#Deep Dive: These small-cap stocks might make you the most money in 2023, based on two important data points

Table of Contents

“Deep Dive: These small-cap stocks might make you the most money in 2023, based on two important data points”

Previous periods of low valuations have resulted in big comebacks for smaller companies

Small-cap stocks are trading near a two-decade low relative to large-cap stocks. When the stock market rebounds next year, as is expected by many investment-bank strategists, those smaller companies may outperform.

Below is a screen of analysts’ favorite small-cap stocks for 2023, culled from the S&P Small Cap 600 Index

SML,

which requires that companies be profitable for inclusion.

Great divide

Following a stock-market rally from mid-October through November, stocks have since been sliding. Recession fears are mounting and the Federal Open Market Committee is gearing up for another interest-rate increase on Dec. 14.

Strategists at BNP Paribas led by Greg Boutle, head of U.S. equity and derivatives strategy, reviewed 100 years of market-crash data and concluded investor sentiment would bottom in 2023. That and an expectation for a recession imply “a trough in the middle of next year,” Boutle said.

That signals a rebound for the stock market as a whole, which might mean an even greater increase for small-cap stocks.

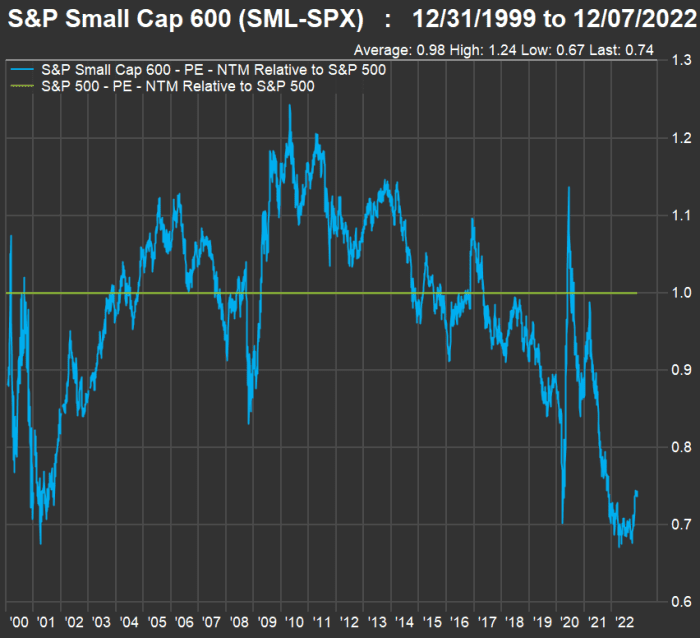

Here’s why: The forward price-to-earnings ratio of the S&P Small Cap 600 Index is near its lowest point, relative to the large-cap S&P 500

SPX,

since the end of 1999:

FactSet

On average, small-caps have traded only slightly below the S&P 500, as indicated on the top right of the chart. They are now close to a low, and only slightly higher than a year ago.

Then again, the weighted forward price-to-earnings ratio for the S&P Small Cap 600 Index is now 12.7, down from 15.5 a year ago, according to FactSet. (The forward P/E for the S&P 500 has declined to 17.2 from 21.4 a year ago.)

Since the stock market can be expected to rally amid a recession in anticipation of a decline in interest rates and a return to economic growth, investors may well be in for an accelerated rebound for small-caps.

The best way to ride the small-caps, if you expect a market recovery, might be to buy shares of an exchange traded fund, such as the SPDR S&P 600 Small Cap ETF

SLY,

the iShares Core S&P Small Cap ETF

IJR,

or the Vanguard S&P Small-Cap 600 ETF

VIOO,

Analysts’ favorite profitable small companies

Some money mangers benchmark their small-cap ETFs or mutual funds to the Russel 2000 Index

RUT,

but that index isn’t selective. In fact, 40% of Russell 2000 companies were unprofitable for their most recent reported fiscal quarters. Only 22% of the S&P 600 were unprofitable, according to FactSet.

Standard & Poor’s criteria for initial inclusion in the S&P Small Cap 600 Index includes positive earnings for the most recent quarter and for the sum of the most recent four quarters.

Taking the idea of profitability further, we screened the S&P 600 as follows:

- Covered by at least five analysts polled by FactSet — 271 companies.

- Positive consensus earnings-per-share estimates for calendar 2023 — 236 companies.

- Rated “buy” or the equivalent by at least 75% of analysts — 56 companies.

Among the remaining 56 companies, here are the 20 with the most upside potential, based on consensus price targets:

| Company | Ticker | Industry | Share “buy” ratings | Dec. 6 price | Consensus price target | Implied 12-month upside potential |

| ModivCare Inc. |

MODV, |

Medical Transportation | 100% | $86.54 | $145.83 | 69% |

| Ligand Pharmaceuticals Inc. |

LGND, |

Pharmaceuticals | 100% | $67.83 | $110.83 | 63% |

| Customers Bancorp Inc. |

CUBI, |

Regional Banks | 75% | $30.08 | $48.25 | 60% |

| Outfront Media Inc. |

OUT, |

Real Estate Investment Trusts | 83% | $17.05 | $27.00 | 58% |

| Smart Global Holdings Inc. |

SGH, |

Semiconductors | 100% | $16.00 | $25.17 | 57% |

| Pacira Biosciences Inc. |

PCRX, |

Pharmaceuticals | 80% | $46.97 | $72.90 | 55% |

| Adtran Holdings Inc. |

ADTN, |

Computer Peripherals | 75% | $19.38 | $29.40 | 52% |

| Talos Energy Inc. |

TALO, |

Oil & Gas Production | 86% | $19.33 | $28.83 | 49% |

| OptimizeRx Corp. |

OPRX, |

Software | 100% | $19.09 | $27.33 | 43% |

| Alarm.com Holdings Inc. |

ALRM, |

IT Services | 75% | $48.55 | $68.86 | 42% |

| Civitas Resources Inc. |

CIVI, |

Integrated Oil | 100% | $59.72 | $84.33 | 41% |

| MaxLinear Inc. | MXL | Semiconductors | 92% | $34.74 | $49.00 | 41% |

| Dave & Buster’s Entertainment Inc. |

PLAY, |

Movies/ Entertainment | 80% | $36.20 | $50.78 | 40% |

| Boot Barn Holdings Inc. |

BOOT, |

Apparel/ Footwear Retail | 92% | $63.86 | $89.27 | 40% |

| Vista Outdoor Inc. |

VSTO, |

Recreational Products | 75% | $27.55 | $38.29 | 39% |

| Digital Turbine Inc. |

APPS, |

Software | 100% | $15.72 | $21.84 | 39% |

| Innovative Industrial Properties Inc. |

IIPR, |

Real Estate Investment Trusts | 75% | $118.05 | $161.83 | 37% |

| Green Plains Inc. |

GPRE, |

Chemicals | 78% | $31.81 | $43.22 | 36% |

| Golden Entertainment Inc. |

GDEN, |

Casinos/ Gaming | 100% | $42.36 | $57.25 | 35% |

| Collegium Pharmaceutical Inc. |

COLL, |

Pharmaceuticals | 83% | $22.40 | $30.25 | 35% |

| Source: FactSet | ||||||

Click on the tickers for more information about any company or index in this article.

You should also read Tomi Kilgore’s detailed guide to the wealth of information for free on the MarketWatch quote page.

Don’t miss: 10 Dividend Aristocrat stocks expected by analysts to rise up to 54% in 2023

By

Philip van Doorn

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.