# Economic forecasts haven’t accelerated after good vaccine news. That’s puzzling, experts say

Table of Contents

“#

Economic forecasts haven’t accelerated after good vaccine news. That’s puzzling, experts say

”

Let’s get through next two quarters, IMF chief economist says

Stock markets certainly have reacted to the good news on the rollout of a COVID-19 vaccine.

The S&P 500

SPX,

has gained about 6% since Pfizer

PFE,

first announced its vaccine was more than 90% successful in treating COVID-19, as has the MSCI World

892400,

But that’s not the case for economic expectations.

Read: World watches as first person receives Pfizer-BioNTech COVID shot

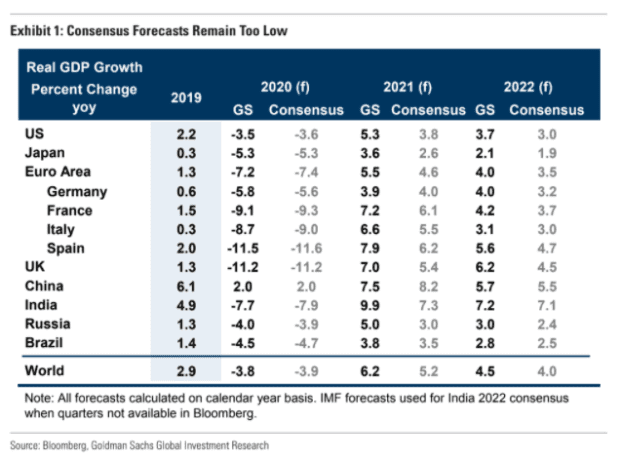

In a note to clients, Jan Hatzius of Goldman Sachs made a similar point. The bank’s global economic growth forecast for 2021 is a full percentage point ahead of the consensus, at 6.2%, and its 2022 forecast of 4.5% growth is above consensus by a half-point. That disparity is similar for its U.S. estimate as well.

“Most recent recessions have resulted from asset price busts and other financial shocks, whose negative effects on output took time to develop and even more time to unwind. By contrast, the 2020 slump resulted from a health crisis, whose negative effect on output was huge and immediate but also quickly reversible,” said Hatzius.

“Some sectors that largely shut down in the spring lockdowns—e.g. auto manufacturing—have learned to keep producing even in a virus-ridden environment. Other sectors that remain depressed for now—e.g. travel and entertainment—are likely to rebound sharply once enough people are vaccinated. This is likely to trigger renewed upgrades in consensus growth forecasts.”

In a presentation to the Wall Street Journal’s CEO Council Summit on Tuesday, IMF Chief Economist Gita Gopinath said there will be two quarters of weak growth before the upside scenario for the global economy becomes evident.

“The fourth quarter of this year will come in weaker than some people expected and so will the first quarter of next year,” Gopinath said.

“Overall, the world economy is recovering,” she said. The risks between downside and upside scenarios will be “balanced” for the next few quarters, because of the positive news on the vaccine front.

“After that, I think we can have some significant upside risks,” she added.

Lawlor said an important point of the vaccines is not simply that economic growth expectations rise, but also that the tail risks recede. “I think the bottom line is that rising bond yields reflect rising growth expectations. And if that was the case, that would not constitute a significant headwind for equities,” he said.

Lawlor said that could generate a fear-of-missing-out rotation trade next year. A pick-up in bond yields should encourage a rotation from quality growth stocks to the COVID-impacted value stocks and financials.

The global economy mirrors the U.S. economy in one key respect -a divergence in the economic prospects between skilled and unskilled workers, the IMF chief economist said.

Advanced economies are recovering more quickly than projected while many developing countries that rely on tourism and commodities have been hit much harder. Vaccines are going to be distributed more slowly in many emerging and developing economies than in advanced economies.

“A K-shaped recovery is, I think, the big challenge of 2021,” Gopinath said.

By

Steve Goldstein and

Greg Robb

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.