# U.S. stocks are demonstrating most of the characteristics of a bubble, but don’t sell yet, says strategist

Table of Contents

“#

U.S. stocks are demonstrating most of the characteristics of a bubble, but don’t sell yet, says strategist

”

Critical information for the trading day

The old investment adage is, “sell in May and go away,” but this year, investors just seem to have done the latter — the S&P 500 has moved all of 0.2% higher during the fifth month of the year. So it’s a good time to step back and look at the bigger picture for stocks.

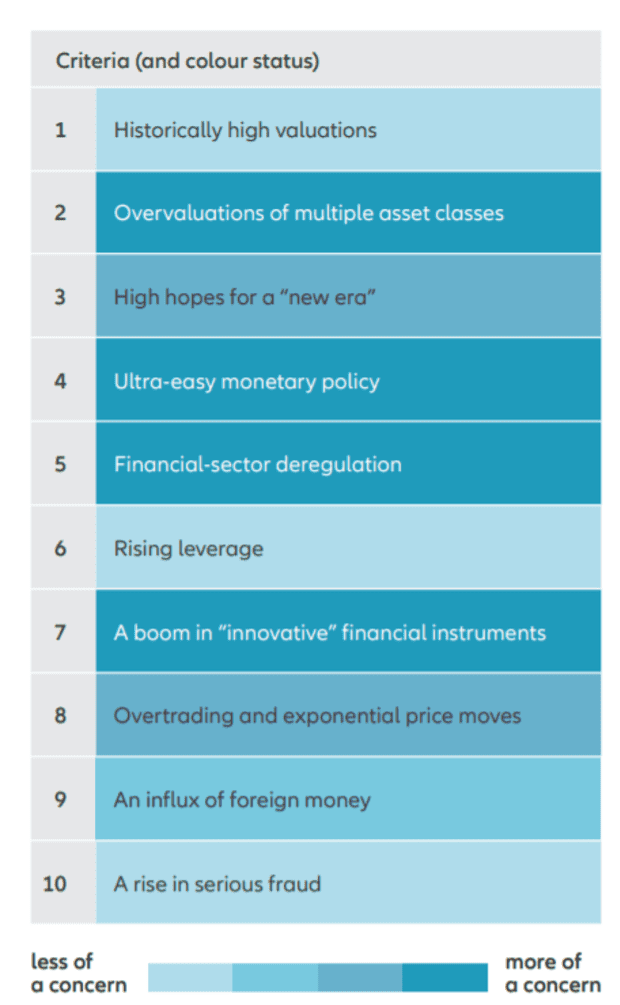

Stefan Hofrichter, head of global economics and strategy at German fund management giant Allianz Global Investors, put together a 10-point checklist for bubbles that he says was inspired by Charles Kindleberger, the author of the 1978 classic, “Manias, Panics, and Crashes.” In the table below, you can see what that list is, as well as the color-coded rating he assigned to them.

At the end of April, the S&P 500

SPX,

traded at a cyclically adjusted price-earnings ratio of 37, a level not seen since the dot-com bubble of 1998, and the Nasdaq Composite

COMP,

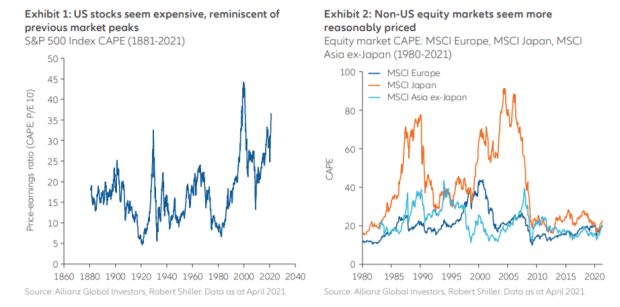

was at an even more-staggering 55. (European, Japanese and Asian equities, by contrast, are trading at or below their long-term valuation multiples.) And he doesn’t agree that the valuations are justified by low bond yields. “Low real yields have historically typically implied rather low multiples, since low yields point to a slow-growth environment and a higher risk of recession,” says Hofrichter. “Monetary policy over the decades has lifted investors’ risk appetite to extremes, powering the run-up in equities,” he says.

Also on the bubble list is that multiple asset classes are overvalued, noting that the term premium for longer-dated sovereign bonds remains around 100 basis points below the long-term average. Another sign of bubbles is that they tend to occur alongside the perception of a new era, which clearly is the case now with artificial intelligence. Ultra-easy monetary policy, the advent of new financial instruments like special-purpose acquisition companies and cryptocurrencies, and what he calls “overtrading” — exponential price movements and signs of above-average risk taking — also are illustrative of bubbles.

So with all these bubble signs, isn’t it a time to sell? “History has shown that bubbles only burst once central banks start to hike rates or take other steps to rein in their ‘easy money’ policies.” Until the Fed starts tapering its bond purchases, “we think there is a reasonable chance that U.S. equities will continue bubbling up further. As a result, we stay nervously ‘risk on’ for now, gravitating towards risk assets. And we have a bias for value stocks, which are trading at a multidecade discount to growth stocks,” he says.

Subtle shift at the Fed

Tim Duy, chief U.S. economist at SGH Macro Advisors, analyzed the wave of comments from Federal Reserve officials, including Vice Chair Richard Clarida. “Notice how slowly the Fed is moving in the tapering direction, mixing in talking about tapering with policy still being in a good place and not seeing substantial progress ‘just yet.’ This is by design. It’s enough that if you are watching for it and you know what to look for, you see the subtle shift but not enough to be any kind of game-changer,” he said. Duy expects the formal pivot toward tapering to be announced at the Jackson Hole, Wyo. conference in August, with the actual reductions starting in the first quarter of 2022, or possibly the final quarter of 2021.

Fed Vice Chair for Supervision Randal Quarles has two speeches, the first on insurance regulation and the second on the economic outlook.

The chief executives of Wall Street banks — including Bank of America

BAC,

Goldman Sachs

GS,

and JPMorgan Chase

JPM,

— will testify in front of the Senate Banking Committee on the topic of oversight.

Read: Big bank CEOs to be grilled on diversity and woke capitalism.

Retailers Dick’s Sporting Goods

DKS,

and Abercrombie & Fitch

ANF,

report results, and after the close, graphics chip maker Nvidia

NVDA,

database software maker Snowflake

SNOW,

and identity management company Okta

OKTA,

release their latest numbers.

Zscaler

ZS,

rose 10% in early premarket trade, after the cybersecurity company’s quarterly results and higher full-year outlook breezed past Wall Street expectations. Retailer Nordstrom

JWN,

fell 5%, after reporting a wider loss than forecast.

Bitcoin reclaims $40,000 level

U.S. stock futures

ES00,

NQ00,

rose, with the yield on the 10-year Treasury

TMUBMUSD10Y,

at 1.57%.

Bitcoin

BTCUSD,

the volatile cryptocurrency, rose over 7% to reclaim the $40,000 level.

Random reads

How parking requirements ruin cities.

A new reality-television series will offer the chance to become an astronaut.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

By

Steve Goldstein

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.