# Opinion: Big tech’s trillion-dollar pandemic year may be just the beginning

Table of Contents

“#

Opinion: Big tech’s trillion-dollar pandemic year may be just the beginning

”

Even if Amazon, Apple, Google, Facebook and Microsoft fail to grow at the same rate in the years ahead, they have established a new baseline for performance that is jaw-dropping, with no evidence yet that they will fall back

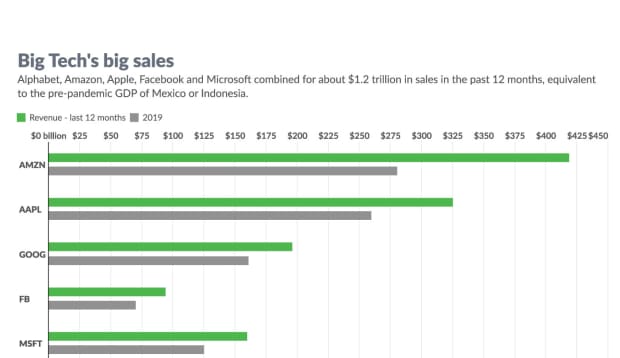

Combining just the revenue of four companies that are in the regulatory spotlight for their dominance of the tech sector and the American economy — Alphabet Inc. GOOG GOOGL (before traffic acquisition costs), Amazon Inc. AMZN, Apple Inc. AAPL and Facebook Inc. FB — gets us to $1 trillion in the twelve full months of pandemic life in the U.S., running from the end of March 2020 to the same time in 2021.

Add Microsoft Corp.

MSFT,

— which should obviously be done, since it is on the cusp of being the second U.S. company to ever claim a market capitalization of $2 trillion, after Apple — and the total grows to about $1.2 trillion. That is equivalent to a top-20 gross domestic product of some countries, roughly the size of the Mexican or Indonesian economies before the pandemic, which had a negative effect on these countries’ output, while seemingly only boosting Big Tech’s.

Out of that $1.2 trillion in revenue, the five tech companies realized nearly a quarter-trillion dollars in profit, roughly $244 billion. And that is GAAP net income, not operating profits, not adjusted earnings, and not the Ebitda figures that many companies use to make their earnings look stronger. No need for juking the stats when you’re Big Tech.

For all five, the first full 12 months of the COVID-19 pandemic would have been their most successful years of all time, if it was actually a fiscal or calendar year. And remember, we are not talking about young companies that haven’t been public long. Apple and Microsoft, which went public in 1976 and 1986, respectively, have been titans since well into the previous millennium, and have produced huge annual profit and sales totals in the past, while Google and Amazon were products of the dot-com boom that ended more than two decades ago.

It’s even more astounding to realize that all of these companies, with the exception of software behemoth Microsoft, are under some sort of federal investigation for anti-competitive practices and behavior, but maybe that is precisely the point of the investigations. Even amid rounds and rounds of time-consuming Congressional hearings and millions of dollars being spent in the first round of legal fees, these companies continue to power on, raking in money hand over fist. In Microsoft’s case, it’s been there, done that, at least for now.

In all aspects, the growing financial strength and powerful effects on the economy from Big Tech cannot be ignored. Amazon grew its workforce by more than 50% in the past 12 months, and is now the second largest American employer behind Walmart Inc.

WMT,

the only other U.S. company besides Apple and Amazon that is putting up regular $100 million sales quarters. In 2020, Amazon hired over 500,000 employees, as it started to prepare for more deliveries, and more services in a increasingly digital world with everyone in lockdown in the first months of the pandemic. The number of employees Amazon hired in the past 12 months eclipses the entire combined workforces of Google, Facebook, and Microsoft.

For more: Tech’s COVID-19 boom won’t last forever, but it’s not going to end just yet

Investors have been richly rewarded for the companies’ performance. All five have seen their stocks hit record highs in 2021, and as of Friday, their combined market capitalization was closing in on $8.5 trillion. While they are collectively only 1% of the companies in the S&P 500

SPX,

their market capitalization accounts for nearly a quarter of the total for the entire index, 23.7%.

The biggest question for investors is if this is a peak or a new baseline. Analyst seem to consider it the latter. While acknowledging it will be hard to grow at the same rate from the current performance, analysts largely expect this type of financial gain to be the new normal for Big Tech.

“It’s a complicated question about earnings peaking,” said Brendan Connaughton, founder and managing partner of Catalyst Private Wealth. “From here, for the next three quarters it will be tough comps….The absolute numbers will continue to be impressive but the growth rates will be less impressive. They are going to be walking around in the C-suite saying, ‘I hope the investors look at the raw numbers not relative to last year.’”

For more: See our Business in the Age of COVID-19 series

Will that be enough to keep pushing shares higher, though? Apple, after revealing an astonishing quarter in which the company surpassed Wall Street’s revenue expectations by $12.5 billion, saw shares end flat on the day after its report.

“It (really) doesn’t get better than this,” Bernstein Research analyst Toni Sacconaghi headlined his note on Apple’s results, and investors seemed to agree.

“When and to what degree the strength in spending from the pandemic will

unwind is clearly the key question,” Sacconaghi wrote, a question that could be asked of every company in Big Tech. “We believe it may be difficult for Apple to grow in FY [fiscal year] 22, and currently model revenues fractionally down in FY 22… but it could be worse.”

Analysts did not expect much of the growth shown in the past week of first-quarter earnings either, however, with all five companies largely blowing away both their internal and analysts’ forecasts for profit and revenue. And even if Big Tech can’t possibly grow at the same rate from the current performance — they can’t, can they? Who even knows by now — just putting up numbers like this commands the huge valuations they are receiving from Wall Street right now.

The monster earnings confirm how these companies are crushing their competition and dominating the U.S. economy. It’s a huge gravy train for investors in Big Tech, but puts a big target on their back for regulators.

By

Therese Poletti and

Jeremy C. Owens

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.