# Opinion: Why switching investment strategies to get a market edge only leaves you behind the pack

Table of Contents

“#

Opinion: Why switching investment strategies to get a market edge only leaves you behind the pack

”

Pick an investment plan with a good long-term record and follow it

“Too much information” usually refers to the inappropriate sharing of excessive personal details, but TMI can sabotage your portfolio too. TMI very much is a problem on Wall Street, where it poses an entirely different sort of challenge: Analysts become paralyzed by a never-ending search for more and more information, in hopes that one more indicator or econometric analysis will provide that crucial edge.

One of the best illustrations of this phenomenon is a study conducted nearly 50 years ago by Paul Slovic, a professor of psychology at the University of Oregon. (I was reminded of this study by a recent post on Macro Ops, a market research firm.) Slovic set out to measure whether our predictions become more accurate as we analyze more and more pieces of information. He found that they did not.

Slovic reached this conclusion upon analyzing a group of professional horse handicappers selected for their expertise. They were presented with a list of 88 variables from which they could choose a handful that would be the basis of their predictions of which horses would win in various 10-horse races. For one set of races they were allowed to choose just five of those 88 variables. They were allowed to focus on progressively more variables in the second-, third- and fourth sets — 10, 20 and 40, respectively.

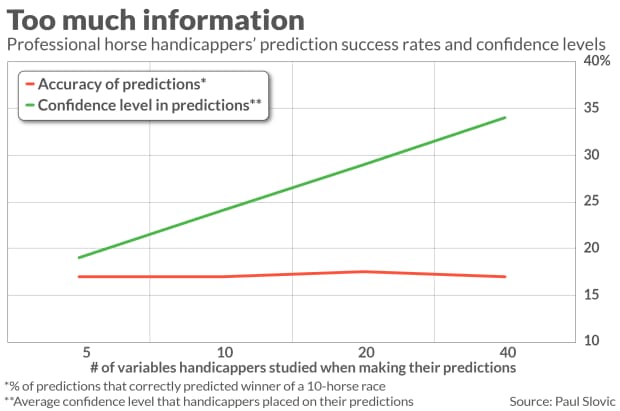

Slovic found that these handicappers’ average success rate stayed the same across all four sets — 17%. On the one hand their success rate was impressive, since if they were no better than a coin flip you’d have expected them to be right just 10% of the time. On the other hand, increasing the number of variables had no effect on their predictive success.

That’s sobering enough, but it’s what Slovic measured next that is really depressing. In each of the four sets of races, he asked the handicappers the confidence they had in the accuracy of their predictions. As you can see from the chart below, their confidence level grew markedly as they were able to focus on more and more variables. So the net effect of the additional analysis the handicappers were able to conduct was to become increasingly overconfident.

To be sure, Slovic is quick to admit, horse racing is not the same as investing. But they’re not as different as many investors would like to admit. Horse racing has newsletters and tip-sheets, just as does investing. The horse racing newsletters are filled with tables and charts slicing and dicing each horse’s past performance. “It doesn’t take too much imagination to see the similarities between these kinds of charts and the data sources used in some forms of financial analysis,” Slovic writes.

Confirmation Bias

You might wonder why the professional handicappers didn’t improve their predictive prowess when focusing on more variables. One answer, as outlined in the Macro Ops article, is what’s known as confirmation bias — defined by Wikipedia as “the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one’s prior beliefs or values.”

Here’s how that might work: By the time they had digested their five favorite variables, the handicappers had already come to at least a tentative conclusion about the horses on which they wanted to bet. When additional variables above and beyond those five pointed to that same conclusion, the handicappers became more confident that their original judgment was correct. When additional variables pointed to a different prediction, they gave those variables less weight or ignored them altogether.

Confirmation bias is also widespread in the stock market, of course. Investing is anxiety-provoking, so it’s natural that we gravitate to arguments and studies that confirm our currently-held outlook. This process is often unconscious, but almost all of us suffer from it. The bulls look to justifications for being bullish even as the bears look for arguments for why they should be bearish.

Having spent more than 40 years monitoring the daily arguments of hundreds of investment newsletters, I can assure you that there never is a shortage of arguments on either side of any issue imaginable. It’s incredibly difficult to keep an open mind in the face of these myriad conflicting arguments.

That’s why the never-ending search for one more indicator or historical analysis is often so futile. The assumption of that search is that there is a perfect approach or strategy, and our job is to find it. But that assumption is wrong. And the search to which that assumption leads causes us to lose the discipline that would make a good (but not perfect) strategy profitable over the long run.

Patience and discipline

The key is to pick an investment strategy that has a good long-term record and then follow it through thick and thin. It won’t always be at the top of the performance sweepstakes, so you must develop the discipline to stick with it through the rough patches. Otherwise, you will find yourself constantly second-guessing your approach, which is just the opposite of having patience and discipline.

Think about it this way: Even if your never-ending quest actually discovered the “perfect” strategy, it wouldn’t help your long-term performance if you didn’t follow it with patience and discipline. In fact, you probably would end up making less with it than you would with a strategy that might be imperfect on paper but which you follow diligently.

Patience and discipline can turn a merely decent strategy into a winner, while the lack of those two qualities can turn a “perfect” strategy into a loser.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: Why Generation ‘I’ — YOLO investors who’ve never seen a bear market — should worry us all

Also read: Why the ‘Fed put’ makes low-volatility stocks an attractive replacement for bonds

By

Mark Hulbert

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.