#Market Snapshot: Stocks trim losses in final hour of trade as investors await outcome of 2-day Fed meeting

Table of Contents

“Market Snapshot: Stocks trim losses in final hour of trade as investors await outcome of 2-day Fed meeting”

U.S. stocks trimmed losses in the final hour of trading on Tuesday, despite economic data that dented hopes for the Federal Reserve to signal a slower pace of rate increases after it delivers what’s expected to be another jumbo hike after its policy meeting tomorrow.

How are stock indexes trading

-

The Dow Jones Industrial Average

DJIA,

-0.18%

fell 40 points, or 0.1%, to 32,693, after rising more than 240 points in early trade. -

The S&P 500

SPX,

-0.31%

was down 9 points, or 0.2%, at 3,862. -

The Nasdaq Composite

COMP,

-3.41%

fell 69 points, or 0.6%, to 10,916.

The Dow rose 14% last month, its best percentage gain since January 1976 and its biggest October rise on record. The S&P 500 gained 8% in October, while the Nasdaq Composite advanced 3.9%.

What’s driving markets

Stocks lost their footing after the Labor Department said U.S. job openings rose to 10.7 million in September, failing to provide any indication a hot labor market is cooling off.

Good news on the economy can be viewed as bad news for stocks because investors worry the data will prevent the Fed from slowing the pace of rate hikes in its bid to get inflation under control — a process that Fed Chair Jerome Powell has said will require a period of below-trend growth.

“The high number of openings continues to underscore the huge divide between supply and demand for labor, contrary to what the Federal Reserve wants to see as it battles inflation. On the other hand, labor market strength bolsters job security, a positive for workers and those aspiring to work,” said Mark Hamrick, senior economic analyst at Bankrate.

In other data, the Institute for Supply Management said its manufacturing index fell 0.7 percentage points to 50.2 in October. Economists surveyed by The Wall Street Journal had forecast the index to inch down to 50. Any number below 50% reflects a shrinking economy. The reading was the lowest level since May 2020.

Outlays for construction projects rose 0.2% in September to $1.81 trillion, the Commerce Department reported Tuesday. Wall Street was expecting a drop of 0.6%.

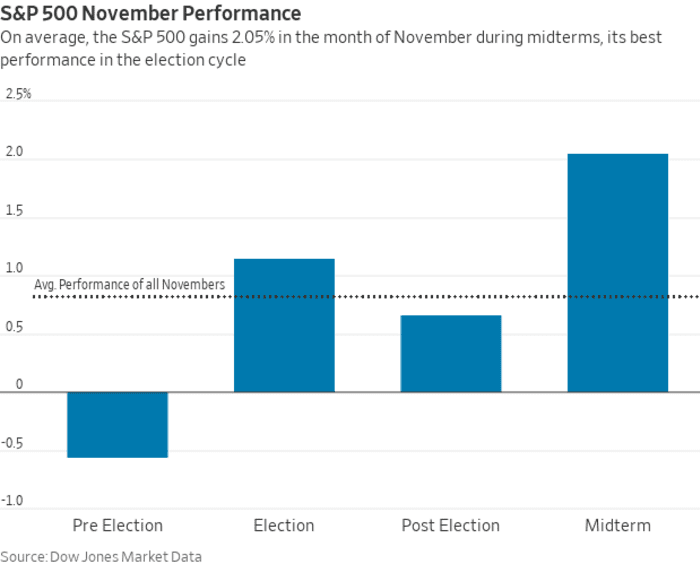

Read: November kicks off ‘best 6 months’ for stock market, but midterms add a twist: What investors need to know

A mixed third-quarter corporate earnings season continues. With 268 of S&P 500 constituents having reported through Monday, 73% have delivered earnings above expectations, 5% have matched and 22% were below, according to Refinitiv data.

The numbers appear not to have been as bad as many investors feared, and this is one of the factors that helped the S&P 500 record a sturdy rally last month, said analysts.

“October proved to be a much better month for financial assets after the disastrous performance over Q3, aided by hopes of a pivot from central banks, a stabilization in Europe’s energy situation, as well as an end to the U.K. market turmoil,” said Jim Reid, strategist at Deutsche Bank, in a note.

“But we shouldn’t get ahead of ourselves, as the S&P 500’s +8.1% gain over the month in total return terms means it’s only partially recovered from its -9.2% loss in September, let alone its -23.9% loss over the first nine months of the year as a whole,” Reid added.

Stocks in the communication services and consumer discretionary sectors were among the worst performers on Tuesday with both sectors shedding nearly 1.5%.

Read: Another jumbo Fed rate hike is expected this week — and then life gets difficult for Powell

The Fed is expected to raise rates by 75 basis points to a range of 3.75% to 4% when it concludes its two-day meeting on Wednesday.

“The market has already priced in a 75 basis point hike for this month and a 50 basis point for December as previously announced by the Fed,” said Guido Petrelli, founder and CEO of Merlin Investor. “If the Fed sticks to their plan, while assuring that a harder move is not deemed to be necessary at this point in time, then I would expect the market to react well with all the major exchanges continuing to gain as we have seen recently.”

“Still if it won’t be the case, then a new wave of panic could be happening by driving down the market again until more positive and consistent data can be obtained, with high volatility continuing to be the name of the game through the beginning of next year,” he wrote in emailed comments on Tuesday.

See: Why did inflation surge to a 40-year high? Here are 4 causes of the worst monetary-policy mistake in years.

American depositary receipts of Chinese companies, including e-commerce giant Alibaba Group Holding Ltd.

BABA,

Chinese internet names iQiyi Inc.

IQ,

Bilibili Inc.

BILI,

Huya Inc.

HUYA,

JD.com Inc.

JD,

were on the rise.

The Wall Street Journal reported Tuesday that Hong Kong stocks appeared to rally in response to an anonymous post on Chinese social media suggested that the government may intend to soften pandemic-related restrictions beginning in March. Other outlets also reported on the rumor.

A spokesman for China’s foreign ministry told reporters he was “not aware of the situation you mentioned,” when asked about the social media posts, news reports said.

Companies in focus

-

Shares of Abiomed Inc.

ABMD,

+49.86%

jumped more than 50%, after the provider of medical technology that supports circulation and oxygenation agreed to acquired by Johnson & Johnson

JNJ,

-0.34%

in a deal valued at $16.6 billion. Johnson & Johnson shares fell 0.2%. -

Uber Technologies Inc.

UBER,

+12.31%

shares jumped 12.6% after the ride-hailing giant topped revenue expectations and gave an upbeat outlook for the current quarter. -

Shares of Pfizer Inc.

PFE,

+3.25%

rose 3.2% after the pharmaceutical giant beat earnings and revenue expectations and raised its outlook. -

Eli Lilly & Co.

LLY,

-2.50%

shares fell 3% after the drugmaker trimmed its 2022 earnings outlook, but posted stronger-than-expected third-quarter results. -

SoFi Technologies Inc.

SOFI,

+5.33%

rose 5.5% after the financial-technology company posted results that were dubbed “outstanding” by one analyst.

— Jamie Chisholm contributed to this article.

By

Isabel Wang

and

William Watts

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.