#Outside the Box: Texas, California and Indiana offer surprising lessons about low taxes and economic growth

Table of Contents

“#Outside the Box: Texas, California and Indiana offer surprising lessons about low taxes and economic growth”

The growth in Texas? In its high-tax areas

Among the most common claims of state economic development officials is that higher taxes drive down growth and cause businesses and people to relocate to low-tax states. If you listen to cable news, you are likely to hear dire stories of people fleeing high-tax states in droves.

Yet the high-tax parts of both California and Texas are growing faster than the low-tax parts of both states. And growth in Indiana, which has cut corporate and personal income taxes in the past decade as well as put a cap on property taxes, is dismal.

Economic research on migration, growth and taxes has a long history. Adam Smith noted that “peace, easy taxes, and a tolerable administration of justice” were all that was necessary to “carry a state to the highest degree of opulence.” Modern economic research consistently reports that lower taxes tend to promote growth and migration, but only when all other factors are held constant.

Here’s the rub: It is straightforward to create a model holding all these other factors constant, but in the real world, they never are constant. So the role of taxes has to be weighed against the value of what tax dollars provide.

The rivalry between Texas and California is a perfect example of rhetoric not matching reality. Stories about people “fleeing” California for Texas are common, and Elon Musk’s high-profile announcement that he was moving to Texas fuels the anecdote-driven news cycle. (He announced in October that Tesla’s headquarters are moving to Austin.) Taxes per capita are higher in California than in Texas, giving weight to the story that low taxes are driving this migration.

“”

In fact, in the last year for which we have data, two out of every 1,000 Californians departed for Texas, while 1.2 of every 1,000 Texans moved to California. This is hardly a notable exodus, and it hardly explains why a rational Texan would head to California. Something else has to be going on.

Part of the misconception is fueled by poor data analysis. People don’t so much move from state to state as from city to city. IRS data illustrates that tax rates vary dramatically between local governments far more than between states. In California, the total state and local taxes in the highest-taxed place were more than three times that of the low-tax county. In Texas, the difference is three times as large as in California.

Population growth in both California and in Texas is concentrated in the higher-tax places. In California, the relationship is too small to be economically meaningful. But in Texas, it is a very strong relationship. This is ironic, since it means Texans are far less reluctant to move to higher-tax places within their state than are Californians.

Put another way, the California counties with above-average taxes are growing at an 0.35% annual rate, while the low-tax counties average a 0.20% growth rate. In Texas, the counties with below-average taxes are shrinking at an infinitesimal rate. In contrast, the Texas counties in the top half of tax rates are growing at a 4.5% annual rate. Again, compared with Californians, those Texans seem not to mind higher taxes one little bit.

Why is this?

Businesses and households are sophisticated economic actors. They are capable of balancing many hundreds of decisions about allocating income to either consume or produce goods and services. Taxes represent one price for living in a particular city or town, but value — not price — is the key decision variable.

For the average family, value comes from tangible amenities like safe, livable neighborhoods, high-quality schools and great parks and trails. They go far beyond natural amenities such as beaches and mountains. While we all face budget constraints, we look for value within our own budget.

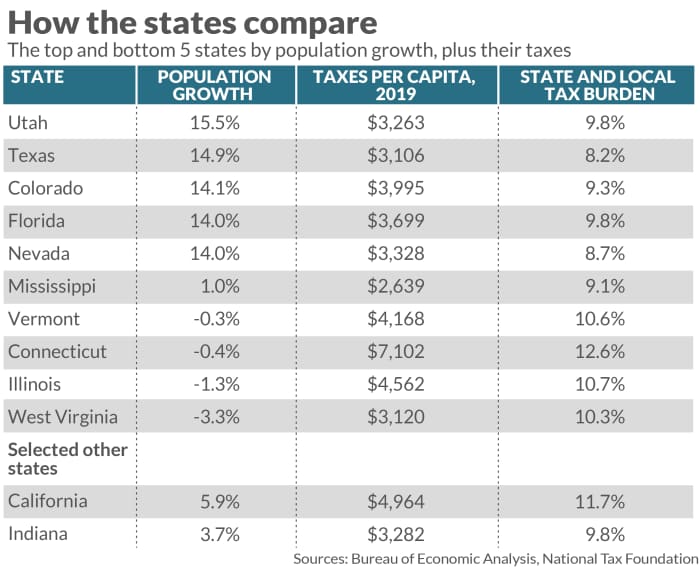

The quest for value has critical policy implications for state and local governments eager for economic and population growth. Over the past decade, the five slowest-growing states had per-capita taxes that ranged from a low of $2,639 in Mississippi to a high of $7,102 in Connecticut. The other states — West Virginia, Illinois and Vermont — all fell in the middle. Again, it is not the price that consumers consider, but value.

I live and work in the Midwest, which remains locked in a half-century doldrum of population stagnation, locally concentrated job losses and decay. In many ways, the Rust Belt is emblematic of the lack of focus on value to residents. Indiana is the perfect example, since no state in the Rust Belt has cut taxes as aggressively as this one. A decade ago, local property tax caps were added to the Constitution, limiting local spending. Then corporate taxes were cut, and income taxes cut. All of this was done with the hopes of boosting population and economic growth.

That didn’t happen. Indiana’s economic recovery from the Great Recession was no more than lackluster, and the clearest result of the rush to cut taxes was to make Indiana a magnet for low-wage employers. The state’s per-capita income dropped to 86% of that of the nation as a whole, down from near 90% in 2012. Half of all job growth went to adult workers without a high school diploma.

The lesson here is that selling your state on price instead of value is likely to draw bargain shoppers. These businesses will view the workforce as a commodity. That is a poor harbinger for the future.

The economics of taxation and economic migration are not new. But the ability of businesses and families to judge the relative value of public services is. The internet offers quick, nearly costless examination of places from afar, and two decades of standardized tests give parents good comparable data on schools.

Both businesses and families are acting upon this information, moving to places with better schools and safe, livable neighborhoods. In the process they are moving to places with much higher taxes, reflecting a hunt for value, not price.

State and local leaders who wish to see more families and commerce in their jurisdictions must adjust to this new reality. Otherwise, you might as well hang out a sign declaring your state or community a bargain basement for employers who pay low wages.

Also read: Some lower-tax states won big in the 2020 Census count. Are Americans really moving to escape the taxman?

Michael J. Hicks is the George and Frances Ball distinguished professor of economics and the director of the Center for Business and Economic Research at Ball State University in Muncie, Ind. Follow him on Twitter @HicksCBER.

By

Michael J. Hicks

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.