#Better monitoring for open-cast mines

“#Better monitoring for open-cast mines”

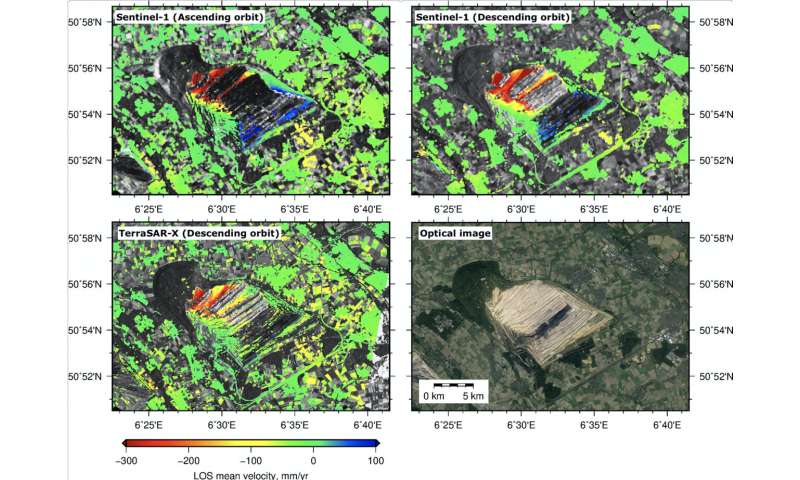

When it comes to safety in open-cast mining, soil stability is one of the most critical factors. Settlement of the ground or slipping of slopes poses a great risk to buildings and people. Now Mahdi Motagh from the German Research Centre for Geosciences GFZ, in cooperation with Chinese scientists, has evaluated data from the Sentinel 1 mission of the European Union’s Copernicus program and thus demonstrated new possibilities for monitoring mining areas. The three researchers used a special radar method, the Synthetic Aperture Radar Interferometry (InSAR), to investigate lignite regions in North Rhine-Westphalia in Germany. They reported on this in the International Journal of Applied Earth Observation and Geoinformation.

The InSAR method in itself is not new and is used in many places to detect ground deformations, whether after earthquakes or subsidence due to the overexploitation of underground water reservoirs. However, it had one decisive disadvantage: InSAR satellites such as ERS or ENVISAT only record a certain region on average once a month or less. “With its six-day repeat time interval and small orbital tube, the Sentinel 1 mission provides SAR data that help us to investigate hazards in very specific mining areas in Germany in much greater detail in terms of time and space than before,” reports Mahdi Motagh, “and we can do this in near real time.” The mission is also able to provide a comprehensive overview of the situation in the mining industry. By combining the results of this new technology with other on-site measurements and high-resolution SAR systems such as the German TerraSAR-X, the geotechnical risk of open-cast mines could be assessed far more completely than before.

The work shows that there is significant land subsidence in the open-cast mining areas of Hambach, Garzweiler and Inden. The reason for this is the compaction process of overburden over refilled areas with subsidence rates varying between 30-50 centimeters per year over Inden, Hambach and Garzweiler. Satellite data also showed a significant horizontal shift of up to 12 centimeters per year at one mine face. Also the former open pits Fortuna-Garsdorf and Berghein in the eastern part of the Rhenish coal fields, which have already been reclaimed for agriculture, show subsidence rates of up to 10 centimeters per year.

Germany land motion mapped

Wei Tang et al, Monitoring active open-pit mine stability in the Rhenish coalfields of Germany using a coherence-based SBAS method, International Journal of Applied Earth Observation and Geoinformation (2020). DOI: 10.1016/j.jag.2020.102217

Citation:

Better monitoring for open-cast mines (2020, November 4)

retrieved 4 November 2020

from https://phys.org/news/2020-11-open-cast.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more Like this articles, you can visit our Science category.