#Online Casino Industry in Southeast Asia: Philippines, Malaysia, and Thailand

Table of Contents

The online casino industry in Southeast Asia is booming. With countries like the Philippines, Malaysia, and Thailand leading the way, this part of the world is becoming a hotspot for online gambling. Revenue in the Online Gambling market in Southeast Asia is expected to reach $1.08 billion. With the advancement in technology and a growing number of users, online casinos are set to make waves in the region’s economy.

The Rising Popularity of Online Casino in Southeast Asia

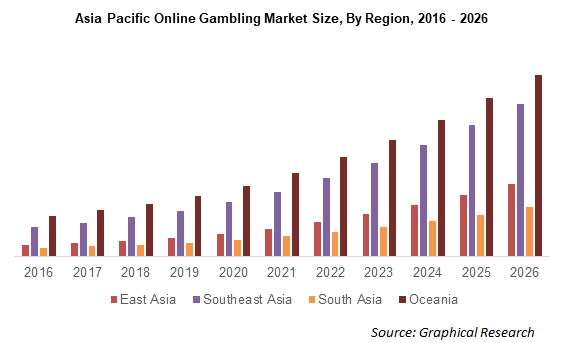

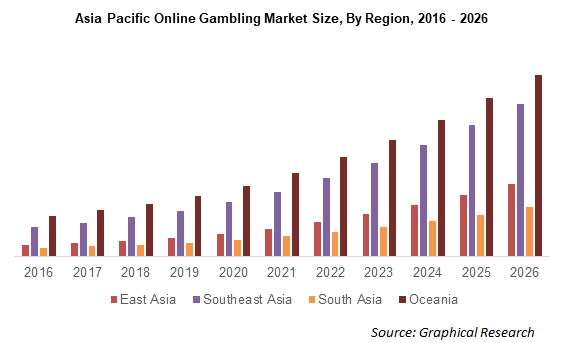

The statistics above say it all. The Asia-Pacific Online Gambling Market was valued at nearly $26.61 billion in 2022 and is estimated to grow at a rate of 10.59%, reaching $53.83 billion by 2029. This growth is not a fluke; several factors contribute to the rising popularity of online casinos in the region.

Mobile Technology

The increasing penetration of the internet and the spread of affordable smartphones have influenced this industry a lot. With a mobile phone in almost every pocket, access to online casinos has never been easier.

3D Animation

Graphics matter. Online casinos are using 3D animation to make the gaming experience more engaging and lifelike. These high-quality visuals are attracting more players and making types of bets more exciting.

Blockchain Technology

In Southeast Asia, blockchain is making a huge impact. For instance, in the realm of supply chain management, it is being employed to track the movement of goods from manufacturers to retailers, reducing the risk of fraud and improving efficiency. In Singapore, Fishcoin uses blockchain to create a transparent supply chain for the seafood industry. Consumers can now know where their seafood comes from and if it’s sustainably sourced.

In financial services, blockchain is also proving to be revolutionary. Take the Philippines-based company Coins.ph, for example. It employs blockchain to make remittances and financial services more accessible, secure, and affordable. This is helping to increase financial inclusion, making it easier for people to access services like bill payments and mobile top-ups.

Cloud Gaming

Cloud gaming is another technology that’s gaining traction in Southeast Asia. Revenue in this market is projected to hit $28.71 million in 2023 and grow at an annual rate of 50.14%, reaching a market volume of $145.90 million by 2027.

The beauty of cloud gaming is that you don’t need to download huge game files; you can stream games right from the cloud. This is not only convenient but also makes online gaming accessible to more people. The number of users in the Cloud Gaming market is expected to rise to 2.7 million by 2027, with an average revenue per user amounting to $17.87.

Though it starts from a smaller base, with user penetration expected to be at 0.2%, it’s predicted to double by 2027. This shows that while the technology is still in its nascent stages in the region, it has enormous potential for growth.

Philippines – A Hub for Online Casino Operations Amid Regulatory Changes

The Philippines is not just another country when it comes to online gambling; it’s a hub for casino operations. With a thriving market, it has captured the attention of both local and international players. Revenue from online casinos in the Philippines is expected to hit a staggering $590.60 million, showing a promising future for the sector.

If you’re interested in exploring what the Philippines has to offer, professional reviewers from Philippinescasinos.ph have created an extensive list of PH online casinos, diving into the range of options available to players. This curated list can serve as an excellent guide for anyone looking to engage in the Philippine online gaming scene. By 2027, the market volume in the country is estimated to reach an impressive $812.60 million, affirming its status as a major player in the region’s digital wagering market.

Regulatory Framework & Licensing

The regulatory landscape for the best online casino in Philippines has changed recently. The Philippine Amusement and Gaming Corporation (PAGCOR) introduced a new framework for offshore gaming licensees in July 2023. This move aims to curb illegal activities associated with offshore gaming operations. Under this framework, all existing licensees and service providers are required to re-apply for their licenses by September 17, 2023. Those failing to comply or found involved in illegal activities will face strict sanctions, including license cancellation.

Revenue & Market Trends

The online gambling industry is a key contributor to the Philippines’ economy. According to Alejandro Tengco, the Chairman of PAGCOR, the country’s Gross Gaming Revenue (GGR) is predicted to reach between 450 billion to 500 billion pesos ($7.9 billion to $8.8 billion) within the next five years. This growth is partly fueled by high-stakes players from countries like China, Japan, and South Korea.

Despite challenges like the COVID-19 pandemic, the Philippine casinos market has shown remarkable resilience. The industry started recovering in 2021 and recorded a GGR of 214 billion pesos in 2022.

Future Prospects and Challenges

The Philippine online casino is leaving no stone unturned to bolster its position as a leading gambling destination. Plans are underway to introduce six new casino facilities, valued at approximately $3 billion. These ambitious projects aim to strengthen the nation’s gaming sector against rising competition from countries like Japan and Thailand.

Malaysia – Thriving Economy Meets Gambling Paradox: A Legal Quandary Amid Cultural Complexities

Malaysia, one of Southeast Asia’s fastest-growing economies, continues to garner attention not only for its economic achievements but also for its complex relationship with gambling. The nation has been actively attracting foreign investments, driven by a diverse population and significant technological advancements.

Legal Aspects and Challenges

Malaysia finds itself in a unique position when it comes to gambling. The country has a Muslim-majority population, yet it allows certain forms of gambling. Land-based casino gaming is technically regulated, but there is currently only one valid licensee: Resorts World Genting. Located 58 km from Kuala Lumpur in Mount Ulu Kali, this resort has been a major player since 1969.

The government has made attempts to update its gambling laws, with the most recent changes aiming to replace the outdated 1953 Betting Act. However, the road to modern regulation is fraught with challenges, particularly after the conservative party Parti Islam Se-Malaysia won the national elections at the end of 2022. They may significantly influence the future discussion on gambling regulation in Malaysia.

Preferences of Malaysian Gamblers

Despite the restrictive environment, the gambling market in Malaysia is quite active, thanks to foreign brands filling the gaps. Malaysian citizens have diverse gambling preferences, reflecting their multicultural background. While the majority of Malaysians are Muslim and therefore refrain from gambling, significant portions of the population indulge in various forms of wagering.

Locals have a penchant for sports betting on badminton and football, including European events like the English Premier League. Aside from sports, Malaysians also enjoy slots, poker, and live dealer alternatives, given that real casino games are not readily accessible to the local audience. Horse racing remains a popular and legal activity, mainly due to its longstanding cultural acceptance.

The Road Ahead

The future of gambling in Malaysia hangs in a delicate balance between cultural norms, economic incentives, and legal frameworks. Despite the complexities, there is a growing recognition that the sector needs updated regulations, not only to combat illegal activities but also to tap into its economic potential.

Thailand – On the Cusp of Change: Navigating a Strict Regulatory Maze in a Budding Market

Thailand’s relationship with gambling has been traditionally strict, primarily due to long-standing regulations that make most forms of gambling illegal in the country. The exceptions to this rule are the national lottery, operated by the government, and horse betting.

However, there are indications that the legal landscape may be changing. Pichet Chuamuangphan, the second vice-chairman of a house committee studying the legalization of entertainment complexes, has submitted findings to the Thai government, suggesting the establishment of legal casinos. A survey by the Casino Committee of Thailand revealed that 81% of 3,296 participants are in favor of a legal casino and entertainment complex in Thailand.

Evolving Market Landscape

Thailand’s market for internet-based games of chance is in a growth phase, despite the stringent regulations. The youth population, who are the primary consumers of such services, have been driving the market. Thai players have been increasingly engaging with offshore operators, especially those based in countries like the Philippines, to satiate their appetite for gaming. Some offshore operators have been crucial in shaping the market and advocating for its legalization in Thailand.

Financial Insights

Revenue in Thailand’s digital wagering market is projected to reach an impressive US$488.90 m in 2023 and an expected annual growth rate of 7.34% until 2027. In contrast, the market segment focused on internet-based games of chance is projected to generate €174.10 m in 2023, with an 8.05% compound annual growth rate through 2027. Although these numbers are not as grand as those in China or India, they are significant in understanding the potential of this sector in Thailand.

External Factors and Influences

Several external factors have been affecting the growth of the market. The COVID-19 pandemic, for example, brought significant changes in user behavior, affecting the sector globally and in Thailand. Additionally, the liberalization of gaming laws in neighboring Asian countries like Singapore, the Philippines, Cambodia, and Malaysia has put pressure on Thailand to consider revising its own regulations.

Conclusion: The Future of the Digital Wagering Industry in Southeast Asia

The digital wagering scene in Southeast Asia is on an upward trajectory, fueled by a youthful, tech-savvy population and evolving regulations. Moreover, you can refer to this Statista analysis for a more comprehensive outlook on the future development of online gambling in Southeast Asia. Revenue growth is expected across different gaming categories, with countries such as the Philippines and Cambodia leading in regulatory reforms. Emerging technologies (blockchain and VR) are set to elevate user experience and security. However, the industry also faces challenges including inconsistent regulations and the threat of cybercrime.

The post Online Casino Industry in Southeast Asia: Philippines, Malaysia, and Thailand appeared first on Spiel Times.

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our Game category.