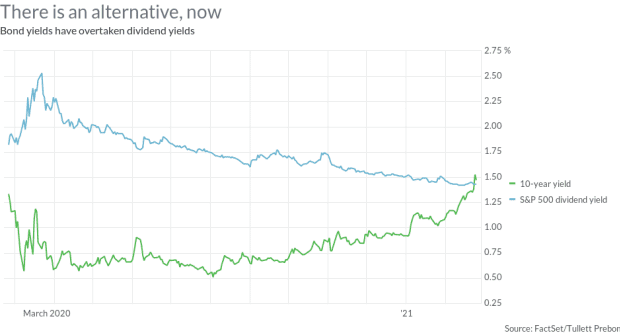

The TINA mantra — there is no alternative — isn’t correct anymore.

The swift and violent rise in bond yields has meant that equities are no longer the obvious choice to make on a relative valuation basis. The chart here shows that the dividend yield on the S&P 500 is now below that of the 10-year Treasury yield, the benchmark security for all valuation.

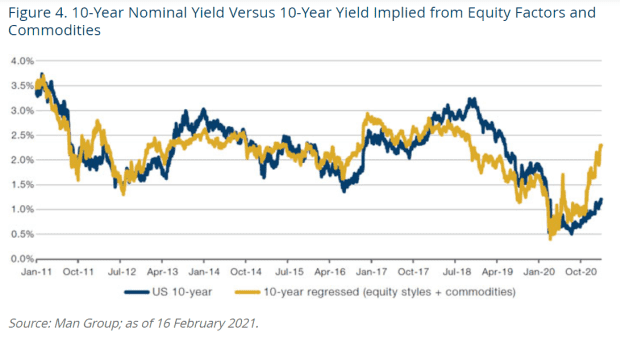

Arguably, interest rates could be much higher. Hedge fund giant Man Group performed a regression analysis to try to discern where the stock and commodities markets were signaling where the 10-year should be.

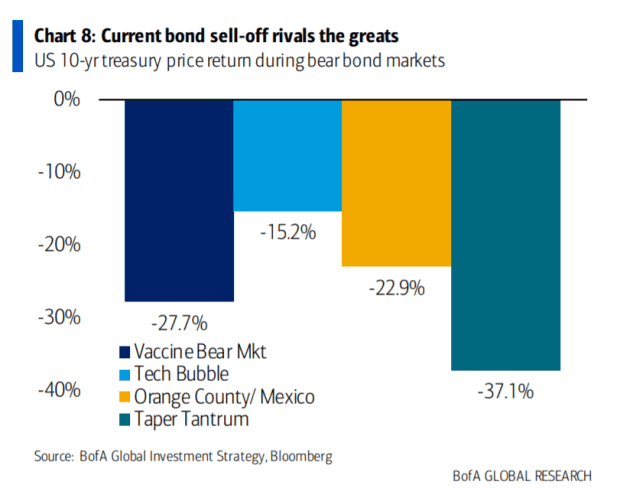

As dovish as Federal Reserve officials including Chair Jerome Powell and Vice Chair Richard Clarida were this week, none of them made the case for increasing the rate of purchases of bonds. The rollout of COVID-19 vaccines and the prospect of further U.S. stimulus have markets convinced the economy is about to heat up. “Despite the Fed’s massive ongoing Treasury purchases, it is highly likely we have entered a bond bear market,” said Mike O’Rourke, chief market strategist at JonesTrading. “Treasuries are getting cheaper every day, expect stocks to follow bonds.”

Data from Bank of America show the current bond market selloff rivals other notable fixed-income declines.

Guild Investment Management, a Los Angeles investment adviser, forecasts the 10-year yield will reach 1.75% with a few months, and it notes inflation already is visible in food and industrial inputs. That said, the firm doesn’t recommend a defensive posture.

“With high fiscal and monetary stimulus and a recovering global economy, investors should look for growth themes and inflation beneficiaries,” the firm says in a presentation. “Small vs large, cyclical vs defensive, emerging markets, commodities, rationally valued innovation.” Good luck, perhaps, finding that last one.

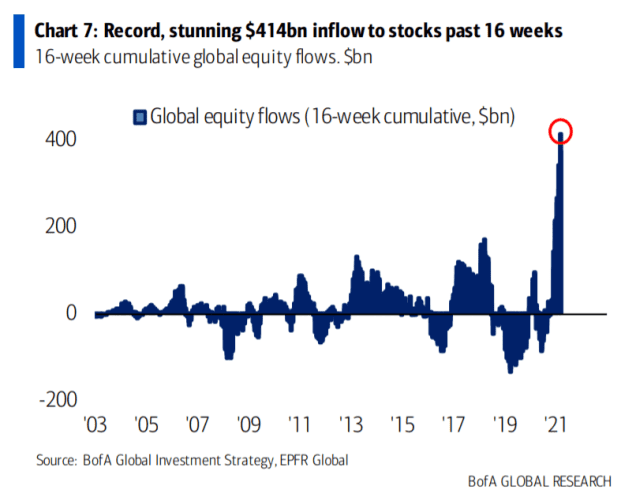

The chart

There is nothing investors like more than chasing higher prices, as the latest fund flow data show. Investors poured $46.2 billion into global stock funds — the third-highest ever — and a net $7.1 billion into bond funds in the week ending Wednesday.

Random reads

Soccer star Zlatan Ibrahimović criticized basketball star LeBron James for social activism.

Queen Elizabeth II said reluctant vaccine takers “should think about other people rather than themselves,” as she said receiving one was “very quick.”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.