#Market Extra: Tiger Global is down 50%, but how is the rest of the hedge fund industry doing?

Table of Contents

“Market Extra: Tiger Global is down 50%, but how is the rest of the hedge fund industry doing?”

It seems like barely a week goes by these days without another headline advertising staggering losses at another billion-dollar hedge fund.

While retail investors can enjoy a dose of schadenfreude at the expense of the “2-and-20” crowd — a reference to the industry’s lofty management fees, since the industry standard is 2% of assets under management plus 20% of returns — poor returns for the industry also affect retirees since many pension funds also invest in so-called “alternatives” like hedge funds and private equity.

On the flip side of that coin is Crispin Odey, founder of London-based Odey Asset Management, whose European-focused fund has seen massive gains in 2022 largely thanks to a bet against government bonds.

Odey recently warned his investors that “life is going to be much more difficult” in a note obtained by the Financial Times, suggesting that he retains a bearish outlook on markets. His firm did not return a request for comment for this story from MarketWatch. Tiger Global declined to comment for this year also.

Because of their opaque structure, the public only learns about fund performance through the media, as only equity funds are required to report their holdings on a quarterly basis. And even then funds don’t need to disclose positions in derivative instruments like options, a fact that infamously allowed Bill Hwang’s family office Archegos Capital Management to accumulate a massive position in a handful of its favorite stocks via total return swaps with its brokers without having to disclose ownership above the Securities and Exchange Commission’s 5% reporting threshold.

So, how are hedge funds really doing? Luckily, a handful of private and public data providers offer a few clues.

Leaders and stragglers

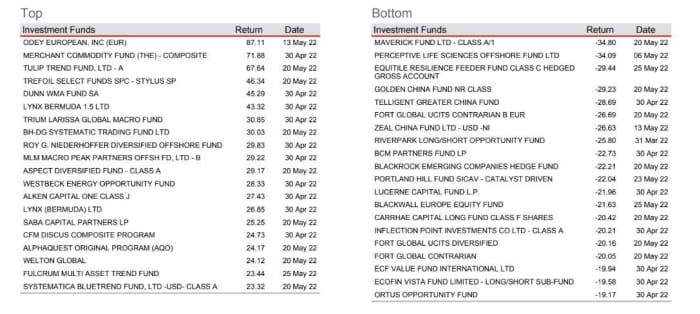

Performance across strategies and across individual funds has varied widely this year, as certain strategies – like long-short equity, for example – have struggled, while others – macro-focused funds and trend following commodity trading advisors – have notched some of their best performances in years.

According to HSBC’s hedge-fund industry tracker, Odey’s European fund is the industry leader in terms of performance since the start of the year: it was up more than 87% year-to-date through May 27.

Second place goes to the Merchant Commodity Fund, which, as its name implies, bets on commodity markets using futures, options and swaps, according to its website.

In third place is Progressive Capital Partners’ Tulip Trend Fund, a systematic trend following fund designed to outperform during bear markets. Merchant and Progressive didn’t return requests for comment.

On the other end of the spectrum, the worst performer so far this year has a connection to Tiger Global: the fund is Maverick Capital’s Maverick Fund, a diversified equity fund with some $800 million in assets. The firm was founded by “tiger cub” Lee Ainslie III. It’s based in Dallas, Texas.

No. 2 on HSBC’s list is the Perceptive Life Sciences Offshore Fund, which is one of the funds run by Perceptive Advisors and its founder, Joseph Edelman. The offshore fund is incorporated in the Cayman islands, and focuses on the biotech and pharmaceutical sectors (it also topped HSBC’s list of biggest losers for 2021).

No. 3 is the Equitile Resilience Feeder Fund, another diversified global equity fund. A representative for Equitile said it’s unfair to compare the Resilience Fund’s performance with long-short equity funds because it’s long-only and doesn’t dial back its exposure to stocks when markets are falling.

Perceptive Advisors and Maverick Capital didn’t return requests for comment from MarketWatch.

Source: HSBC

Macro funds outperform

For a broader view of how the industry is doing, HFR publishes monthly updates on industry performance. Their roundup of hedge fund performance in May showed that macro funds were up more than 12% on an asset-weighted basis, ranking them among the best performers.

Commodity funds were up 12.5%, while diversified systematic funds — that is, funds that typically employ algorithm-driven strategies — were up 14.4% for the year so far.

In the equity space, HFR’s index of equity-fund performance was down 8.85% year-to-date, while an index of technology and health-care funds was down a more than 15%.

Unsurprisingly, funds focused on Russia and Eastern Europe were among the biggest losers for 2022 so far: this sub-index is down more than 50% year-to-date.

As for equity funds, a broad-based index of global equity fund performance showed these funds were off 0.5% in May despite the stock market’s rally during the final week of the month, which helped the S&P 500 and Dow Jones Industrial Average eke out barely-there gains for the month. That was still better than their performance in April; where the index was down 2.9% on an asset-weighted basis.

Fund performance broken down by region showed North American funds off more than 5%, compared with a 0.7% gain for HFR’s world-wide index.

Another popular gauge that’s seen as a proxy for equity-focused hedge funds is the Goldman Sachs Hedge Fund VIP index ETF

GVIP,

With just over $150 million in assets, the ETF — which tracks a basket of stocks purportedly popular among the hedge fund crowd — is down more than 22% so far this year, compared with more than 13.6% for the S&P 500

SPX,

and more than 22.7% for the Nasdaq Composite

COMP,

which is more heavily comprised of technology stocks.

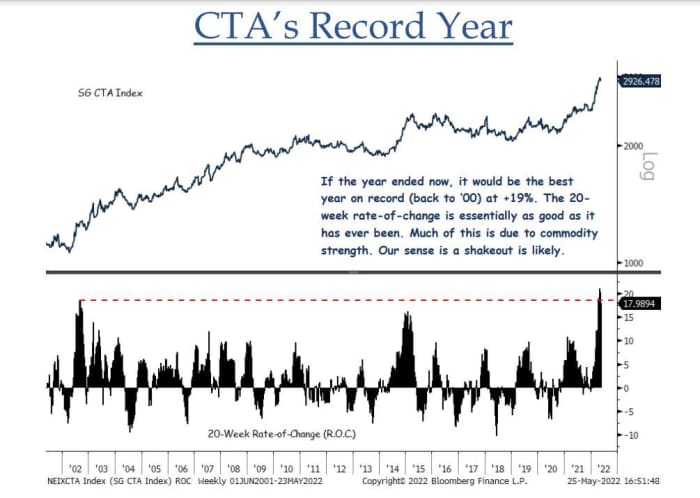

CTAs on track for best year in decades

While sometimes treated a distinct group separate from hedge funds, it’s worth noting that commodity trading advisors, or CTAs, are having one of their best years in recent memory. According to the Societe Generale CTA index, these trend-following funds were up nearly 20% so far this year through June 1.

Source: BTIG

The industry’s rocky performance this year hasn’t had much of an impact on the amount of capital hedge funds have to manage. Hedge fund assets increased by $19.8 billion during the first quarter of 2022 on a net basis, according to HFR.

Total assets under management stood at $4.002 trillion at the end of the first quarter, compared with $4.008 trillion as of the end of 2021.

Event-driven funds raised the most new capital during the first quarter, bringing in $12.8 billion to manage, despite losing more than $27 billion in the market. Equity funds raised just $1.9 billion, while losing nearly $50 billion.

Macro funds, by comparison, raised just $3 billion, but gained more than $37 billion from their trading activity.

Equity funds are still the most popular strategy, with 29.49% of industry assets in these funds, while event-driven funds were second with 27.53% of assets. Relative value funds came in third place with just over 26.05% of assets, while macro funds managed roughly 16.94%.

By

Joseph Adinolfi

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.