# Goldman Sachs cuts growth forecasts for the U.S. and Europe, citing worries over COVID-19’s winter spread

Table of Contents

“#

Goldman Sachs cuts growth forecasts for the U.S. and Europe, citing worries over COVID-19’s winter spread

”

Near-term risks remain to the downside, says Jan Hatzius, the investment bank’s chief economist

A discarded face mask lies on fallen autumn leaves in Berlin’s Kreuzberg district on November 7, 2020 amid the novel coronavirus (Covid-19) pandemic.

david gannon/Agence France-Presse/Getty Images

With the U.S. presidential election in the past, surging COVID-19 infections on both sides of the Atlantic are coming more sharply back in view and will weigh on major economies in the near term, warned Goldman Sachs.

Hatzius said Biden will likely be working with a Republican majority in the Senate and settle for a $1 trillion stimulus package, less than half of what the bank expected if Democrats had been able to claim the Senate in addition to the White House, while retaining control of the House of Representatives

Read: What a Joe Biden presidency means for taxes, health care, housing, student debt — and another COVID-19 stimulus package

That should “suffice for a small positive fiscal impulse to U.S. growth in coming quarters,” he said. But that still leaves the troubling near term and, hence, fresh downgrades by Goldman.

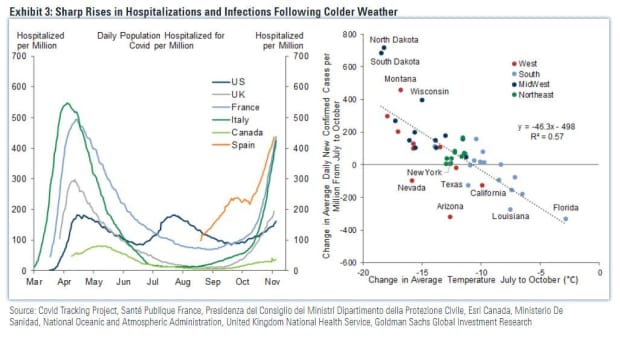

The team cut its first-quarter U.S. growth forecast to 3.5% from 7%, and dramatically slashed Europe’s fourth-quarter estimate from growth of 9.1% to a contraction of 8.7%. “Risks are tilted to the downside if the virus news continues to deteriorate,” said Hatzius and the team.

Fresh lockdowns announced across Europe in recent weeks are a key reason behind those deep cuts to the region’s near-term growth outlook. And while U.S. states and municipalities haven’t announced tighter restrictions on movement, beyond multiday quarantines of people traveling from some states to others, the economists have built potential shifts into that forecast.

Virus news has been overshadowed by a lengthy and bitter election in the U.S., even as the country reported nearly 133,000 infections on Friday, a third straight record-setting single-day case tally. Biden was set to announce a new COVID-19 task force on Monday, Axios first reported.

Europe has seen soaring hospitalizations, notably in the Czech Republic and Belgium. When adjusted for population, data show individuals are being hospitalized with the virus at a much higher level in Europe than in the U.S., which the New York Times also recently reported.

Goldman Sachs

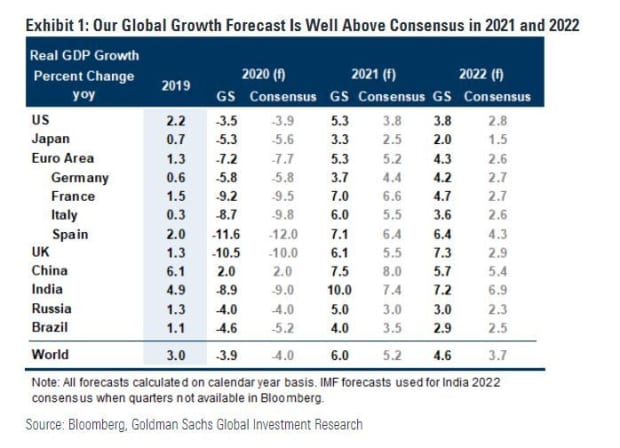

But for the longer term, Hatzius and the team say their forecasts are much more upbeat than others.

They expect “current weakness to give way to much stronger growth when the European lockdowns end and a vaccine becomes available.” In light of the near-term growth downgrades, Goldman’s 2021 global forecast now stands at 6%, which is still above consensus of 5.2%, but a half-point downgrade versus where the bank stood a month ago.

Read: Dr. Atul Gawande on COVID-19: ‘It’s never too late to save another 100,000 lives’

The team is specifically looking for the Food and Drug Administration to approve at least one vaccine by January and mass vaccination of the general U.S. population to start after that. That should lead way to a sharp growth rebound, or a second-quarter V-shaped recovery, in which the “V” stands for vaccine, said the Goldman team.

Goldman Sachs

“One important assumption underlying our forecast is that governments in countries hard-hit by coronavirus infections will continue to do a reasonable job replacing private-sector income lost to the disruptions via wage subsidies, enhanced unemployment benefits, and other income transfers,” said Hatzius and the team.

Read: ‘The 25-cent solution’ would have prevented the COVID recession, says the most accurate forecaster

Elsewhere, they are holding on to mostly above-consensus estimates for emerging countries in 2021-22, except in China, where output has already returned to pre-pandemic levels.

By

Barbara Kollmeyer

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.