#Deep Dive: Why consider the Dow transports when they point to a slowing economy? Because these 7 stocks are cheap

Table of Contents

“Deep Dive: Why consider the Dow transports when they point to a slowing economy? Because these 7 stocks are cheap”

There are always special circumstances, such as the airline industry’s recovery and ever-building demand for package delivery services

The Dow Jones Transportation Average has long been considered a good forward indicator of the direction of the U.S. economy. With early signs that an economic slowdown is coming, this might be an obvious portion of the stock market to avoid.

Then again, this group of 20 stocks includes four that are both expected to be profitable this year and grow earnings at a double-digit pace through 2024. It also includes some bargain stocks, especially if you believe the dark days of the pandemic are behind us.

The transportation warning

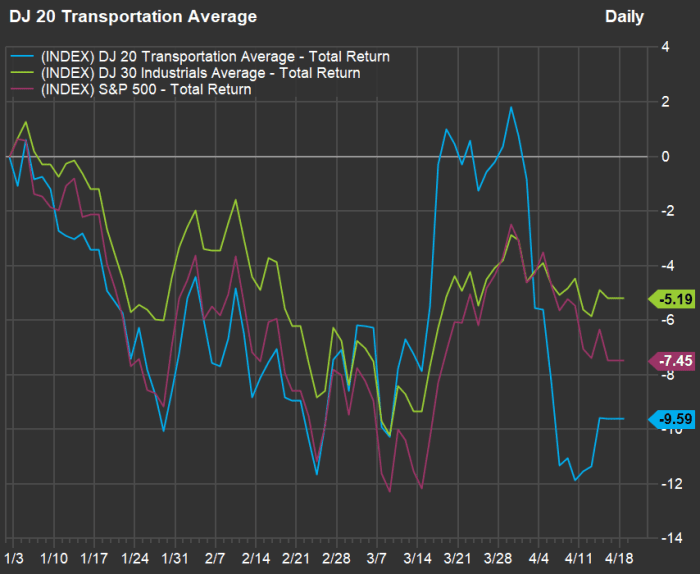

First, here’s a chart showing total returns (with dividend reinvested) for the Dow Jones Transportation Average

DJT,

the Dow Jones Industrial Average

DJIA,

and the S&P 500

SPX,

this year through April 14:

FactSet

The Dow Transports have been bringing up the rear. Following a 5% drop for the Dow Transports on April 1, a day when the Dow Jones Industrial Average and the S&P 500 were up, Mark Hulbert called the action a “bad omen.” He cited government data correlating poor performance among transportation stocks with economic slowdowns over succeeding months.

Along with this year’s weak showing for the Dow Transports, consumer and wholesale price increases were at 40-year highs in March, and the Federal Reserve is expected to accelerate its interest-rate increases and begin reducing its bond holdings soon to counter inflation. Rising rates have given home builders the jitters, and it remains to be seen if the Fed’s moves will cause a recession or lead to a “soft landing” for the economy.

The case for (some of the) Dow Transports

To screen the Dow Jones Transportation Average, we began with the entire list of 20 stocks and consensus 2022 estimates for earnings per share, among analysts polled by FactSet. A baseline of 2022 may be more useful than a 2021 starting point, because of the pandemic-induced turmoil for airlines and the supply squeezes that affected other industries.

Here are the 20 stocks in the Dow Jones Transportation Average, sorted by industry and then alphabetically, with projected compound annual growth rates (CAGR) for earnings per share through 2024:

| Company | Ticker | Industry | Estimated EPS – 2022 | Estimated EPS – 2023 | Estimated EPS – 2024 | Two-year estimated EPS CAGR | Price/ 2024 EPS estimate |

| C.H. Robinson Worldwide Inc. | CHRW | Air Freight/ Couriers | $6.35 | $5.78 | $5.95 | -3.2% | 17.4 |

| Expeditors International of Washington Inc. |

EXPD, |

Air Freight/ Couriers | $6.99 | $5.87 | $5.57 | -10.8% | 17.4 |

| FedEx Corp. |

FDX, |

Air Freight/ Couriers | $21.72 | $23.87 | $25.84 | 9.1% | 8.0 |

| United Parcel Service Inc. Class B |

UPS, |

Air Freight/ Couriers | $12.78 | $13.40 | $13.76 | 3.8% | 13.7 |

| Alaska Air Group Inc. |

ALK, |

Airlines | $3.00 | $6.23 | $8.28 | 66.3% | 6.9 |

| American Airlines Group Inc. |

AAL, |

Airlines | -$3.44 | $1.57 | $3.63 | N/A | 5.2 |

| Delta Air Lines Inc. |

DAL, |

Airlines | $2.53 | $5.83 | $7.25 | 69.4% | 5.8 |

| JetBlue Airways Corp. |

JBLU, |

Airlines | -$0.49 | $1.28 | $2.14 | N/A | 6.0 |

| Southwest Airlines Co. |

LUV, |

Airlines | $1.13 | $3.11 | $4.28 | 94.6% | 10.9 |

| United Airlines Holdings Inc. |

UAL, |

Airlines | -$2.52 | $6.26 | $8.80 | N/A | 5.1 |

| Avis Budget Group Inc. |

CAR, |

Rental/ Leasing | $22.55 | $15.93 | $14.82 | -18.9% | 17.9 |

| Ryder System Inc. |

R, |

Rental/ Leasing | $11.60 | $10.17 | $11.75 | 0.7% | 5.4 |

| Kirby Corp. |

KEX, |

Marine Shipping | $2.11 | $3.39 | $4.46 | 45.3% | 14.9 |

| Matson Inc. |

MATX, |

Marine Shipping | $26.11 | $11.21 | $6.31 | -50.8% | 13.9 |

| CSX Corp. | Railroads | $1.79 | $1.96 | $2.15 | 9.6% | 16.3 | |

| Norfolk Southern Corp. |

NSC, |

Railroads | $13.82 | $15.27 | $16.50 | 9.3% | 15.9 |

| Union Pacific Corp. |

UNP, |

Railroads | $11.65 | $12.96 | $13.93 | 9.3% | 17.7 |

| J.B. Hunt Transport Services Inc. |

JBHT, |

Trucking | $8.84 | $9.75 | $10.35 | 8.2% | 16.6 |

| Landstar System Inc. |

LSTR, |

Trucking | $11.08 | $9.49 | $9.54 | -7.2% | 15.2 |

| Old Dominion Freight Line Inc. |

ODFL, |

Trucking | $11.01 | $12.06 | $12.80 | 7.8% | 20.7 |

| Source: FactSet | |||||||

Click on the tickers for more about each company.

Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

The estimates are for calendar years, because some companies have fiscal years that don’t match the calendar. For example, FedEx Corp.’s fiscal year ends on May 31.

Some notes about the data:

-

Among the 20 stocks, American Air Lines Group Inc.

AAL,

-2.42% ,

JetBlue Airways Corp.

JBLU,

-0.94%

and United Airlines Holdings Inc.

UAL,

-2.57%

are expected to show net losses for 2022, so there are no EPS CGAR figures in the table. -

Among companies expected to be profitable this year, four — Alaska Air Group Inc.

ALK,

-0.46% ,

Delta Air Lines Inc.

DAL,

-0.54% ,

Southwest Airlines Co.

LUV,

-1.07%

and Kirby Corp.

KEX,

+0.21%

— are expected to show double-digit EPS CAGR through 2024. -

Among the 20 stocks, seven trade for 8.0 times consensus 2024 EPS estimates or lower. These include all the airline stocks except for Southwest, along with FedEx Corp.

FDX,

-1.21%

and Ryder System Inc.

R,

+0.59% .

In comparison, the S&P 500 trades for 16 times its weighted aggregate consensus 2024 EPS estimate. - Note that a low valuation to expected earnings means a good number of investors aren’t (or aren’t yet) confident about a company’s prospects or those of its industry.

Any stock screen has its limitations and should only serve as a starting point for your own research.

Don’t miss: Inflation is raging, but these 16 companies have pricing power

By

Philip van Doorn

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.