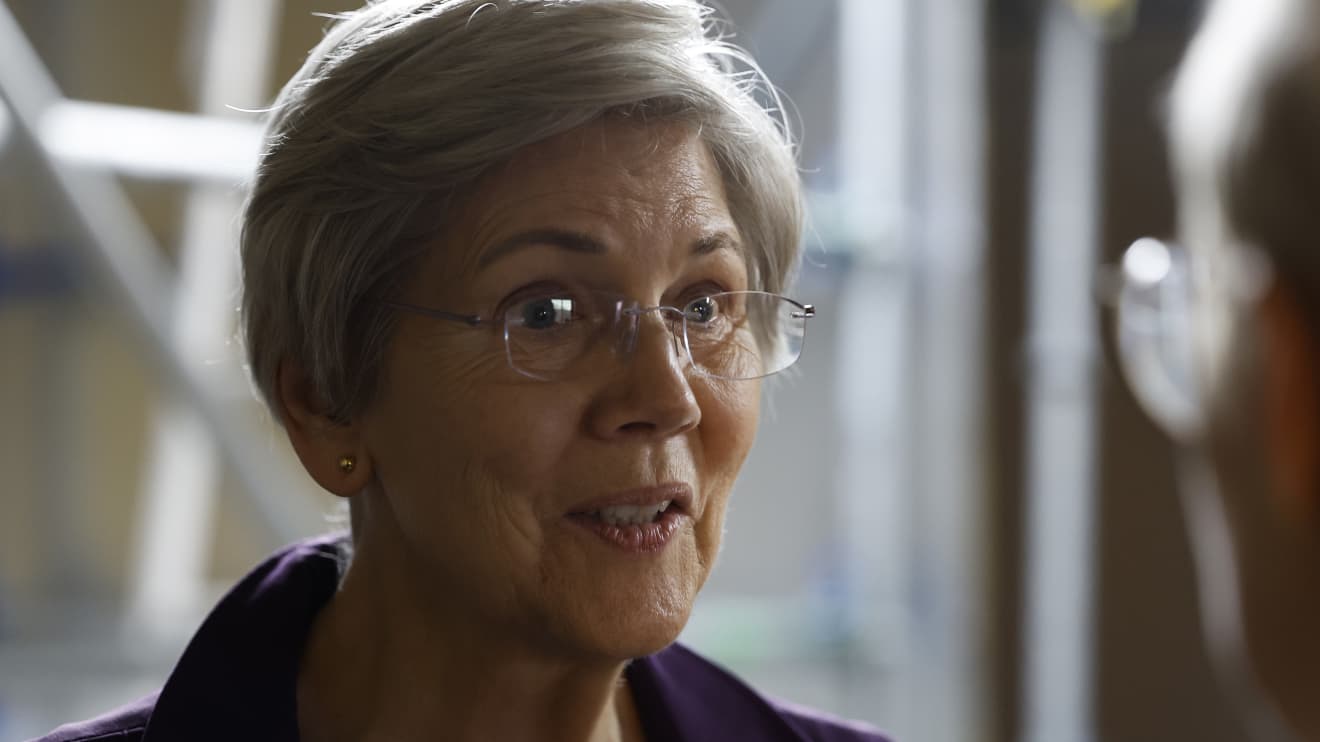

Influential Sen. Elizabeth Warren on Wednesday reiterated her criticism of the 2018 easing of Dodd-Frank rules for small and midsize banks

KRE,

-3.37%,

after joining with dozens of fellow Democratic lawmakers to introduce a bill that would scrap that rollback in the wake of Silicon Valley Bank’s collapse.

“What we need to do right now, here in Congress, is to say, ‘We now have evidence of what happens when you ease up on the regulations for banks of that size,’” the Massachusetts Democrat said during a CNBC interview.

“We just need to put those tougher constraints back in place and tell the regulators to toughen up against banks of that size, because remember the argument. The argument was that these banks made, ‘We’re just little tiny banks, just like community banks. We pose no risk.’ I think we’ve seen that’s not the case.”

Warren, Rep. Katie Porter of California and other Democrats rolled out their Secure Viable Banking Act on Tuesday, but the bill’s prospects are uncertain. Democrats have a slim majority in the Senate, while Republicans have a similarly tenuous grip on the House of Representatives.

In a talk in New York on Tuesday night, Randal Quarles, a former Federal Reserve vice chair for supervision, said the regulation rollback during his tenure “had nothing to do” with the collapse of Silicon Valley Bank

SIVB,

,

according to a Bloomberg report.

Quarles said Washington’s focus should be on the supervision of the bank and the treatment of uninsured deposits. He was appointed by President Donald Trump and served from 2017 to 2021.

In a similar vein, a spokeswoman for Sen. Tim Scott of South Carolina, the top Republican on the Senate Banking Committee, also has expressed skepticism over ramping up regulations.

“Regulators failed to do their job with regards to SVB, and if regulators can’t do their job with what the law gives them now, why is giving them more regulations the better route?” the spokeswoman, Ryann DuRant, said, according to a Roll Call report.

Moreover, Democrats who teamed up with Republicans and Trump to enact the 2018 rollback haven’t expressed regrets. Sen. Mark Warner of Virginia told ABC on Sunday that he thought the measure “put in place an appropriate level of regulation on midsized banks.”

Warren blasted the 2018 Dodd-Frank rollback earlier in the week, writing in a New York Times op-ed published Monday that “recent bank failures are the direct result of leaders in Washington weakening the financial rules.” President Joe Biden made that point as well in a speech on Monday, noting that “the last administration rolled back some of these requirements” and calling for stronger rules.

U.S. stocks

SPX,

-1.91%

DJIA,

-2.15%

traded sharply lower Wednesday as fresh concerns over the health of Credit Suisse

CSGN,

-24.24%

CS,

-22.28%

sparked renewed banking-sector

KBE,

-3.62%

anxiety.

MarketWatch’s Greg Robb contributed to this report.

Now read: Silicon Valley Bank failure called a ‘black eye’ for bank regulators, Congress

Also see: Elizabeth Warren calls on Fed chief Powell to recuse himself from Silicon Valley Bank investigation

Plus: SEC chief Gensler pledges investigation in wake of bank failures