# Disney is focusing on streaming after pandemic put changes into hyperdrive

Table of Contents

“#

Disney is focusing on streaming after pandemic put changes into hyperdrive

”

Disney earnings preview: Reorganization of media and entertainment businesses to focus on streaming was expected under new CEO, but COVID-19 accelerated the transition

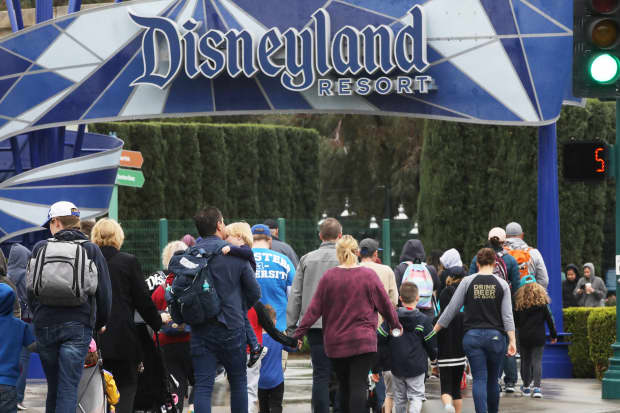

Disneyland Park and Disney California Adventure remain closed during the pandemic, cutting into Disney revenue.

Getty Images

Walt Disney Co. has plenty on its plate heading into earnings on Thursday: No less than redefining a multibillion-dollar business.

Last month, the media empire

DIS,

made a hard pivot toward its direct-to-consumer business while trying to reopen its theme parks in California. A strategic reorganization of Disney’s media and entertainment businesses to focus on streaming was underway but accelerated because of the pandemic, Chief Executive Bob Chapek said at the time.

Streaming service Disney+, which has attracted more than 60 million subscribers since its November 2019 launch, has adopted a more aggressive approach to taking content direct to streaming amid the COVID-19 pandemic. Movies such as “Mulan” and “Hamilton” debuted on the service instead of in theaters in the U.S., and last week, Disney said Pixar’s next animated film, “Soul,” will premiere on Disney+ on Dec. 25.

“We view the reorganization as further strengthening Disney’s ability to control its distribution by making [direct-to-consumer] streaming the primary mechanism for monetization (rather than cable network distribution) across all businesses,” Guggenheim analyst Michael Morris said in an Oct. 12 note. He maintained a buy rating on Disney shares with a price target of $140.

To be blunt, Disney has little choice. It faces competition from media giants Apple Inc.

AAPL,

Netflix Inc.

NFLX,

Comcast Corp.

CMCSA,

AT&T Inc.

T,

Amazon.com Inc.

AMZN,

and more. In late October, Netflix said its standard plan, which allows two streams at HD quality, will increase from $12.99 a month to $13.99 a month. Its premium plan, which allows up to four concurrent streams with more high-definition offerings, will jump from $15.99 to $17.99.

Read more: Netflix increases prices in U.S. after wave of pandemic subscription additions, stock jumps

Disney is putting its eggs in the digital basket as the company awaits a green light from health officials for Disneyland and Disney California Adventure to reopen in Southern California. The company announced 28,000 layoffs from its Parks, Experiences and Products segment in late September because of protracted theme-park closures caused by the coronavirus pandemic.

Indeed, a record surge in COVID-19 cases nationwide is suppressing average daily attendance at Disney World, according to a Deutsche Bank Research note Nov. 5. “We believe the continued march higher in average daily cases in both the U.S. and Florida is negatively impacting park attendance,” analyst Bryan Kraft said, noting a 15% dip from the previous week.

Last week, Disney-owned ESPN said it is slashing 300 jobs, or about 6% of its workforce, as cost pressures from the pandemic hasten the sports media company’s move into streaming.

Still, all isn’t rosy for Disney+ as it approaches its first anniversary. A key element to the service’s success — Verizon Communications Inc.

VZ,

customers who received a free year of the streaming service as a promotion — must now start paying or cancel. This, in turn, has prompted angst among Disney officials that a large percentage of Verizon users will cancel, according to a report in The Information.

What to expect

Earnings: Analysts on average expect Disney to report a loss of 73 cents a share, down from net income of $1.07 a share a year ago. Analysts have lowered their outlook for the quarter since the last earnings report, as theme parks in California remain shuttered and live-action productions remain in limbo because of the pandemic; analysts were projecting a loss of 17 cents a share at the end of June.

Contributors to Estimize — a crowdsourcing platform that gathers estimates from Wall Street analysts as well as buy-side analysts, fund managers, company executives, academics and others — project a loss of 59 cents a share on average.

Revenue: Analysts on average expect Disney to report $14.15 billion in fourth-quarter revenue, down from $19.1 billion in the same quarter a year ago. Estimize contributors predict $14.12 billion on average.

Stock movement: Disney’s stock is down 14% this year, as the S&P 500 index

SPX,

has increased 2%.

By

Jon Swartz

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.