#ETF Wrap: A $2.5 trillion behemoth among mutual funds wants in on ETFs — underscoring a fast-moving trend

Table of Contents

“#ETF Wrap: A $2.5 trillion behemoth among mutual funds wants in on ETFs — underscoring a fast-moving trend”

Hi there! Everyone wants a piece of the action. ETFs aren’t a shiny new object for Wall Street as they have has been around for years, but that hasn’t stopped what feels like a steady drumbeat of fund providers from either converting existing assets into exchange-traded funds or launching their own ETFs.

That is the case with Capital Group, a $2.5 trillion fund manager, which is kicking off a half-dozen actively managed funds with an ETF tax-efficient wrapper. We’ll take stock of the strategy.

The Capital of ETFs?

Capital Group said it plans to launch a batch of ETFs by the end of the first quarter of 2022, and the initiative is setting up to be a prelude to a deeper entree into the fund type by the Los Angeles-based company, known for its American Funds series of mutual funds.

ETF Wrap asked Todd Rosenbluth, head of ETF and mutual fund research at CFRA, to put Capital Group’s ambitions into perspective for us.

“They have $2.5 trillion in assets and are showing up late to the ETF party with money to spend to have success,” he said.

“Demand for actively managed ETFs has never been stronger and they have the strong relationships, a record of success with stock picking and scale to make waves even in a crowded and concentrated market,” he explained.

As Barron’s wrote on Tuesday, the trend of actively managed ETFs includes offerings from the likes of Fidelity, JPMorgan Chase, and T. Rowe Price, but the active segment still represents a mere slice of the nearly $7 trillion ETF business.

Citing Morningstar data, Barron’s wrote that among the 325 stock ETFs launched this year and last, more than half are actively managed.

Why the shift? We’ve mentioned before, ETFs offer a cheaper alternative to mutual funds and providers see it as an opportunity to feed what has been perceived as growing demand for such products that offer investors the ability to buy baskets of assets and track their values daily in a transparent and tax-efficient wrapper.

Rosenbluth wrote that Capital Group’s first six products — five equity-pegged funds and one for bonds — will likely be the beginning of the company’s ETF franchise.

“We expect Capital Group will expand its lineup over the next few years to

provide an ETF alternative for clients across dozens of strategies,” he wrote.

The good and the bad

| Top 5 gainers of the past week | %Return |

|

SPDR S&P Oil & Gas Exploration & Production ETF XOP, |

10.6 |

|

VanEck Vectors Oil Services ETF OIH, |

9.6 |

|

Invesco China Technology ETF CQQQ, |

9.6 |

|

VanEck Vectors Rare Earth/Strategic Metals ETF REMX, |

8.9 |

|

SPDR S&P Biotech ETF XBI, |

8.8 |

| Source: FactSet, through Wednesday, Aug. 25, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

| Top 5 decliners of the past week |

%Return |

|

iShares 20+ Year Treasury Bond ETF TLT, |

-1.6 |

|

SPDR Portfolio Long Term Treasury ETF SPTL, |

-1.5 |

|

iShares 10-20 Year Treasury Bond ETF TLH, |

-1.3 |

|

Invesco Taxable Municipal Bond ETF BAB, |

-1.1 |

|

Consumer Staples Select Sector SPDR Fund XLP, |

-1.1 |

| Source: FactSet |

TLC for TLT?

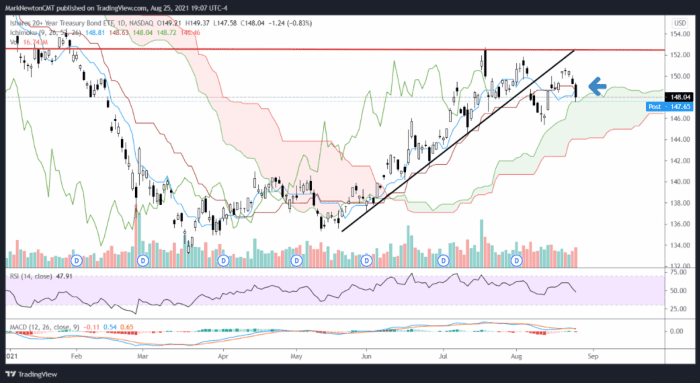

The iShares 20+ Year Treasury Bond ETF

TLT,

was one of the worst performers this week among funds that ETF Wrap tracks (see attached chart) and there are some analysts who see the long-term bond ETF as suggesting that yields are heading higher in the near term as Jackson Hole looms and Federal Reserve Chairman Jerome Powell is expected to set the table for tapering of the central bank’s monthly purchases of $120 billion in Treasurys and mortgage-backed securities.

Mark Newton, market technician at Newton Advisors, says that although yields have been climbing, as reflected in the benchmark 10-year Treasury note

TMUBMUSD10Y,

at around 1.37% Thursday morning, he’s not entirely sold on the prospect of a renewed push up for yields.

“Does this mean yields are headed straight back higher? I am skeptical of that technically just yet, as TLT seems to be right near support after this mild selloff,” he writes in a recent research note.

via Newton Advisors

Climbing yields have helped the Financial Select Sector SPDR Fund

XLF,

rally this week, up 3%, and in the month of August, up 6.3%. But Newton warned that the sector and yield move could stall out too and even reverse.

A rebound for China ETFs

The KraneShares CSI China Internet ETF

KWEB,

one of the best ways to get exposure to China’s internet market is making a bit of comeback, up 12% on the week, according to FactSet but off 36% in the year to date after China cracked down on the internet and technology sector earlier this spring.

Bloomberg reported that the fund added $181 million of new money on Tuesday, despite its woes. The new cash brings its total assets to $6.2 billion. The ETF is now larger than the $6.1 billion iShares MSCI China ETF

MCHI,

the site reported. The iShares China fund is up 4.7% so far this week.

“Investors are making a bet that the pressure on Internet stocks will be short-lived,” Rosenbluth told ETF Wrap in emailed remarks.

The analyst added that he harbors concerns for investors betting on KWEB, referring to the ticker symbol for the KraneShares ETF. He thinks that buyers may not be adequately rewarded relative to the risks of investing in the region and sector.

A low-vol change

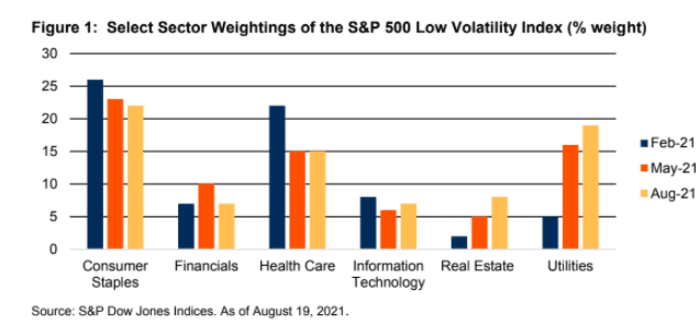

The Invesco S&P 500 Low Volatility ETF

SPLV,

which tracks a low-vol index composed of stocks with the lowest realized volatility over the past 12 months, saw its quarterly restructuring last Friday, with its weighting to financials downshifted and utilities ratcheted higher.

CFRA

The financials sector weighting fell to the 7% in August, after initially climbing to 10% in May, notes CFRA. That represents the lowest weighting for financials since February for the ETF. Utilities now represent 19% of assets, up from 16% in May, while real estate is 8%, up from 5%.

Losing patience?

Cathie Wood’s ARK Invest funds may be losing some appeal among investors after a tough stretch, according to Evie Liu at Barron’s, a MarketWatch sister publication. She writes that since the end of June, investors have pulled a net $2.7 billion from the fund complex, citing FactSet data.

Wood’s flagship Ark Innovation

ARKK,

fund has seen the bulk of those outflows, about $1.4 billion, according to Barron’s. Ark Innovation is down more than 3% so far in 2021 but is up 4.1% so far this week, and up by about 0.5% in August.

By comparison, the Dow Jones Industrial Average

DJIA,

has gained 15% in 2021 so far, the S&P 500 index

SPX,

has advanced 19% and the tech-heavy Nasdaq Composite Index

COMP,

has climbed nearly 16% in the year to date.

Check out: The case for sinking Cathie Wood’s Ark—here’s how one ETF provider outlines the short thesis

Is there a bitcoin ETF

There is no bitcoin

BTCUSD,

ETF yet.

However, Bloomberg Analyst Eric Balchunas has speculated, via Twitter, that the Securities and Exchange Commission is likely to approve an ETF pegged to bitcoin futures

BTC.1,

and that it could be launched as early as October.

We reported on the prospect for a futures based bitcoin ETF here: SEC’s Gary Gensler may have just laid out the clearest road map to the first U.S. bitcoin ETF

Good ETF reads

By

Mark DeCambre

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.