Don’t expect much more out of the famous “third year effect” in the U.S. stock market.

I’m referring to the seasonal pattern that keys off the presidential election cycle. The third year of the four-year U.S. presidential term historically has been far and away the best performer of the four. In fact, only the third year’s average return is sufficiently different than the all-year average to be statistically significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

When measured in fiscal-years since World War II ending Sept. 30, for example, the Dow Jones Industrial Average

DJIA,

-1.02%

in third years has produced an average gain of 19.4%, more than quadruple the 4.6% average gain, respectively, in the first-, second- and fourth years.

If these statistics were all we had to go on, we’d bullishly conclude that the seasonal winds will continue to blow in the direction of a higher stock market through this coming September, seven months from now.

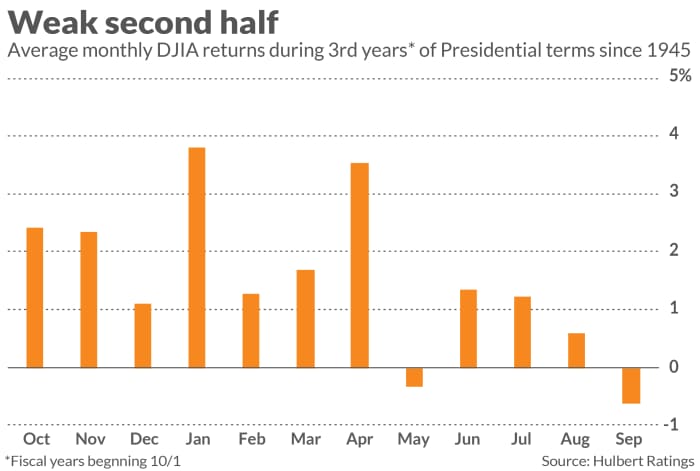

But what is not well-appreciated on Wall Street is that the third year’s above-average performance is front-loaded. That is, the strong rally that typically occurs during third years is often concentrated in the first few months of those years, leaving relatively little upward seasonal bias for the remaining months.

The accompanying chart reviews the monthly stock market pattern for third years of presidential terms since 1945. Notice that the strongest average returns occur in the first four months. But for April, there is a distinct pattern of declining average returns after January. From this perspective, the stock market’s weakness this February is not much of a surprise.

The pattern plotted in the chart makes theoretical sense, according to a study that appeared in July 2021 in the Journal of Financial Economics. Entitled “Asset prices, midterm elections, and political uncertainty,” the study was conducted by Kam Fong Chan of the University of Western Australia and Terry Marsh of the University of California, Berkeley.

They found that the stock market’s strength during third years of presidential terms traces to the resolution of the uncertainty that exists prior to the midterm elections. After the election, and especially by January, when congressional leadership contests and committee chairmanships are determined, most of that uncertainty will have been resolved.

Since last fall, at least, the stock market has largely adhered to the historical pattern for third years. From October of last year through the end of January, the Dow produced an 18.8% gain. So far in February, in contrast, it has shed close to 4%.

None of this means the U.S. stock market won’t be higher at the end of September. The lesson of the market history presented here is that, if it does, it won’t be due to the presidential election cycle .

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: This little-known indicator with an excellent record is projecting below-average long-term returns

Also read: The stock market is just taking a breather after January’s monster rally. These stocks and ETFs can power the next leg up