# GoPro stock blasts off after big profit beat, as shift to DTC model pays off

Table of Contents

“#

GoPro stock blasts off after big profit beat, as shift to DTC model pays off

”

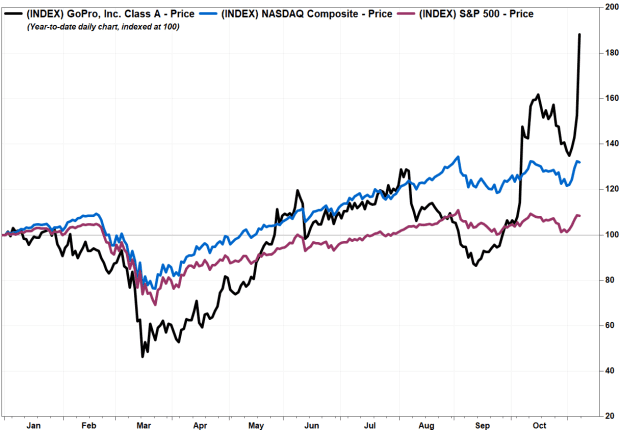

Shares have run up nearly 80% this year to a 3-year high, boosting the market cap to more than $1.2 billion

GoPro founder and CEO Nick Woodman, from the company’s IPO in 2014

Getty Images

Shares of GoPro Inc. rocketed toward a three-year high Friday, after the wearable action camera maker swung to a third-quarter profit on revenue that more than doubled, beating Wall Street expectations by wide margins.

“As execution continues and confidence grows in a multiyear run of sustainable cash flows, we believe there is considerably more upside,” Uerkwitz wrote in a note to clients.

The stock

GPRO,

ran up as much as 33.2% early in the session before paring gains to be up 16.3% in afternoon trading, which puts it on track for the highest close since December 2017. It has now soared 77.4% year to date, to increase GoPro’s market capitalization to $1.30 billion.

In comparison, the Nasdaq Composite

COMP,

has rallied 32.7% this year and the S&P 500 index

SPX,

has gained 8.7%.

FactSet, MarketWatch

The company reported late Thursday net income of $3.3 million, or 2 cents a share, after a loss of $74.8 million, or 51 cents a share, in the same period a year ago. Excluding non-recurring item, GoPro swung to adjusted earnings per share of 20 cents from a per-share loss of 42 cents, beating the FactSet EPS consensus of 6 cents.

“In Q3 2020, our direct-to-consumer and subscription-centric strategy expanded margin, increased subscribers and significantly lowered our operating expenses, resulting in GAAP and non-GAAP profitability,” said Chief Financial Officer Brian McGee. “This approach is also enabling efficient working capital management as we drove [days sales outstanding] down 25% sequentially, lowered channel inventories and reduced our own investments in inventory.” (GAAP refers to generally accepted accounting principles and non-GAAP refers to adjusted earnings.)

Revenue climbed 113.9% to $280.5 million, well above the FactSet consensus of $234.5 million. Subscribers increased 65% to 501,000.

Gross margin improved to 35.4% from 21.7%, with average selling prices increasing 11% to $304.

“Q3 was strong for GoPro from start to finish, culminating with the successful launch of our stunning new flagship, HERO9 Black,” said founder and Chief Executive Nicholas Woodman.

GoPro Inc.

Wedbush analyst Michael Pachter followed by lifting his stock price target to $8 from $6, as the results showed that the company’s strategic shift is going smoothly. He reiterated the neutral rating he’s had on the stock since no later than January 2018, however, citing valuation.

J.P. Morgan’s Paul Belden reiterated his neutral rating and kept his stock price target at $8, but was also upbeat about GoPro’s strategic shift.

“The shift to subscription service provides higher visibility into the customer bases, more consistent cash flow, and provides a nice avenue to upsell accessories and drive camera upgrades in the future,” Belden wrote.

By

Tomi Kilgore

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.