#Earnings Watch: Bank stocks whipsawed last week but bank profit estimates barely budged

Table of Contents

“Earnings Watch: Bank stocks whipsawed last week but bank profit estimates barely budged”

Earnings Watch: Wall Street remains calm on bank earnings as businesses on the ground scramble; results due from GameStop, Nike during the week

Anna Vocino, the founder and chief executive of Eat Happy Kitchen in Santa Ynez, Calif., said she experienced Silicon Valley Bank’s collapse this way: On the morning March 10, she’d logged in to the bank system there to set up bill payments that were due that Monday. Then, her husband told her the media was reporting that the bank was in trouble. Some 15 to 20 minutes later, right as another breaking news alert about the bank’s collapse hit her inbox, the online interface she was working in crashed.

“I was getting emails, automated emails, from Square and Shopify and Quickbooks — you name it,” she said. “Anybody where I’d ever gotten an electronic transaction to or from was writing me saying your bank accounts are null and void. I was like: Yeah, I know.”

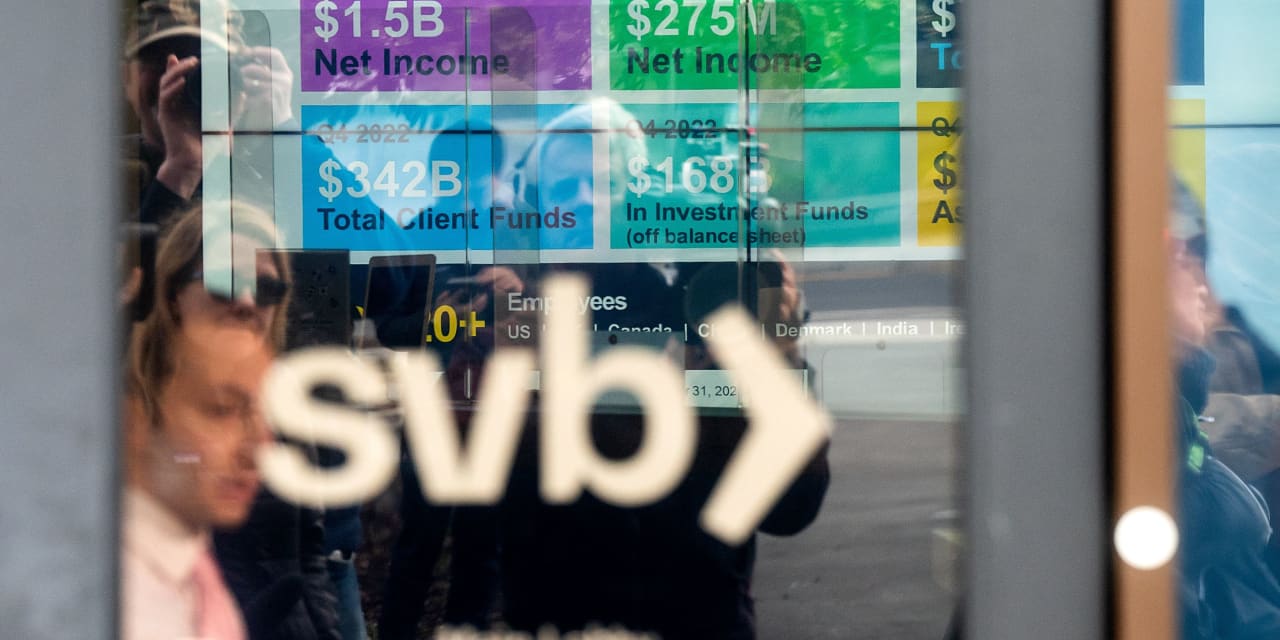

The stress of SVB’s collapse — and the collapse of Signature Bank, and the teetering and propping-up of First Republic Bank

FRC,

and Credit Suisse Group AG

CSGN,

— has rippled through markets and shocked smaller businesses on Main Street.

But the Wall Street analysts who try to predict companies’ quarterly results — and whose estimates often drive stock action when those results come in above or below them — have been calmer about financial-industry profits overall. At least, so far.

Between March 8 and Wednesday, per-share profit forecasts for the financial industry, and the companies that make up the S&P 500 Index

SPX,

overall, barely ticked lower, FactSet data shows.

For the full year over that time, those profit estimates for the financial sector dipped 0.8%. For the S&P 500 overall, those estimates fell 0.09%.

Only three companies in FactSet’s financials sector overall — Charles Schwab Corp.

SCHW,

KeyCorp

KEY,

and Comerica Inc.

CMA,

— saw their earnings-per-share estimates fall by more than 1% over that time, according to FactSet.

“It appears analysts are not making significant estimate cuts to other companies in the sector at this time,” John Butters, senior earnings analyst at FactSet, said in an email on Wednesday.

Still, those estimates will likely run lower as the weeks progress, and there’s plenty of room for trepidation elsewhere. Others noted that banks could still set aside more money to cover souring loans, as inflation and concerns about cracks in the banking industry threaten to create a bigger cash crunch for shoppers and businesses.

“They are likely to increase their reserves for loan losses, which will weigh on Q1 earnings,” said Ed Yardeni, president and chief investment strategist at Yardeni Research. “They will probably give a heads-up to the analysts in coming weeks before the start of earnings season.”

Elsewhere, analysts have said smaller banks could shoulder more of the financial fallout from any of their larger, distressed counterparts. UBS analysts on Thursday noted that nearly half of the nation’s lending came from outside the nation’s 25 biggest banks. And they said “it is in this smaller group where deposit growth and costs could be a bigger challenge.”

Goldman Sachs Research said in a blog post on Thursday that within smaller U.S. banks, “the tightening in lending standards among those institutions is expected to reduce economic growth this year.” A new recent study also found that nearly 190 U.S. banks remain prone to similar issues that sank SVB.

Vocino said she rolled out a discount on items a day after SVB failed in an effort to bring in cash as access to her money in the bank remained in flux. Her customers, she said, stepped up, and several products on the Eat Happy Kitchen website, as of Friday, were sold out.

Vocino, who is also a voiceover artist, said the switch from SVB to her new banks was set to happen on Friday or Monday. Successfully pulling money out of one bank — and waiting for the funds to land in another — can take a few days, and thus carries its own suspense.

“Nobody wants to change banks,” she said. “It’s such a pain in the a–. Nobody wants to do that.”

And amid the flood of takes on what SVB’s collapse means for the tech world and the years of low interest rates that fueled its ascent, she said there were other aspects of the bank’s downfall worth focusing on.

“I was watching CNBC,” she said. “And the whole focus is on tech bros, and Silicon Valley crashing. And I’m like: Hello? There are all these other businesses with this company.”

This week in earnings

Outside the tremors in the nation’s banks, the earnings reporting season’s calmer stretch will continue in the week ahead. Only five S&P 500 companies, including one Dow 30 member, report quarterly results during the week ahead, according to FactSet.

Among them: Results from RV maker Winnebago Industries Inc.

WGO,

will follow those from rival Thor Industries Inc.

THO,

as well as a slowdown in RV demand as rising interest rates and prices cut into a surge in enthusiasm for road trips when the pandemic shut down the economy. Petco Health & Wellness Co. Inc.

WOOF,

and Chewy Inc.

CHWY,

also report during the week, as rising prices test customers’ capacity to spoil their pets.

Elsewhere, results from General Mills Inc.

GIS,

could offer more clarity on the direction of stubbornly-high food prices. Retail chains Express Inc.

EXPR,

and Ollie’s Bargain Outlet Holdings Inc.

OLLI,

also report, as analysts try to gauge how much retailers still need to cut prices to attract shoppers who are increasingly uneasy about the economy.

The calls to put on your calendar

Nike and Foot Locker: Foot Locker Inc. and Nike Inc., both of whom in recent years have tried to rely less on each other for sales, report results on Monday and Tuesday, respectively. But they’ll do so following a drop-off in demand for shoes and clothing, after more customers opted to save what money they had to pay necessities, like food and gas. Nike

NKE,

in December, reported results that were better than expected. But Foot Locker

FL,

has cut staff, wound down an athletic fashion brand in Europe, and undergone a broader executive shake-up over the years.

The numbers to watch

GameStop earnings: Video-game chain GameStop Corp., the original meme stock, reports results on Tuesday. While big stock moves may come and go depending the moods of meme traders, Wedbush analyst Michael Pachter, in a note on Thursday, raised bigger concerns about the company.

“Short-term headwinds include a potential holiday season letdown, hardware challenges at Microsoft and Nintendo, the impact of layoffs, and an underwhelming start for the non-fungible token marketplace,” he said. “Long-term headwinds include potential liquidity challenges and changing gamer preferences, with greater appetites for cloud, digital, mobile, and subscription. We expect significant cash burn through FY:23 at least, eventually forcing the company to issue more equity.”

By

Bill Peters

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.