#Market Snapshot: Dow futures slump over 300 points amid earnings, rising bond yields and geopolitical tensions

Table of Contents

“Market Snapshot: Dow futures slump over 300 points amid earnings, rising bond yields and geopolitical tensions”

U.S. stock futures on Tuesday were pointing to a poor start to a holiday-shortened trading week as earnings from major retailers, rising bond yields and geopolitical tensions weigh on sentiment.

How are stock-index futures trading

-

S&P 500 futures

ES00,

-0.97%

dipped 34 points, or 0.8%, to 4053 -

Dow Jones Industrial Average futures

YM00,

-1.05%

fell 316 points, or 0.9%, to 33550 -

Nasdaq-100 futures

NQ00,

-1.22%

lost 133 points, or 1%, to 12256

The Dow

DJIA,

rose Friday, but logged a third straight weekly decline, while the , the S&P 500

SPX,

saw a 0.3% weekly fall, its second straight decline. The Nasdaq Composite

COMP,

rose 0.6% last week. U.S. markets were closed Monday for the Presidents Day holiday.

What’s driving markets

U.S. investors returned from the three-day weekend in a downbeat mood.

Trader sentiment is cautious as they observe benchmark bond yields near their highs of the year on expectations recent robust economic data will encourage the Federal Reserve to keep borrowing costs higher for longer.

Minutes of the Fed’s Jan. 31-Feb. 1 meeting will be published on Wednesday.

Tensions over Russia’s invasion of Ukraine, as President Joe Biden visits Poland and a Chinese delegation goes to Moscow, are adding to the anxiety.

“So far, risky assets have digested the rates repricing well — while the broad ‘risk-on’ rally has slowed to a crawl, the higher terminal rates have not moved through assets like a wrecking ball as some had assumed,” said Stephen Innes, managing partner at SPI Asset Management.

“But there remains a heightened degree of caution due to the steep rise in U.S. yields and rate volatility, an environment where the U.S. dollar tends to benefit,” Innes added.

Such caution was matched by Jonathan Krinsky, chief technical strategist at BTIG, who noticed that the latest rally had nevertheless begun to fade.

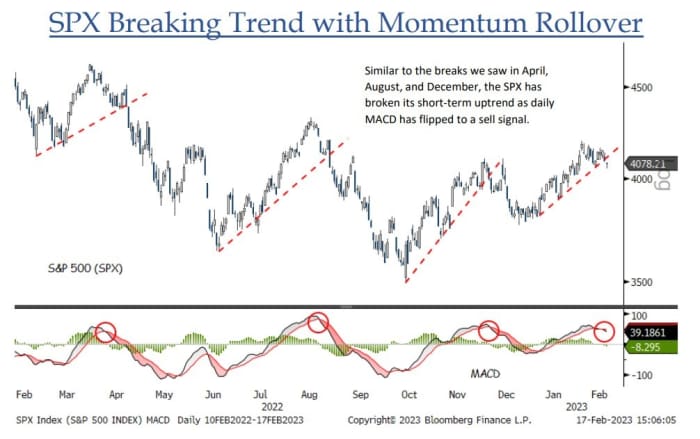

“After a few weeks of chopping around, the SPX looks to have broken its short-term uptrend just as momentum has begun to roll over, similar to breaks we saw in April, August, and December of 2022,” Krinsky wrote in a note to clients.

Source: BTIG

“As a reminder, the back-half of February is often one of the weaker parts of the calendar. This has come on the heels of rates which have been moving higher for the last couple of weeks. A slow equity reaction to rates has not been atypical over the last 18-months, as each of the prior six tactical peaks all occurred one to four weeks after the low in rates,” he added.

U.S. economic updates set for release on Tuesday include the S&P flash services and manufacturing purchasing managers’ indices for February, due at 9:45 a.m. Eastern. Existing home sales figures will be published at 10 a.m.

Companies in focus

-

Walmart Inc.

WMT,

+1.50%

shares were trading lower in the premarket after the retail giant reported its fourth quarter earnings and offered its forward guidance. The company beat estimates on earnings and sales, but also offered guidance on the first quarter and the full fiscal year 2024 that fell short of expectation. -

Home Depot Inc.

HD,

-1.02%

shares were also trading lower after fourth quarter results from the home improvement chain. While posting a beat on profits during the quarter, sales missed expectations and the company’s downbeat forward guidance cited continuing challenges with inflation, labor markets and supply chains. -

Shares of Meta Platforms Inc.

META,

+0.26%

rose 2% after the parent company of Facebook and Instagram said it is testing a paid subscription tier to verify accounts.

Movers & Shakers: Home Depot and Walmart slip after earnings guidance; Facebook parent Meta rises on trial of subscription tier

By

Jamie Chisholm

Andrew Keshner

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.