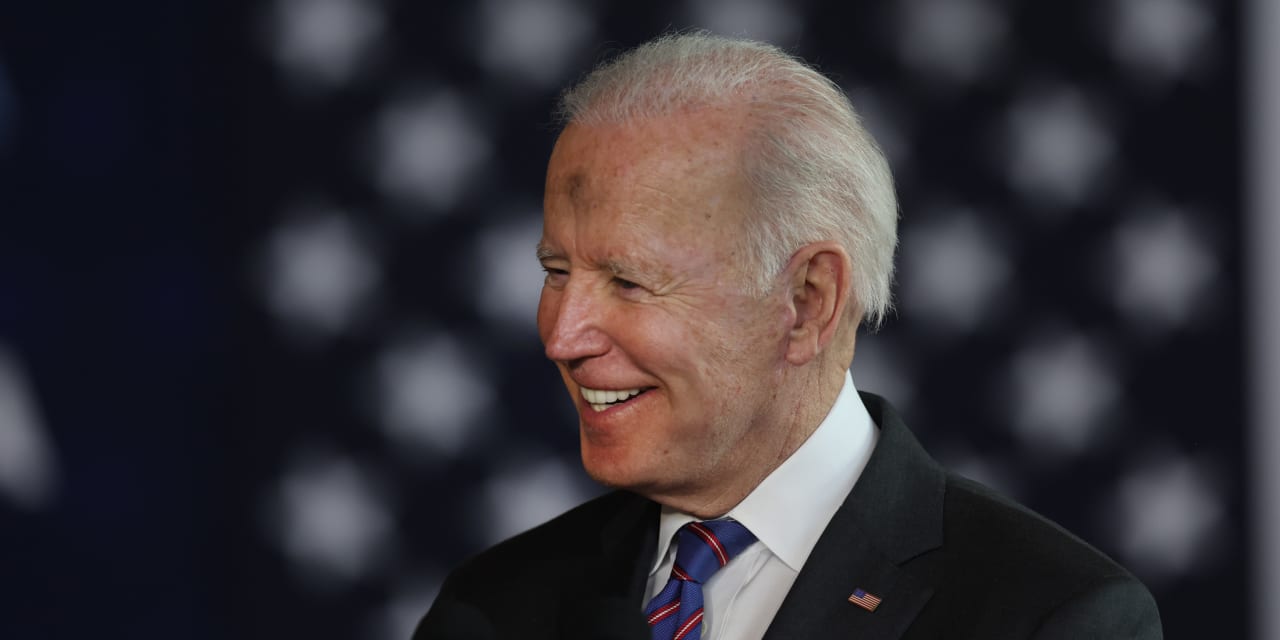

Leading figures in the cryptocurrency industry are applauding President Joe Biden’s executive order on digital assets as an important milestone and evidence that crypto has reached the mainstream.

The order directed federal agencies to conduct a broad review of their policies related to cryptocurrencies and other digital assets and to put forth proposed regulatory and legal changes needed to foster consumer protection, financial stability and innovation while guarding against illicit finance and threats like ransomware attacks.

“It’s more industry friendly than some in the cryptocurrency world might have feared,” Jonathan McCollum, a lobbyist who represents crypto companies before Congress, told MarketWatch, adding that the administration decision to engage in a deep study of the issues before issuing new regulations was welcome by the industry.

Read more: SEC chief Gary Gensler wants to bring the public’s ‘trust’ back to the stock market — and even to crypto

Executives from some of the largest companies in the digital asset space agreed.

“The Biden administration’s executive order on digital assets represents a watershed moment for crypto…akin to when the government in the 90s realized the commercial power of the internet,” Jeremy Allaire CEO of Circle, the company behind the dollar-pegged stablecoin USD coin, in a statement.

Faryar Shirzad, chief policy officer at crypto exchange Coinbase

COIN,

+10.48%

said in tweet Wednesday that the executive order gives reasons for “optimism” because the White House “seems to understand and embrace the transformational potential of digital asset technology, and the importance of maintaining American leadership.”

Nathan McCauley, CEO and co-founder of Anchorage Digital Bank argued that the order “is a shot in the arm for crypto,” in an email. He added that the industry should meet the administration halfway and recognize that “for the benefit of the industry, regulators have a role to play in the crypto ecosystem.”

Jerry Brito, executive director of the crypto think tank Coin Center argued on Twitter that the order could open the gates for entrepreneurs who might have been hesitant to get into the crypto industry, given legal uncertainties.

Anne Termine, who served as the chief trial attorney at the Commodity Futures Trading Commission before entering private practice at Bracewell LLP, told MarketWatch that while the industry may be happy with this initial step, the difficult part will come when agencies start to propose regulations and Congress considers legislation.

She said that while the CFTC and the Securities and Exchange Commission were doing their best to foster investor protection, a major goal of the executive order, significant regulatory gaps remain.

Given that the two most popular cryptocurrencies, bitcoin

BTCUSD,

-7.43%

and ether

ETHUSD,

-5.34%,

are thought to be commodities and therefore outside the SEC’s jurisdiction, Termine said Congress may decide to give the CFTC direct oversight of the spot markets in those assets. The CFTC has authority to oversee futures and other derivatives markets that are based on the spot markets for digital assets, but not the spot markets themselves.

“The CFTC can only regulate from behind, after fraud has occured,” she said. “The CFTC could more but it needs permission to do more.”