#Study finds that board renewal can benefit the environment

Table of Contents

“Study finds that board renewal can benefit the environment”

In an age when environmental awareness is widespread among investors, board renewal mechanisms that better align investors’ and directors’ interests can enhance a firm’s environmental performance, according to a new study by Hannes Wagner (Bocconi University, Milan). Interestingly, the study also finds a positive relation between the appointment of female directors and environmental performance.

Wagner’s investigation with his coauthors Alexander Dyck (University of Toronto), Karl V. Lins (University of Utah), Lukas Roth (University of Alberta), and Mitch Towner (University of Arizona) is titled “Renewable Governance: Good for the Environment?”, and it is published in the Journal of Accounting Research.

The authors identified two potential board renewal mechanisms: the adoption of majority voting and the introduction of a female director. Under majority voting, directors must obtain more than half of the votes cast by shareholders to be elected. Without it, directors only need a plurality of the votes cast. Thus, majority voting gives investors the ability to vote against directors, rather than just withhold their votes.

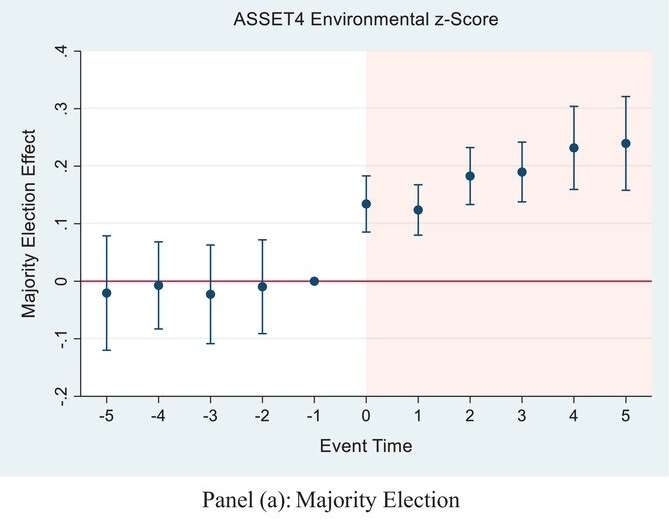

The paper finds that the introduction of majority voting is correlated to a significant increase in a firm’s environmental performance. In recent years investors have been pushing for firms to focus on environmental, rather than just financial, performance. Majority voting ensures a greater alignment between the interests of investors and directors.

The findings are even stronger when considering the relation between environmental performance and the appointment of a female director in the board. Most interestingly, the coefficients are still significant when controlling for board member characteristics such as education and experience. This suggests that the improvement in environmental performance is a direct effect of gender itself rather than of characteristics of female directors.

“The key contribution of our work is providing a roadmap for investors,” Professor Wagner said. “We show that if they want to increase environmental performance, they should not only monitor sustainability metrics, but also take action ‘upstream’, at the board level, where changes that produce such improvements are decided.”

The authors exploit quasi-exogenous shocks in different countries as a testing field for their hypotheses. These shocks are useful as they cause a change in one of the two variables investigated in the paper (female presence in the board or majority voting) without specifically intending to address firms’ environmental performance.

To evaluate the effect of appointing a female director, the authors analyzed countries that introduced compulsory gender quotas for boards. The results show that firms that introduced a female board member for the first time environmentally outperformed firms that did not by 8%, on average.

“Currently, regulatory efforts are aimed at increasing gender equality in boards. As an interesting and welcome side effect, these measures appear to also improve environmental performance of firms,” Prof. Wagner commented.

As for majority voting, the authors exploited the pressure from a campaign conducted by a large investor group in Canada. In this case, too, firms that switched to majority voting after the campaign exhibited a significant improvement in environmental performance measures.

Finally, the link between board renewal mechanism and environmental performance was stronger in countries with better investor protection laws and stricter disclosure requirements. But that is not all. The same (stronger link) was true also for firms having a more “motivated” shareholder base. This result reinforces the hypothesis that investors use board renewal to align the boards’ interests with their own.

“As ever more shareholders look for sustainability when making investment choices,” Prof. Wagner concluded, “investigating the drivers of environmental performance at the board level is something that can produce meaningful and tangible results. As so often, academic research can help better decision making.”

ALEXANDER DYCK et al, Renewable Governance: Good for the Environment?, Journal of Accounting Research (2022). DOI: 10.1111/1475-679X.12462

Provided by

Bocconi University

Citation:

Study finds that board renewal can benefit the environment (2023, January 26)

retrieved 26 January 2023

from https://phys.org/news/2023-01-board-renewal-benefit-environment.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more Like this articles, you can visit our Science category.