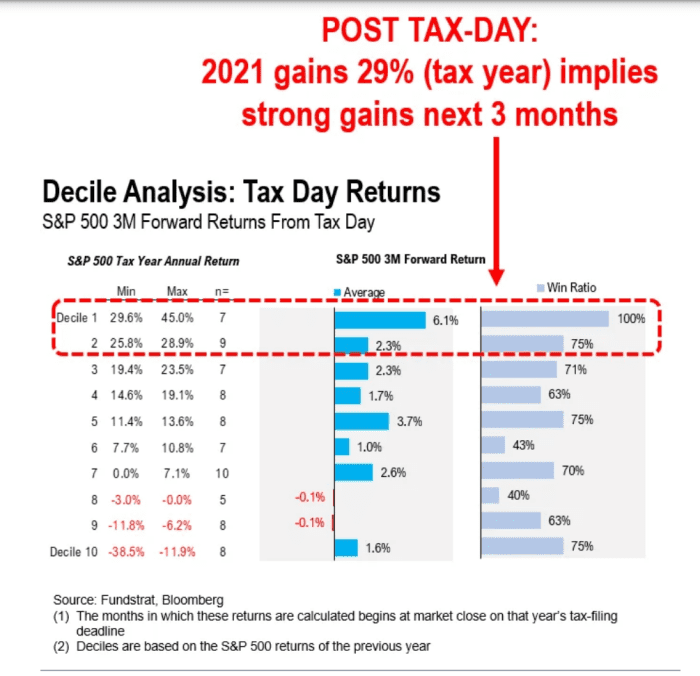

The note highlighted research that shows stocks have tended to suffer in the runup to “Tax Day,” as investors raise cash to pay Uncle Sam, often followed by a sustained bounce in years when investors face hefty tax bills (see chart below).

They faced a doozy after another big year of gains for equities in 2021, Fundstrat has estimated, putting total capital-gains taxes on equities at a record of more than $800 billion, along with another $150 billion or more for crypto-related capital gains.

Fundstrat found that since 1945, post-Tax Day returns have been strongest following a big up year for the S&P 500, defined as in the top two deciles. The 29% advance for the S&P 500 last year was just shy of the cutoff for the top decile at 29.6% (see chart below).

The Dow

DJIA,

+0.94%

jumped 499.51 points, or 1.5%, Tuesday to close at 34,911.20, while the S&P 500

SPX,

+0.15%

rose 1.6% and the Nasdaq Composite

COMP,

-0.96%

advanced 2.2% — the biggest percentage gains for all three indexes since March 16, according to Dow Jones Market Data.

The Dow was adding to gains in late trade Wednesday, up around 260 points, or 0.8%, while the S&P 500 flipped between small gains and losses as shares of Netflix Inc.

NFLX,

-35.88%

plunged around 36% after losing a net 200,000 subscribers in the first quarter.

Sign up for the premarket Need to Know newsletter