#Mark Hulbert: Why short-sellers dumping GameStop puts Reddit followers and other day traders at greater risk

Table of Contents

“#Mark Hulbert: Why short-sellers dumping GameStop puts Reddit followers and other day traders at greater risk”

Short sellers play an essential role in the market’s price-setting process

Individual retail traders may be winning their battle against the short sellers. But there’s little doubt they will lose the war.

I’m referring to the hedge funds and other short sellers who have recently thrown in the towel on their bets against high-flying stocks like GameStop.

GME,

This has led some to breathlessly declare that a new era has dawned on Wall Street — one in which the little guy finally exacts revenge against the big boys.

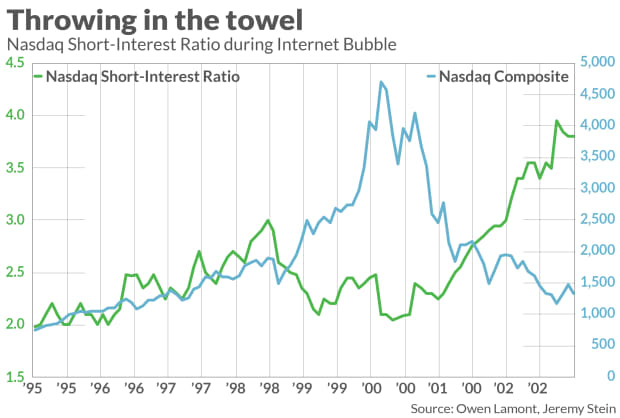

Far from being different, the recent behavior of the short sellers is actually quite similar to what happened in the latter stages of the internet bubble in the late 1990s and early 2000. Then, as now, the short sellers threw in the towel, as internet stocks were bid up to unimaginable levels. But that didn’t mean they had altered their underlying belief that those stocks were wildly overvalued.

Instead, according to research conducted by Jeremy Stein, chairman of Harvard University’s economics department, and Owen Lamont, managing director and associate director of quantitative investment group multi-asset research at Wellington Management Company, the most likely reason the short sellers threw in the towel back then was that these stocks could remain outrageously inflated indefinitely. They also recognized that these stocks could become even more overpriced in the meantime, exacting even higher carrying costs on their shorts.

The short sellers staged what amounted to nothing more than a tactical retreat. But they stood ready to aggressively short again once the market finally turned. This is illustrated in the chart below, which plots the Nasdaq Composite Index

COMP,

along with the Nasdaq short-interest ratio. Notice that this ratio hit a high in 1998 and then fell dramatically until after the internet bubble burst in March 2000.

We may be seeing the same thing now, Stein argued in an email. “The short sellers throwing in the towel on stocks like GameStop may simply be recognizing that the market can stay irrational longer than they are either willing or able — given margin calls and funding constraints — to stick with their trades. So one would certainly not want to conclude from such behavior on the part of short sellers at this point that they think GameStop and other previously heavily shorted stocks are now fairly valued.”

Stein is pointing out a flaw in the otherwise efficient stock market. When the market works as it is supposed to, short sellers play an essential role in the market’s price-setting process. When prices become too high, their selling helps to bring the price back to earth — just as buying pressure becomes more pronounced when a stock becomes undervalued. The tug-of-war between buyers and sellers results in an equilibrium price that, in most cases, is fairer than what any one of us would think is appropriate.

When the short sellers leave the playground and go home, they no longer provide the checks and balances that keep prices from inflating to wildly unreasonable levels. Market theorists refer to this phenomenon as “the limits to arbitrage.” Today isn’t the first time we’ve encountered those limits, and it surely won’t be the last.

So enough with the “new era” talk. What we’re witnessing with GameStop is not unique. While we may not know the particular twists and turns this story will take, we do know how it will end.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: How will this wild GameStop saga end? The ghosts of trading catastrophes past offer clues

Also read: GameStop and AMC show why you should practice trading before playing with real money

By

Mark Hulbert

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.