# This stock fund may be for you if you want to sleep well at night and still make money

Table of Contents

“#

This stock fund may be for you if you want to sleep well at night and still make money

”

Jordan Kahn of ACM Funds explains his long/short strategy that has outperformed the S&P 500 through the COVID-19 pandemic.

Just about every financial adviser recommends that individual investors avoid timing the stock market. That advice can go in one ear and out the other in turbulent times, such as during last year’s coronavirus-induced panic.

Professional money managers have various strategies to limit downside risk. Some of those are being sought out today, as a recent change of direction for interest rates has rattled stock market investors.

ADOIX,

follows a long/short strategy that seeks to give investors a measure of protection. However, its approach isn’t to short-sell stocks that the portfolio managers believe will decline. Instead, the ACM team uses a rules-based strategy to short index ETFs, such as the SPDR S&P 500 ETF Trust

SPY,

or the Invesco QQQ Trust

QQQ,

during periods of broad weakness for the market, as well as using options to hedge its long positions.

The fund is rated four stars (of five) by Morningstar, and has performed well against the investment-research firm’s Equity Long/Short category. Here’s a comparison against the category, the HFRX Equity Hedge Index, and the S&P 500 Index through Feb. 23. (The HFRX Equity Hedge Index’s numbers are through Feb. 22):

Morningstar, FactSet

In an interview, Jordan Kahn, chief investment officer of ACM Funds in Los Angeles, explained the strategy and how he selects long positions.

He said the fund isn’t designed to outperform the S&P 500, even though it has done so over the past year. The figures, above, are net of expenses, which are 1.68% of assets annually for the fund’s Class I shares. That’s a high level of expenses. It has $96 million in assets under management.

The fund will hedge according to the movement of broad stock indexes relative to various time frames.

“When the indexes are all above the moving averages, we ill be 100% long,” Kahn said. As indexes fall below 30-day and longer moving averages, the fund will be more and more hedged, he said.

“In a shallow pullback, the portfolio may only go from 100% long to 85% or 90% long … but by the time the market is 10% down, we are fully hedged,” he said.

What happened in 2020

This is what happened in February and March of last year.

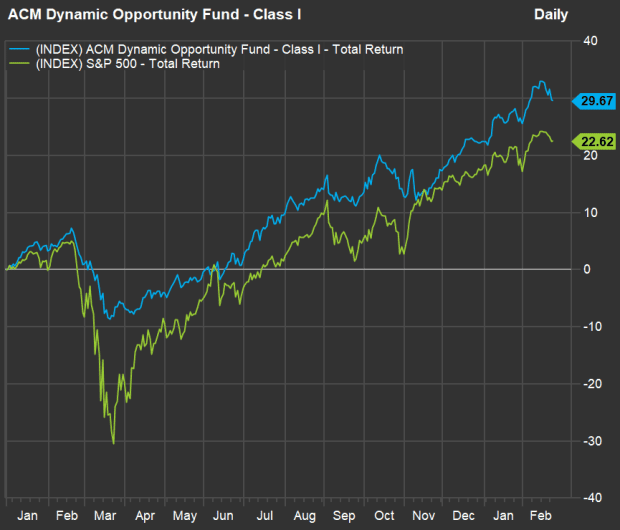

The S&P 500 fell 34% from its pre-pandemic closing peak Feb. 19, 2020, through its closing bottom March 23, while the ACM Dynamic Opportunity Fund’s Class I shares declined 14%. So Kahn and his team don’t have a crystal ball. The fund’s rules-based hedging moves don’t take place until after a decline begins, but can forestall the worst of a brutal beating.

Kahn also said the fund had changed its strategy following a V-shaped decline and recovery in 2019, when it “underperformed by a large amount,” to make it more sensitive and add long exposure more quickly during a recovery. You can see that underperformance reflected in the table above.

The change in strategy has worked out well since the end of 2019, through the Covid-19 pandemic’s stock market decline and recovery cycle:

(FactSet)

High valuations, rising interest rates and fear

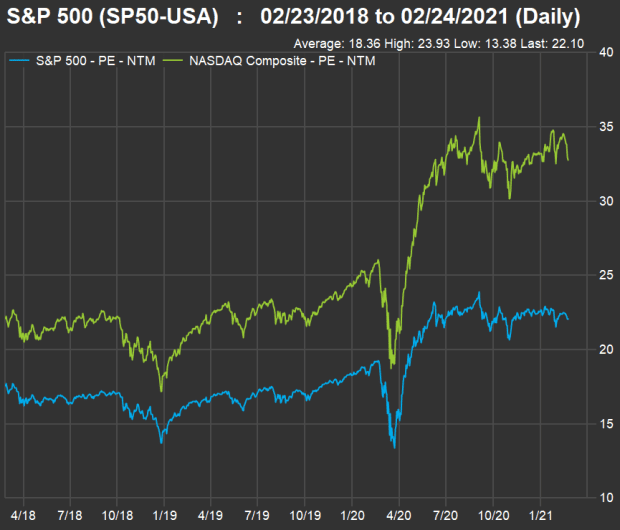

Long-term interest rates have been rising, along with the fear of inflation, following the massive increase in the U.S. money supply during the COVID-19 pandemic. This has affected stocks of faster-growing companies the most, so far, but that makes sense because that group’s valuations have expanded the most during the bull market.

Here’s how forward price-to-earnings ratios have increased for the S&P 500 Index

SPX,

and the Nasdaq Composite Index

COMP,

over the past five years:

(FactSet)

So there are short- and long-term concerns for investors who fret over valuation.

Investors lack a ‘strong stomach’

A disciplined investor who can ride out the stock market’s repeating decline/recovery cycles might be best served by not bothering with a hedging strategy. After all, if you are making regular contributions to a 401(k) or similar tax-deferred retirement account (hopefully with your employer matching some of the contributions), you pay lower prices during periods of decline. And even with all of its oscillations and movements from crisis to crisis, the S&P 500’s average annual return over the past 30 years has been a tidy 10.4%, according to FactSet.

Jordan Kahn, chief investment officer at ACM Funds.

ACM Funds

But Kahn made a good argument for the hedging strategy based on his 30 years as an investment adviser and portfolio manager: “Nine times out of 10, investors will say they have a strong stomach for risk, but inevitably, when you get into the teeth of a downturn, when all the news is bad, they second-guess themselves, sell at a very inopportune time and then buy back in at much higher prices.”

Long stock positions

Kahn said the ACM Dynamic Opportunity Fund’s objective is to pursue long-term growth by investing in 30 to 50 stocks of “true market leaders,” while also following the hedging strategy described above. Here are the fund’s largest 10 long positions as of Jan. 31:

ACM Funds, FactSet

Don’t miss: If you want to get rich with marijuana stocks, you need to know the crucial difference between U.S. and Canadian companies

By

Philip van Doorn

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.