#In One Chart: Stocks face ‘meaningful’ downside risk amid ‘complacent’ markets: JPMorgan

Table of Contents

“In One Chart: Stocks face ‘meaningful’ downside risk amid ‘complacent’ markets: JPMorgan”

As Wednesday’s data continued to point to a resilient U.S. economy, strategists at JPMorgan Chase & Co. issued a warning about what could be “meaningful” downside risks in the equity market.

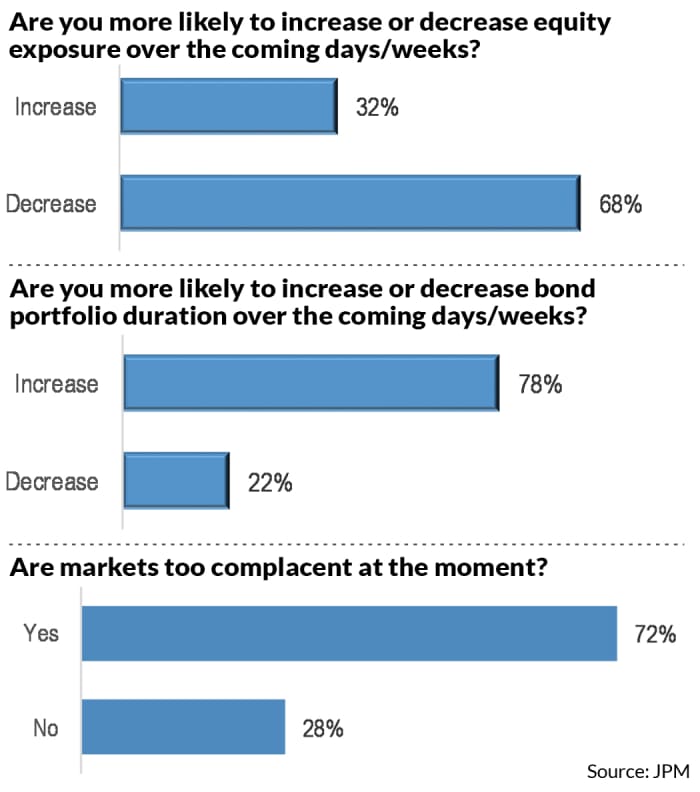

Early results from a survey of JPMorgan’s clients this week showed that 68% were more likely to decrease their exposure to stocks in the coming days and weeks, while 32% were likely to increase it. In addition, 78% said they were more likely to boost bond-portfolio duration over the same period and 22% were likely to decrease it.

The JPMorgan survey is the latest indication that investors may be finally coming around to the view that the Federal Reserve won’t likely pivot toward a rate cut later this year, given the economy’s unexpected strength even after eight straight rate hikes since last March.

Seventy-two percent of respondents in JPMorgan’s survey described markets as being too complacent. January’s stock action had been driven by a “fear-of-missing-out” rally and, for a time, it seemed retail participation was on its way back, with recent sentiment among individual investors turning bullish. Data from Refinitiv Lipper, however, shows investors have been walking away from stock-market funds and going into bonds for weeks.

Read: Why the stock market’s ‘FOMO’ rally paused and what will decide its fate

Source: JPMorgan

Wednesday’s economic data revealed a surprisingly strong 3% jump in retail sales for January, giving fresh hope to the idea that the U.S. can avoid a recession in the first quarter in what some are calling a “no landing” scenario. The report comes a day after January’s consumer-price index underscored that inflation is grudgingly slowing and still sticky, and almost two weeks after a blowout jobs report showed 517,000 new jobs created last month.

Interestingly, U.S. economic strength appears to be translating into greater risks in the financial market, by ensuring the Fed’s rate-hike campaign endures. Indeed, some economists have argued that a “no landing” scenario could sink stocks as a hot labor market and other factors force the Fed to drive rates higher than policy makers and investors currently expect.

See: Top Wall St. economist says ‘no landing’ scenario could trigger another tech-led stock-market selloff

On Tuesday, January’s hotter-than-expected CPI report had traders lifting the likelihood of a June rate hike to almost 52%, up from 35% a week ago, and was already raising the possibility that it could deal a massive blow to the stock market. After Wednesday’s retail-sales report, traders were slightly boosting the chances of a half-percentage-point rate hike in March, which would take the fed-funds rate target to between 5% and 5.25%, though the overwhelming likelihood remained in place for a quarter-point move.

In an updated note released on Wednesday, Marko Kolanovic and other JPMorgan strategists said that “with equities trading near last summer’s highs and at above-average multiples, despite weakening earnings and the recent sharp move higher in interest rates, we maintain that markets are overpricing recent good news on inflation and are complacent of risks. Equity markets appeared to read this month’s central bank meetings as dovish, while dismissing the weak Q4 earnings and the implications of the strong U.S. payroll report for both monetary policy and corporate margins.”

“We see the equity risk/reward as skewed to the downside, as upside potential for markets is likely fairly limited given stretched valuations and high rates, while downside could be meaningful, e.g. in case of a further weakening of activity, persisting inflation, higher terminal rates, or a resurgence of geopolitical risk,” the team said.

Other preliminary results of the survey that 38% percent of respondents see the next U.S. recession starting in the first half of 2024, while 34% expect the downturn to begin in the second half of this year.

On Wednesday, major U.S. stock indexes

DJIA,

SPX,

were mostly lower in afternoon trading as investors digested the implications of the retail-sales report. Meanwhile, most Treasury yields traded higher, led by a jump in the 20- and 30-year rates

TMUBMUSD30Y,

By

Vivien Lou Chen

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.

![#Insufficient prototype testing could put Titanic sub passengers in ‘extreme danger’ [Video]](https://s.yimg.com/ny/api/res/1.2/rOKOqHFtmxR6yrteHKcnOQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MjU-/https://media.zenfs.com/en/aol_associated_press_484/ad2ad67da0504714da0881dbfe2f56d2)