# Opinion: Why any stock market rally right now will be quick

Table of Contents

“#

Opinion: Why any stock market rally right now will be quick

”

Market-timers are running with the bulls but quick to turn bearish, reflecting weak support for current stock prices

Contrarian investors suspect that the stock market’s recent decline has run its course — for now.

That’s because these market timers, especially those who focus on the Nasdaq

NDX,

market in particular, have become sufficiently bearish that the short-term path of least resistance has turned up. Still, it’s not clear that any new rally will have much lasting power. An even more serious U.S. market decline cannot be ruled out over the coming couple of months.

DJIA,

had fallen around 1,200 points from its previous all-time high, or 3.4%. The S&P 500

SPX,

was 4.0% below its high, and the Nasdaq Composite

COMP,

was down 7.8%.

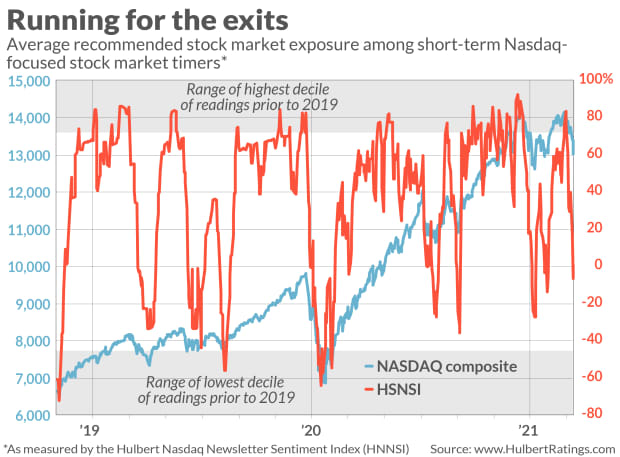

Consider how the Nasdaq-focused market timers reacted to these declines. As you can see from the chart below, their average recommended equity exposure (as represented by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI) fell to minus 10.7%. That means that the Nasdaq-focused market timers are now recommending that their clients allocate an average of 10.7% of their equity trading portfolios to going short. As recently as Apr. 29, this average exposure level stood at plus 83.6%.

That reflects a remarkably quick rush for the exits — 94.3 percentage points in just 10 trading sessions. In fact, out of the 5,000+ trading days since 2000, there have been only 18 — 0.3% — in which the HNNSI’s decline over the trailing 10 days was greater.

To appreciate the contrarian significance of this, consider that, on average following those past few occasions when the HNNSI declined by this much and this fast, the Nasdaq Composite was 5.3% higher in one month’s time.

Why, then, haven’t the contrarians become more bullish? The answer is also evident in the chart: The HNNSI’s plunge over the past 10 days stopped well short of the excessive bearish zone, defined as being in the bottom 10% of the historical distribution. That zone is represented by the beige-shaded box at the bottom of the chart.

The last time the HNNSI fell into that zone was in March 2020. That was when the market’s “wall of worry” became incredibly strong and was able to support an impressive rally. That wall today is not as strong.

The sentiment picture that the recent data are painting shows the market timers to be trigger-happy. They are quick to jump on the bullish bandwagon when the market rallies, and then jump on the bearish bandwagon when the market declines. As a result, both rallies and declines tend to be short-lived.

A longer-lasting rally will require more extreme bearishness among the market timers, and for them to stubbornly hold onto their bearishness in the wake of the rally’s initial liftoff. Except for that to happen, the market to itself most likely would have to suffer a worse decline than we’ve experienced in recent days. In the meantime, enjoy this rally — while it lasts.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Plus: There is a ‘super sale’ in Big Tech and other ‘high-quality’ stocks, says this fund manager

Also read: Wall Street’s ‘Big Lie’: Performance claims that are increasingly straining credulity

By

Mark Hulbert

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.

![#China claims more than 10 U.S. balloons flew in its airspace [Video]](https://s.yimg.com/ny/api/res/1.2/ARs98GgEng6m9ITXIJVsuA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/ap.org/02ca4751499a5934f9958af064ae15cd)