# Cryptos and stocks like NIO and Tilray are crucially linked. Here’s what you need to watch, says strategist.

Table of Contents

“#

Cryptos and stocks like NIO and Tilray are crucially linked. Here’s what you need to watch, says strategist.

”

Critical information for the U.S. trading day

The technology-heavy Nasdaq opened lower on Thursday, extending its slide from the past two days as it hovers near 3% lower since the beginning of the week.

But investors are continuing to pour money into Big Tech stocks as individual investor favorites keep suffering. And cryptocurrency prices may be a key reason, according to strategist Ben Onatibia’s team at investment research group Vanda, in our call of the day.

FB,

Amazon

AMZN,

Apple

AAPL,

Alphabet

GOOGL,

Netflix

NFLX,

and Microsoft

MSFT,

according to the team at Vanda, with major tech funds recording massive retail inflows as well.

Not only does this point to individual investors buying the dip, but it suggests that institutional investors are partly responsible for the selloff, as they cut their exposure to tech in favor of commodities and financials.

But “tech supremacy has also crowded out investments from other speculative stocks,” Onatibia said, with individual investors showing much more hesitation about buying the dip in the likes of cannabis or clean energy stocks. The team at Vanda believes this environment is likely to persist, especially given the poor performance of widely held stocks like Apple and Advanced Micro Devices

AMD,

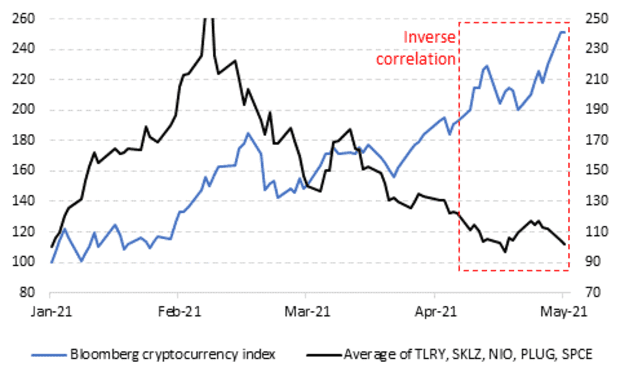

One of the key preconditions the team at Vanda said is necessary to “bring the mojo of fallen retail angels back” is a correction in cryptocurrency prices. According to Onatibia, prices of stocks like Tilray

TLRY,

Skillz

SKLZ,

Virgin Galactic

SPCE,

Plug Power

PLUG,

and NIO

NIO,

have been inversely correlated with cryptocurrencies in 2021, and this is indicative of a rotation among individual investors. That is a crucial relationship.

Chart via Vanda Research

“Investors in [environmental, social, and governance-focused stocks], electric vehicles, and a host of other highflying sectors will need to pay full attention to developments in the crypto world,” Onatibia said. “A significant correction is all they may need to get some of their lost appeal back.”

When the price of bitcoin

BTCUSD,

sank following the initial public offering of crypto exchange Coinbase

COIN,

“all retail favorite stocks enjoyed a decent recovery,” Onatibia said. “But as the price of ethereum

ETHUSD,

and other altcoins skyrocketed this week, retail favorite stocks have given up most of their recent gains.”

More compelling evidence from Vanda that individual investors are behind the crypto rally — at the cost of highflying favorites — is that popular trading platform Robinhood crashed following “unprecedented trading activity” in crypto assets this week.

The buzz

Shares in vaccine makers Pfizer

PFE,

BioNTech

BNTX,

and Moderna

MRNA,

dropped 3% to 7% , after U.S. Trade Representative Katherine Tai said that the U.S. supports the waiver of intellectual-property protections on COVID-19 vaccines. Moderna is also due to report earnings on Thursday.

Here’s the latest update after the third day of the trial between Apple and Epic Games — the developer of the videogame “Fortnite.” The antitrust case could lead to changes in Apple’s business model, with Epic arguing that the tech giant is a price-gouging monopolist that abuses its dominance for competitive reasons.

On the U.S. economic front, 498,000 Americans filed for unemployment last week, lower than the 527,000 expected and a decline from 590,000 in the week prior. Continuing jobless claims for the week of April 24 came in at 3.69 million. Productivity growth in the first quarter of 2021 was reported at 5.4%, outpacing expectations of 4.5%, while unit labor costs in the quarter fell 0.3%, less than the 1% decline predicted. Later, at 4 p.m. Easter, the Federal Reserve will release its Financial Stability Report.

China suspended an economic dialogue with Australia in the latest souring of relations between Beijing and Canberra. China has been ratcheting up pressure on Australia for supporting a probe into the origins of COVID-19, and has also blocked imports of wheat, coal, and other goods as relations hit a multidecade low.

Amazon Chief Executive Jeff Bezos sold nearly $2.5 billion worth of shares this week in the company he founded, according to filings with the Securities and Exchange Commission.

Daily new COVID-19 infections in India topped 400,000 for the second time since the devastating surge of coronavirus hit the country last month, as demand for medical oxygen jumped sevenfold.

The markets

U.S. stocks are mixed

SPX,

COMP,

with the Dow ticking up after investors cheered a better-than-expected jobs report.

European equities are broadly lower

SXXP,

PX1,

DAX,

However, stocks in London

UKX,

remain in the green after the Bank of England decided to reduce the rate of government bond purchases while insisting it wasn’t changing monetary policy. Asian stocks

NIK,

HSI,

SHCOMP,

finished mostly in the green.

The chart

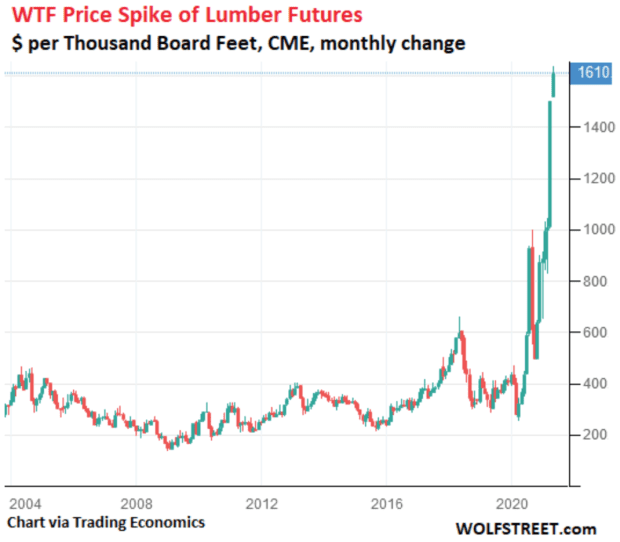

Chart via Wolf Street

Lumber futures

LB00,

traded on the Chicago Mercantile Exchange have quadrupled in price since February 2020 to hit a record high of $1,610 per thousand board feet, as shown in our chart of the day, courtesy of Wolf Richter from the Wolf Street financial blog.

“A sign of scary-crazy inflation amid suddenly blistering demand from builders, insufficient supply to meet that sudden surge in demand, growing lead times, and irrational behavior by buyers betting on being able to pass on that irrationality via higher prices to their customers,” Richter wrote.

Random reads

Talk about stratospheric asset prices: A bottle of French wine that spent more than a year in space will be auctioned off with a price tag of $1 million.

The owner of a Massachusetts pizza parlor fraudulently obtained $660,000 in COVID-19 relief funds and used some of the money to set up an alpaca farm, federal prosecutors allege.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

By

Jack Denton

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.