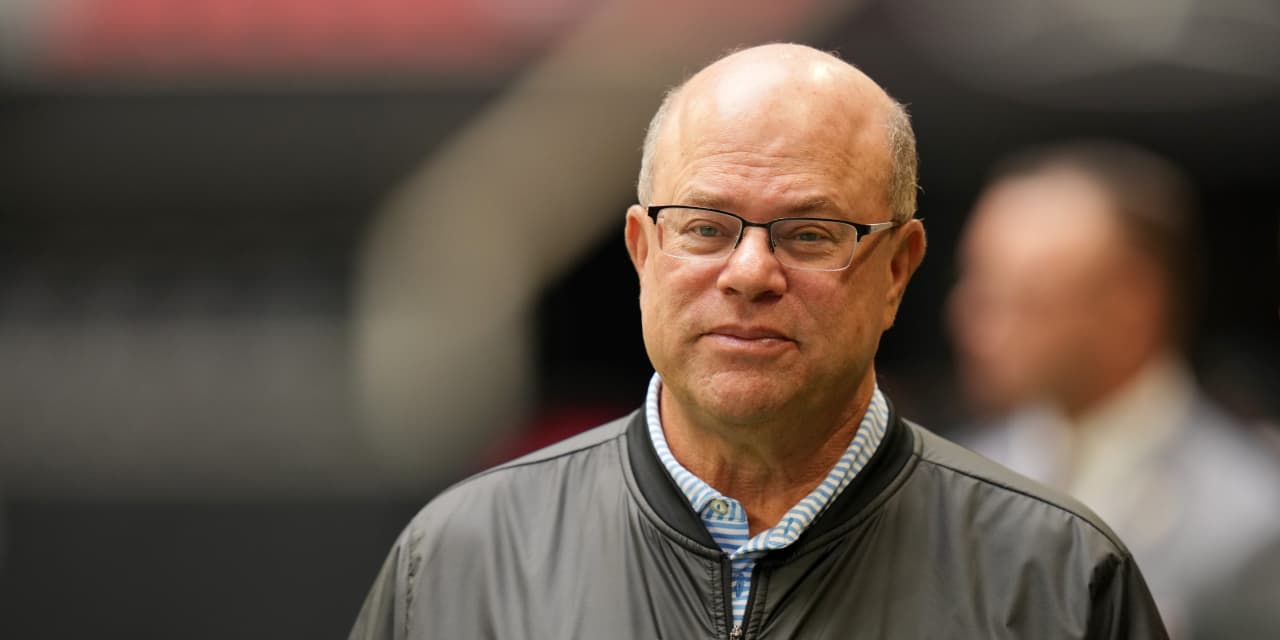

“‘I’m leaning short on the equity markets right now because I think the upside/downside just doesn’t make sense to me when I have so many…central banks telling me what they’re going to do…’”

— David Tepper, founder, Appaloosa Management

That’s David Tepper, one of the top-performing hedge-fund managers of all time, offering up a simple proposition: When the Fed and other central banks say they’re going to keep raising rates and shrinking their balance sheets, you should believe them.

In a CNBC interview, Tepper, who bought the NFL’s Carolina Panthers in 2018, said investors don’t seem to be taking central bankers’ messages fully on board.

“When the Fed says they’re going to do something, I tend to believe them,” said Tepper, whose remarks are often described as market-moving. “The market says they’re not going to carry forward. I believed the Fed before and I believe them now.”

Fed Chair Jerome Powell was clear last week when he indicated rates would peak above 5%, Tepper said, but he noted that the central banker’s “teddy bear” demeanor may have blunted the message. The same message was delivered in a more forceful fashion the next day by European Central Bank President Christine Lagarde, who warned that the central bank was likely to deliver another half-point rate hike at its next meeting and perhaps at the two meetings after that as well, Tepper said.

“She grizzlied on me,” Tepper said.

Read: ECB slows rate hikes, but signals it’s far from done

Stocks ended Thursday off session lows, but still logged sharp losses. The Dow Jones Industrial Average

DJIA,

-1.05%

declined nearly 350 points, or 1.1%, while the S&P 500

SPX,

-1.45%

dropped 1.1% and the Nasdaq

COMP,

-2.18%

slid 2.2%.

Don’t miss: Why a ‘reverse Tepper trade’ points to a ‘lose/lose’ stock-market scenario