# Zoom Video gets tepid endorsement from Deutsche Bank as stock heads toward a ‘death cross’

Table of Contents

“#

Zoom Video gets tepid endorsement from Deutsche Bank as stock heads toward a ‘death cross’

”

Analyst Matthew Niknam sees Zoom as an ‘integral part’ of post-COVID world, but he started coverage with a hold rating

Zoom Video Communications Inc. will play an “integral” role in a post-COVID world, but Deutsche Bank analyst Matthew Niknam said the stock has already rallied too much to recommend buying at current levels.

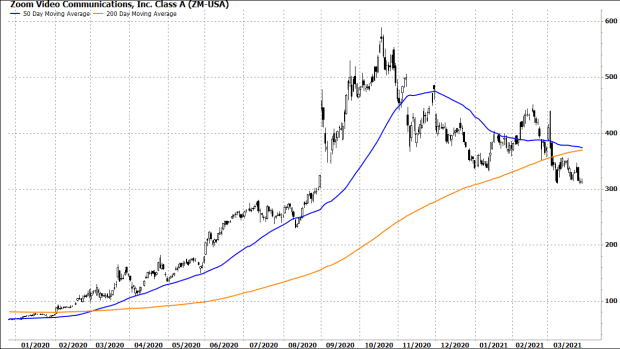

Niknam’s tepid endorsement comes as a bearish “death cross” pattern is set to appear in Zoom Video’s stock chart

ZM,

in the coming days, which many on Wall Street see as a warning signal for further losses. Read more about the “death cross.”

He was mostly positive on Zoom’s business prospects, given the growing consensus among businesses that a hybrid/remote work environment using video communications is here to stay. And beyond the “meaningful customer base and scale Zoom as amassed” over the past year, Niknam sees more avenues for growth through the Zoom Phone, increasing penetration within businesses and international expansion.

But he stopped short of recommending buying the stock.

Don’t miss: Zoom Video can still thrive in a post-vaccine world, analysts say.

“Coming off a historic FY21, where Zoom grew 325%+ and became an integral part of daily life (it still is!), we believe the ‘sequel’ to the story (Zoom, post-COVID) presents a more balanced risk/reward setup for shares,” Niknam wrote in a note to clients.

Zoom’s last fiscal year ended on Jan. 31.

Also read: Zoom earnings roared to nearly $1 billion in 2020, and the stock is rising again.

One fundamental concern Niknam has is that many of Zoom’s small business customers, or those with less than 10 employees which grew significantly during the pandemic, are at greater risk of leaving once the economy fully reopens.

He said that customer base represents about 37% of Zoom’s total revenue, and he estimates monthly churn in the high-single digit percentage range going forward.

“The key risk is here is that elevated churn could drive a sharper than expected deceleration in growth,” Niknam wrote.

Of the 28 analysts surveyed by FactSet who cover Zoom, Niknam is one of the 14 who are neutral on the stock. Of the rest, 12 have the equivalent of buy ratings and two have the equivalent of sell ratings.

‘Death cross’ set to appear next week

After rocketing 735.3% from the end of 2019 to a record close of $568.34 on Oct. 19, as investors saw the company as a key beneficiary of COVID-19-related lockdowns, the stock has fallen steadily as restrictions have lifted and COVID-19 vaccine administration has ramped up.

On Friday, the stock was down as much as 2.6% to an intraday low of $306.75, the lowest price seen since Aug. 31, 2020, before staging a late-day rally to close up 1.6%. It has dropped 43.7% from its record close, and earlier this month fell below the 200-day moving average , which many use as a dividing line between longer-term uptrends and downtrends, earlier this month.

Although the 200-day moving average (200-DMA) is still rising, to $369.66 on Friday according to FactSet, the recent weakness has led the 50-day moving average (50-DMA), seen by many as a shorter-term trend tracker, down to $373.85

FactSet, MarketWatch

At the current trajectories, the 50-DMA will likely cross below the 200-DMA around the middle to the end of next week. That would form what technical analysts refer to as a “death cross,” which many believes marks the spot that a shorter-term decline can start being defined as a longer-term downtrend.

The last time the 50-DMA was below the 200-DMA was March 2, 2020. The next day the 50-DMA crossed above the 200-DMA to form a “golden cross,” suggesting the longer-term trend could start being referred to as bullish.

Moving-average crosses aren’t necessarily good market timing tools, as they are usually well telegraphed, but they can help put a stock’s recent trend in historical perspective.

So far this year, Zoom shares have fallen 5.2%, while the S&P 500 index

SPX,

has gained 5.8%.

By

Tomi Kilgore

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.

.jpg)