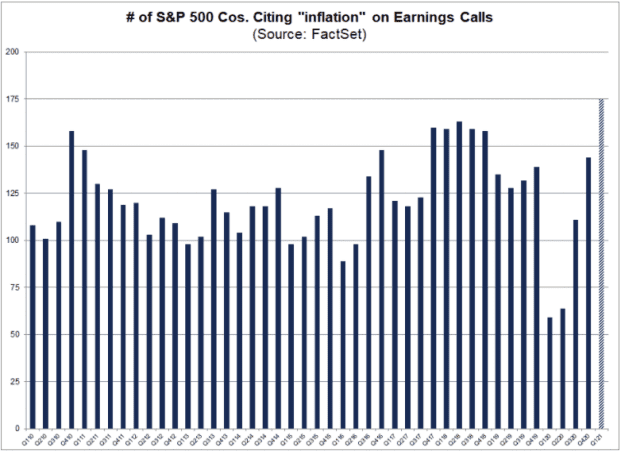

The word “inflation” is being thrown around in post-earnings conference calls by the most companies in at least 11 years, enough to set a fresh record, according to research provided by FactSet.

The companies are seeing from the ground up, what data from the top down have been showing. The U.S. Bureau of Labor Statistics said that the rate of wholesale inflation jumped in April to the highest level since the index was reformulated in 2009, and said consumer inflation rose to the highest level in nearly 13 years.

See related: U.S. consumer spending is surging — but so is inflation.

From March 15 through May 14, FactSet said the 175 companies within the S&P 500 index

SPX,

-0.37%

that reported quarterly results mentioned “inflation” during their earnings calls, the highest overall number going back to at least 2010, and on track to break the previous of 163 companies for the second quarter of 2018.

Among things mentioned as drivers of inflation are increases in raw materials costs, as a result of rises in commodities prices, and supply-and-demand dynamics, as demand has increased along with COVID-19-related reopenings faster than supply chains have reopened, given labor and weather-related disruptions.

The impact on consumers is likely to increase, as the passing of price increases to customers tends to lag increases in wholesale prices.

Don’t miss: Companies that make things used to make things have seen earnings boosted by big jumps in prices. Is that a bad thing?

Among sectors, those seeing the highest percentage of companies mentioning inflation were consumer staples at 84% and materials at 75%. Meanwhile, industrials saw the total highest number of companies mentioning inflation at 46, followed by consumer discretionary at 25 and financials at 22, FactSet Senior Earnings analyst John Butters wrote in “FactSet Insight” blog post.

Read more: DuPont sees a big jump in inflation costs for the rest of the year.

It wasn’t just the most companies mentioning inflation in more than 10 years, the first quarter also marked the largest year-over-year increase in companies using the I-word — up 116 companies — going back to at least 2010, Butters wrote.

The record number of inflation mentions comes even with 42 of the S&P 500 companies, or 8.3%, still having not reported results, so the actual number for the quarter will likely be higher, Butters said.

What could be of more interest to investors is what companies say about inflation in the second quarter, as many, including the Federal Reserve, expect inflation pressures to be temporary.

“[T]he Fed seems convinced that the spike in inflation is transitory, and will subside as the year progresses,” said William Lynch, director of investments at Hinsdale Associates Inc. “However, the trend over the next few months bears watching as investors may have legitimate concerns that it may not be temporary and interest rates could head higher as a result.”

Also read: Energizer CEO says inflation will keep going and going, disputing what the Fed has said.