# How bitcoin is like Tesla and here to stay, but will feel volatility from this unique effect, says Deutsche Bank

Table of Contents

“#

How bitcoin is like Tesla and here to stay, but will feel volatility from this unique effect, says Deutsche Bank

”

Critical information for the U.S. trading day

The past week has been another blockbuster for bitcoin: The cryptocurrency cleared the $60,000 milestone last weekend and has been bolstered by news from major banks.

Morgan Stanley

MS,

is set to offer wealthy clients the ability to invest in bitcoin funds, and Bank of America

BAC,

said the main argument for the crypto was “sheer price appreciation.”

DB,

analyst and Harvard economist Marion Laboure has our call of the day: Bitcoin is here to stay but will remain volatile.

With a $1 trillion market capitalization, bitcoin

BTCUSD,

is “too important to ignore,” Laboure said, and prices could keep rising as long as asset managers and companies continue buying.

But the economist said the real debate is whether the evolution of bitcoin into its own asset class can come from valuations alone, because low liquidity remains a key obstacle. Just compare it to Apple

AAPL,

stock, says Laboure: 40 billion shares of the technology giant (270% of the total in circulation) changed hands in 2020, compared with 28 million bitcoins (150% of total bitcoins in circulation).

This is feeding into the ultra-volatility of bitcoin, said the Deutsche Bank analyst. Only a few additional large purchases or market exits are needed to “significantly impact the supply-demand equilibrium,” according to Laboure.

The value of bitcoin will remain volatile, and continue to rise and fall depending on what people believe it is worth, in what is known as the “Tinkerbell Effect,” said Laboure. This is an economic term that describes how something is likelier to happen when more people believe in it, and is named after Peter Pan’s claim that the fairy Tinkerbell exists because children believe she does.

In fact, bitcoin is like Tesla

TSLA,

said Laboure, because it “will have to transform potential into results to sustain its value proposition.”

Tesla’s stock market valuation prices in the significant shift in the automotive world toward electric vehicles, and hypothesizes that Tesla will be the absolute leader in that market.

Bitcoin’s total value is around 102% of the yen in circulation, 65% of the euros, 53% of the U.S. dollars, and 904% more than the amount of British pounds, according to Laboure, but the average number of bitcoins exchanged daily represents only around 0.06% of British pounds in circulation.

If the crypto’s current valuation is here to stay, the shift toward cross-border digital currencies will have to come in force, according to Laboure — and bitcoin must lead the charge in becoming the means of payment for the future.

The buzz

In the first face-to-face meeting between senior U.S. and Chinese officials since President Joe Biden was elected, Beijing will pressure the U.S. to reverse many of the tough-on-China policies introduced by the Trump presidency, The Wall Street Journal reported.

On the economic front, all eyes are looking at jobs. 770,000 Americans filed for unemployment last week, outpacing the 700,000 expected and up from the 712,000 reported in the week prior. There were 4.12 million continuing claims for the week of March 6, little changed from the 4.14 million in the week prior. The manufacturing survey for March from the Philadelphia Federal Reserve jumped to 51.8, far ahead of the 22.0 expected. At 10 a.m., the Index of Leading Economic Indicators for February is due.

And in case you missed it, here’s what we did and didn’t learn from Jerome Powell’s press conference on Wednesday. Following the two-day Federal Open Market Committee meeting, the Fed Chair said the central bank intends to be dovish until the data indicate otherwise.

Apple plans to announce new iPads next month, at the earliest, with a processor to rival the faster M1 chip in the latest MacBook Pros, according to a report from Bloomberg.

The European Union’s medical regulator will report on its investigation into the risk of blood clots associated with the COVID-19 vaccine developed by drug company AstraZeneca

AZN,

and the University of Oxford. Many European countries have suspended the vaccine, despite a statement from the European Medicines Agency on Tuesday that the benefits of the vaccine outweigh the risks.

The markets

Stock markets are mixed, with the S&P 500

SPX,

lower and the tech-heavy Nasdaq

COMP,

under more pressure as the yield on the 10-year U.S. Treasury

TMUBMUSD10Y,

surged above 1.750%.

The Dow Jones Industrial Average

DJIA,

has eked out gains to continue its march higher after clearing the 33,000 point milestone on Wednesday, just five trading days after passing 32,000 — the fastest-ever trip through consecutive, 1,000-point milestones on a closing basis.

European stocks

UKX,

DAX,

PX1,

rose in early trading before settling into a mix as the region’s markets took their first opportunity to react to the Fed decision. Asian equities

NIK,

HSI,

SHCOMP,

finished the trading day in the green.

The chart

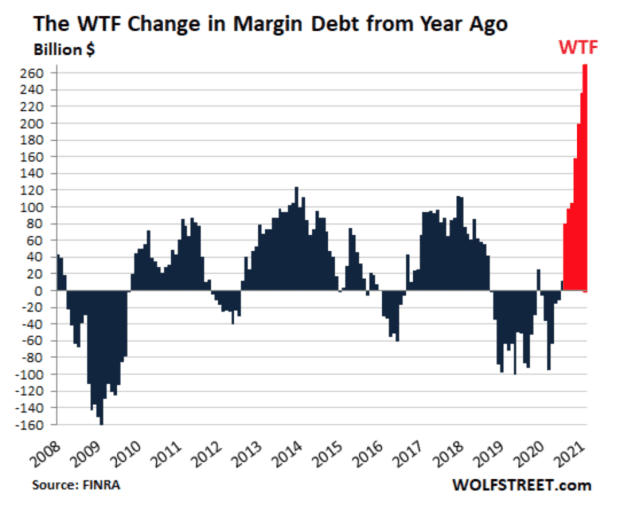

Superhigh levels of stock market leverage represent just another sign “that the zoo has gone nuts,” says Wolf Richter of the popular Wolf Street financial blog, who has our chart of the day.

The amount that individuals and institutions borrow against their holdings is called margin debt, and it is a key indicator of stock market leverage tracked monthly. Margin debt surged by a record $154 billion over the past four months to historic highs, topping $813 billion in February.

Random reads

High valuations everywhere: A 15th century bowl found at a yard sale, highlighted by Need To Know earlier this month when it was valued at up to $500,000, just sold for nearly $722,000.

Not medal-worthy: Tokyo Olympics ceremonies chief resigns over sexist ‘Olympig’ remark.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

By

Jack Denton

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.