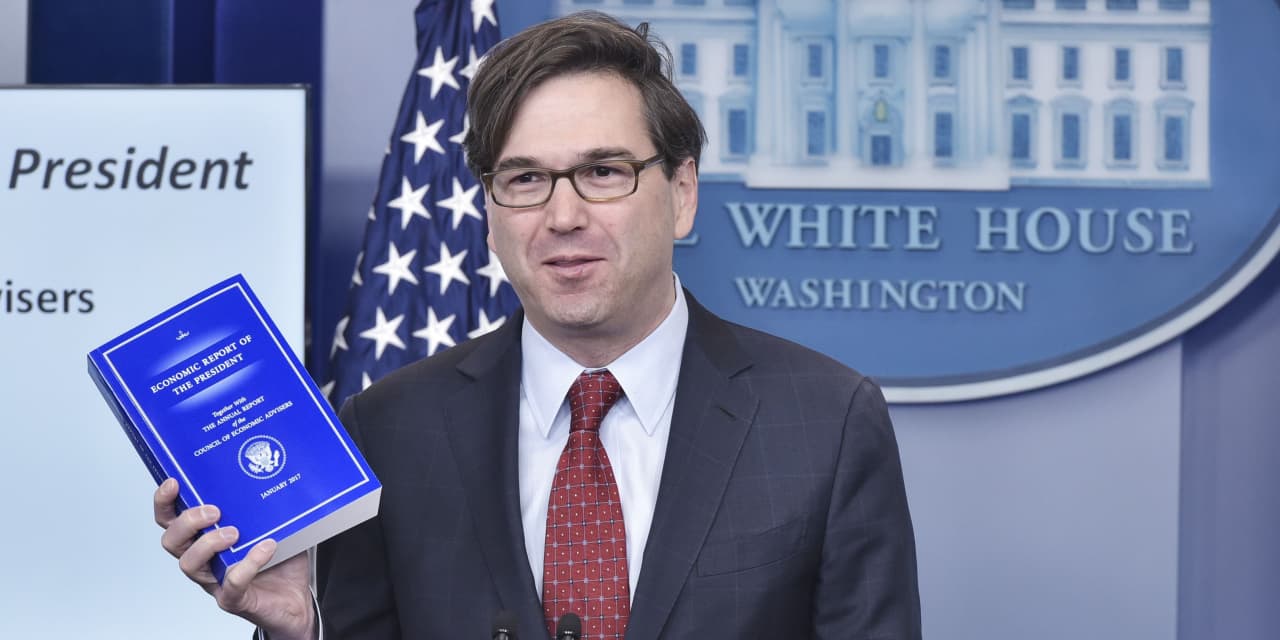

The Federal Reserve could raise its benchmark interest rate as high as 5.5% by the end of next year in its effort to bring inflation down, said Jason Furman, a Harvard economics professor who chaired the Council of Economic Advisers under President Barack Obama.

It is entirely “plausible” that the Fed raises its benchmark rate to 4% this year and then undertakes a string of quarter-percentage-point rate hikes in 2023 to get up to 5.5%, Furman said, in an interview with MarketWatch on the sidelines of the Fed’s summer retreat in Jackson Hole, Wyo.

“ ‘The list of presidents who have supported the Fed when they were hiking rates is not long.’ ”

— Jason Furman, adding that President Joe Biden has done so

The Fed’s benchmark rate is now in a range of 2.25% to 2.5%. The central bank’s own projections have it stopping its run of rate hikes just shy of the 4% level.

Read: Powell says bringing down inflation will cause pain for households and businesses

Furman said the Fed needs to push its benchmark rate above 5% to get inflation down to less than a 4% annual rate, he said. Consumer price inflation was running at an 8.5% annual rate in July.

Inflation has morphed from a straightforward matter of too much demand and too little supply to become more about rising wages and prices, he said.

Furman said he likes to refer to the situation as featuring wage and price “persistence” rather than a “spiral” because inflation is not spinning out of control but is holding its own and has staying power. It is likely that inflation “comes down very slowly,” he added.

Furman observed that the U.S. inflation outlook is not “dire or insurmountable.”

Unlike in the 1970s and early 1980s, wages are not indexed to inflation, and the public has not come to expect high inflation.

The Fed also benefits from support from President Joe Biden, Furman said. “The list of presidents who have supported the Fed when they were hiking rates is not long,” Furman said.

The likelihood of a recession in the next nine months is relatively small, Furman said.