# Opinion: Use these powerful tools to strike the right money tone with your kids

Table of Contents

“#

Opinion: Use these powerful tools to strike the right money tone with your kids

”

Start by describing the relationship you want them to have with money when they are adults

You picked up your own feelings about money from the adults around you when you were a kid. Now, your children are taking their financial cues from you: watching your body language as you pay the bills, gauging your reaction when they ask for that shiny new toy, soaking up the words you use to describe what and how you’re earning and spending.

As we enter the “new normal,” here are powerful tools for taking charge again, for proactively setting the tone with your kids around money, and for shaping their feelings, habits and approaches toward it both now and in the future.

Start with the end-state in mind. Imagine your kids as adults, or even as working parents themselves. How do you want them to think about and relate to money at that point in their lives?

Get specific: pick five to seven adjectives that describe the relationship you want them to have with their dollars and cents. If you know for certain that you want your daughter to feel comfortable, frugal, on-it and in-charge about money when she’s all grown up, it will be easier to strike the right note with and around her today.

Make it tangible. Direct debit, credit card tap-and-pay, home delivery, Venmo: they’re all powerful, time-and-hassle saving tools, and throughout a year of isolation and lockdown, were invaluable. What none of those tools do, however, is allow your child to see or feel – to really understand – what things cost, what’s being spent, or how to take care of their cash.

So give them some real-world, real-time practice. Next time you’re at the supermarket, for example, ask your child to read out the price of every item that goes into the basket, or encourage your third-grader to count up the jar of change you’ve accumulated on your nightstand (perhaps for a 10% commission). In other words, create opportunities for them to touch, feel, see and understand money in a kid-appropriate way.

Get visual. Instead of slumping over your computer as you pay those bills, sit up tall. Let your son see how you keep your wallet: tidy, and with bills grouped by denomination. Create the impression, and not just the voice-over narration, that you’re in charge of and own your money, and not the other way around.

Describe your “why.” Your child saw you glued to a Zoom screen for hours throughout lockdown – and it brought on arguments or tantrums. Why can’t we play? Why are you always looking at your phone?

Good questions, and ones you can answer best and most effectively by explaining your money whys. A calm “I’m in meetings today because it’s part of my job, which I do to earn money to take care of you and Mommy and baby Oliver” beats snapping “because I have to!” or apologizing.

Paint a complete picture. Your child wants that new toy…or their own iPad….or car. And either that item simply isn’t in the budget, or you don’t want it to be. Instead of a simple “no” answer, however, think about offering a more complete, 360-degree rationale. Answers like “we can pay for soccer camp or for new toys, but not both”, or “because Dad and I are saving for college, we can’t make other big purchases” reinforces the idea of money choices and trade-offs – in other words, responsible budgeting.

Harvard Business Review Press

Watch your language – and keep it positive. Sure, your son’s math tutor is expensive – but if you believe education is essential to his future, why say so? Refer to the tutoring time as an “investment” or “priority” instead, and you’ve killed two birds with one stone: conveyed that yes, it costs real money – but that in your family, education comes first. And instead of announcing “I have to go to work”, consider saying “I get to go to work.” This simple change sends your child a subtle but important message that work, and earning, is something you want to do.

Foster money-savviness, but let your kids be kids. Maybe some of your most lucrative accounts dried up during the pandemic or you’re looking for a new gig. Either way, that’s not something your 10-year-old can help you with. So make it clear that the situation, and any attendant money strain, is on you. For example, say something like “mom’s job is to look for a new role. Your job is to study for the algebra test Thursday, and to keep your room tidy. Let’s go over those practice problems again…”

This my job/your job approach acknowledges money realities, but keeps your child on-task and feeling safe – which, as a good parent, matters deeply to you.

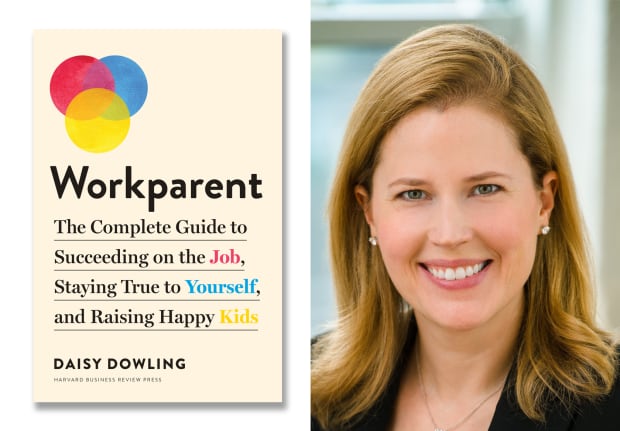

Daisy Dowling is the author of “Workparent: The Complete Guide to Succeeding on the Job, Staying True to Yourself, and Raising Happy Kids” as well as an executive coach to working mothers and fathers and advisor to organizations that employ them.

By

Daisy Dowling

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.