# Is this the Manchin rally? Bonds are rising and stocks at record high as spending expectations wane

Table of Contents

“#

Is this the Manchin rally? Bonds are rising and stocks at record high as spending expectations wane

”

Critical information for the trading day

You wouldn’t expect stocks and bonds to rise after a hotter-than-forecast inflation reading in a market that has been obsessed with the I-word, yet that’s what happened on Thursday.

With consumer prices excluding food and energy shooting up 3.8% year-over-year in May — the hottest reading since 1992 — the yield on the 10-year Treasury slipped 3 basis points, down to 1.46%. Yields move in the opposite direction to prices. The S&P 500

SPX,

finished at a record high, and the technology heavy Nasdaq Composite

COMP,

has climbed four of the last five days.

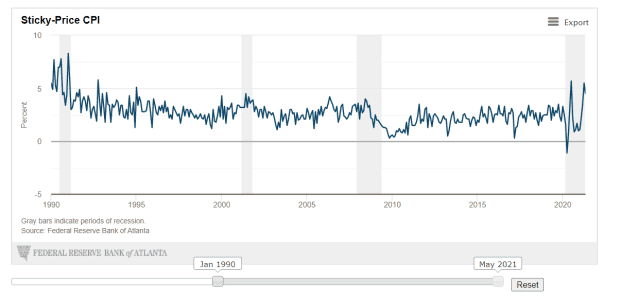

Sure, there was some talk that what drove the consumer-price index higher were transitory items, like used-car prices, which should come back to reality once the semiconductor shortage is resolved, making new cars more easily obtainable. But a look at the Atlanta Federal Reserve’s breakdown doesn’t lend support to that interpretation. The sticky price CPI — that is, the cost of goods and services that are typically slow to change in price — shot up an annualized 4.5% in May, after jumping 5.5% in April. There haven’t been two back-to-back readings this strong in 30 years.

Kevin Muir, a former institutional equity derivatives trader turned blogger, called it the Manchin rally on his Macro Tourist blog. Sen. Joe Manchin’s unwillingness to go for a Democrats-only infrastructure package — on Tuesday, he said he wasn’t even thinking about using what’s called reconciliation, which would allow for passage without any Republicans voting — is tempering fiscal spending, as well as tax, expectations.

The West Virginia Democrat is part of a bipartisan group, which also includes another moderate Democrat, Sen. Kyrsten Sinema of Arizona, that is calling for $1.2 trillion in infrastructure spending over eight years, without tax increases apart from indexing federal gas taxes to inflation. That is well short of the $1.7 trillion President Joe Biden is seeking, who also calls for increased corporate taxes. Biden separately is calling for $1.8 trillion in investments in what he calls the American Families Plan, in areas like child care and healthcare, to be paid for by increased taxes on the wealthy.

“The firm rejection over the past several weeks of many of Biden’s tax increases,” added Joe Lieber, managing director at Eurasia Group, “is also likely to shrink a bill’s size to the bottom end of our base case $2-$3 trillion range, and increase reliance on deficit financing such a package.”

Reading the tea leaves in Washington is more art than science, but it is also notable this week that former Vice President Al Gore lobbied Biden to keep climate investments in the infrastructure package, a sign of the growing feeling that the president would accept a less sweeping deal.

10-year continues to fall

The 10-year yield

TMUBMUSD10Y,

continued to drop on Friday, sliding down to 1.434. U.S. stock futures

ES00,

NQ00,

inched higher.

World leaders from the Group of Seven are meeting in Cornwall, England, discussing plans for a global corporate minimum tax and to distribute COVID-19 vaccines, among other topics.

The University of Michigan’s consumer sentiment index for June highlights an otherwise quiet day on the economics front.

Tesla

TSLA,

Chief Executive Elon Musk took a break on Thursday from his cryptocurrency tweeting to unveil the Model S Plaid, a high-performance version of the sedan.

Cinema chain operator AMC Entertainment

AMC,

had its credit rating upgraded by S&P, due to the company raising cash by selling equity to meme-stock-obsessed investors. S&P nonetheless rates the chain as seven tiers below investment grade.

Chewy

CHWY,

the online pet-products retailer, beat expectations on earnings but also flagged the impact of labor shortages.

Vertex Pharmaceuticals

VRTX,

fell 14% in premarket trade, as the biotech stopped development of a drug for a rare genetic disease, in what may be good news for Arrowhead Pharmaceuticals

ARWR,

which is working on a drug treating the same condition. Arrowhead shares rose 4%.

Random reads

Bidding to fly into space in July surged after Amazon

AMZN,

Chief Executive Jeff Bezos said he is going to be on the Blue Origin rocket.

North Korean leader Kim Jong Un isn’t a fan of K-pop.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers

By

Steve Goldstein

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.