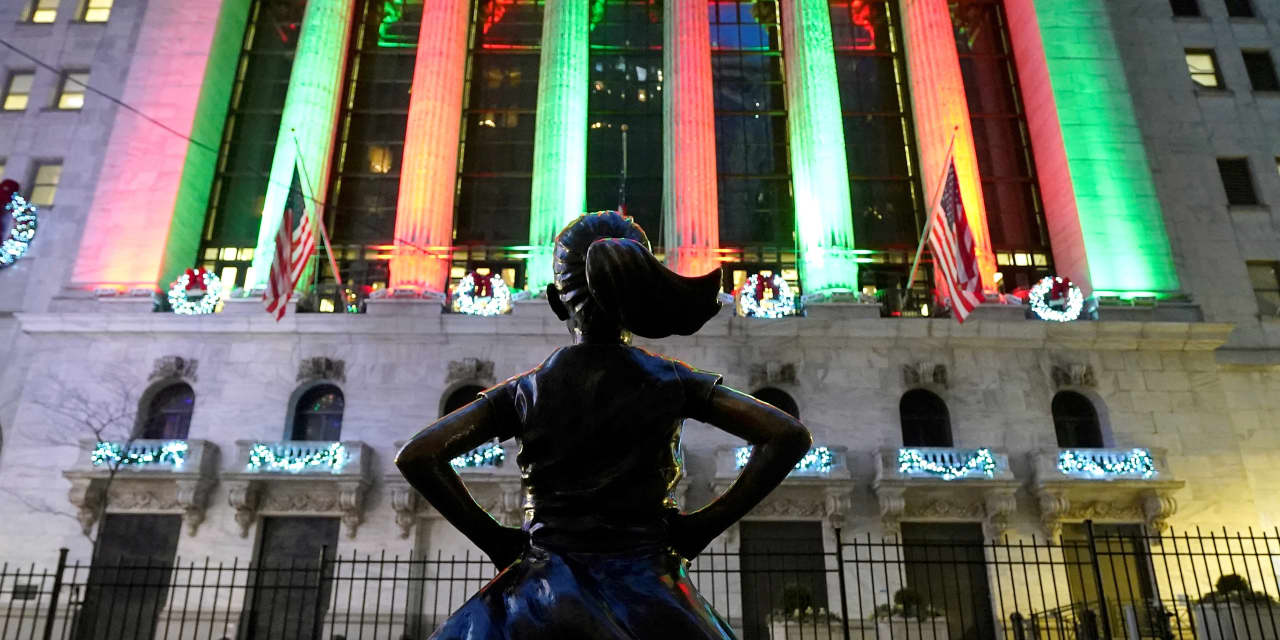

#Russia misses bond interest payment as potential default looms

Table of Contents

“Russia misses bond interest payment as potential default looms”

Russia committed a “failure to pay” credit event when it missed a $1.9 million interest payment on one of its sovereign bonds in April, an international committee determined Wednesday — a sign that the Kremlin is edging toward its first foreign debt default since World War I.

Russia violated the terms of an international dollar-denominated bond that matured on April 4 after it failed to include the interest payment within a grace period, according to the results of a vote by members of the Credit Derivatives Determinations Committee, a group of institutions that oversees the derivatives market.

Credit Suisse, Goldman Sachs, JPMorgan Chase and Barclays were among the financial institutions that voted to confirm a “failure to pay” event.

Russia initially attempted to pay the dollar-denominated bond in rubles – a move that would have triggered a default – only to reverse course and transfer payment in dollars within a 30-day grace period. But the late payment did not include the $1.9 million in interest that accrued during the delay, Bloomberg reported.

Investors asked the committee to rule on whether Russia was in violation of the terms as they sought to collect on credit-default swaps, which function as a form of insurance against nonpayment of bonds.

The swaps covered a net of approximately $1.5 billion of outstanding Russian debt through the end of May, according to the outlet.

Despite the missed interest payment, Russia’s other bond payments are not yet considered to be in default. A so-called “cross default” would only occur if Russia failed to pay at least $75 million, according to the terms of its Eurobond agreements.

Russia has narrowly avoided default for weeks following the implementation of crippling Western sanctions since the Kremlin invaded Ukraine in late February. Those penalties have included the ejection of Russian financial institutions from the SWIFT international payments systems and the freezing of vast swaths of Russia’s foreign currency and gold reserves.

Last week, the White House said Russia was likely on the verge of failing to cover its international debt obligations after the Treasury Department allowed a key waiver to expire, ensuring that US banks and individuals could no longer accept bond payments from the Russian government.

“This means that Russia will likely fail to meet its obligation and face default, an enduring sign of their status as a pariah in the global financial system,” White House Press Secretary Karine Jean-Pierre told reporters.

Meanwhile, Russia Finance Minister Anton Siluanov has decried the tightening financial vise as an “artificial situation created by an unfriendly nation.”

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.