#Market Snapshot: Dow futures point to slide to end week as COVID-19 cases rise in Europe

Table of Contents

“#Market Snapshot: Dow futures point to slide to end week as COVID-19 cases rise in Europe”

U.S. stock index futures headed lower Friday, amid growing concerns over rising cases of COVID-19 in the U.S. and a national lockdown in Austria, with Germany threatening similar action to mitigate the spread of the infectious disease COVID-19 that has plagued the globe for two years.

How are stock-index futures trading?

-

S&P 500 futures

ES00,

-0.18%

slipped 11 points, or 0.2%, to 4,690. -

Dow Jones Industrial Average futures

YM00,

-0.53%

fell 198 points, or 0.6%, to 35,613. -

Nasdaq-100 futures

NQ00,

+0.43% ,

however, gained 0.4%, rising by about 68 points to reach around 16,550.

On Thursday, the Dow closed down 60.10 points, or 0.2%, at 35,870.95, the S&P 500

SPX,

rose 0.3% to end at a record 4,704.54 and the Nasdaq Composite

COMP,

climbed 0.5% to finish at a record 15,993.

What’s driving the market?

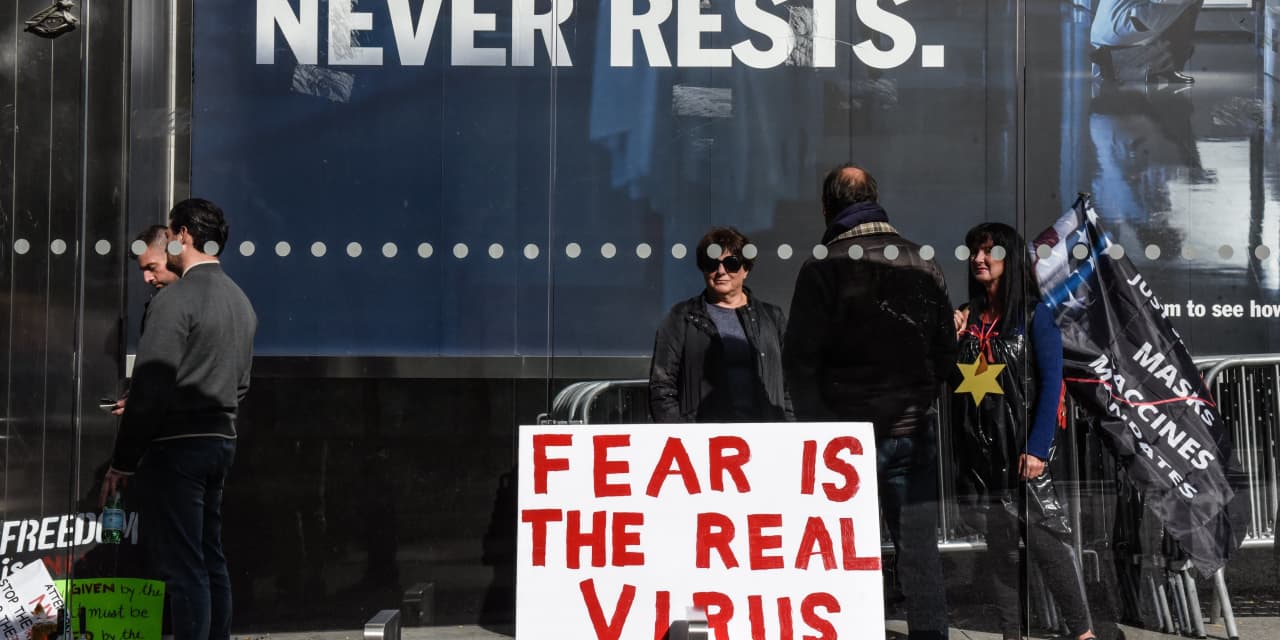

An announcement of a 20-day nationwide COVID lockdown by the Austrian government has spooked stock markets and sparked buying in government safe-haven bonds on Friday.

Austria’s lockdown will include both those vaccinated and unvaccinated, with movement for the latter having been restricted over the past week. The news from Vienna comes as Germany’s health minister on Friday said that lockdowns couldn’t be ruled out in his country, with record cases this week in Germany and Austria.

“I think we’re seeing a knee-jerk reaction to Austria’s lockdown announcement that’s more a reflection of fear than reality,” said Craig Erlam, senior market analyst at OANDA, in emailed comments. “Other countries like the U.S., U.K. and others will be very reluctant to impose such measures again and will likely adopt a lighter touch, if necessary, and unless unavoidable.”

In the U.S. cases have been rising in the Upper Midwest, with a busy travel season about to begin ahead of next Thursday’s Thanksgiving holiday. Also, the daily case count topped 100,000 for a second straight day on Thursday, with the seven-day average rising to a six-week high of 94,669, according to a New York Times Tracker.

That said, the daily average of hospitalizations remains flat at 48,276 and a decision on whether the booster program should be expanded to all adults is expected by Friday, according to media reports.

The reports of rising cases also pushed down oil prices on fears of a fall in demand resulting from the COVID lockdowns. West Texas Intermediate crude was down

CL00,

3% to $76.08 a barrel and Brent

BRN00,

crude was down 3.3% to $78.49 a barrel, at last check early Friday.

A mixed week for stocks is poised to leave the S&P 500 with a gain of nearly 0.4%, a 0.8% gain for the Nasdaq, while the Dow is down 0.6% in the week to Thursday. Markets will close for the U.S. Thanksgiving holiday next Thursday, with a shortened session of trading on Friday.

Still, a number of analysts remain bullish on equities.

“Buy any dip in the next two weeks and be positioned for a bullish couple of months to follow,” the founder of asset-management firm Navellier & Associates, Louis Navellier, advised clients in a note Thursday.

“Expectations were that interest rates would rise and punish growth stocks more than value stocks from a compression of P/E multiples,” he said. “Most likely now is a consolidation phase, with a bias to companies with strong cash flows, and then a sprint by growth names into year-end with a follow-through into traditionally risk-on January.”

Read: Should stock-market investors who ‘missed the rally’ buy now? Here’s what UBS says

The U.S. economic calendar is clear for Friday, though Federal Reserve’s No. 2 Richard Clarida is due to speak.

Markets are waiting for President Joe Biden to nominate who will head the central bank after Jerome Powell’s term finishes in February. Markets expect Biden will either renominate Powell or Fed Gov. Lael Brainard.

Read: Why banks prefer Brainard over Powell to lead the Fed

Elsewhere, House Democrats were poised to move Friday on Biden’s $1.85 trillion social spending agenda, after plans for a Thursday evening vote were delayed by a nearly four-hour speech by Minority Leader Kevin McCarthy.

Which companies are in focus?

- Shares of Walmart Inc. WMT rose 0.7% in premarket trading Friday, after the discount retail giant got a bullish boost from MKM Partners analyst Bill Kirk, who said the company is “doing the most, but getting the least credit.”

- Shares of Foot Locker Inc. FL fell 4.5% in premarket trading, even after the athletic shoe and apparel retailer reported Friday fiscal third-quarter adjusted profit and sales that rose above expectations, while cost of sales fell, and said it was “ready” for the holidays despite the supply chain issues.

- KinderCare Learnings Companies Inc. KLCsaid it will postpone its initial public offering, citing regulatory delays.

- Shares of Workday Inc. WDAY were initially down in extended trading Thursday after the software company reported fiscal third-quarter results that surpassed Street estimates, named Barbara Larson as new chief financial officer, and its intention to acquire VNDLY, a cloud-based vendor-management software company.

- Nike Inc. NKE said late Thursday that its board of directors has approved a 11% dividend increase to 30.5 cents a share.

By

Barbara Kollmeyer

and

Mark DeCambre

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.