Forget “FAANG” stocks — this is a market of “BANG” stocks.

In fact, the biggest of these so-called meme stocks — social media favorites GameStop

GME,

+1.05%

and AMC Entertainment

AMC,

+10.07%

— appear to hold the key to the U.S. market’s volatility. When their share prices rise, so does the broad market’s volatility — and vice versa.

The best way to show this development is the growing correlation between the CBOE’s Volatility Index (VIX)

VIX,

-2.48%

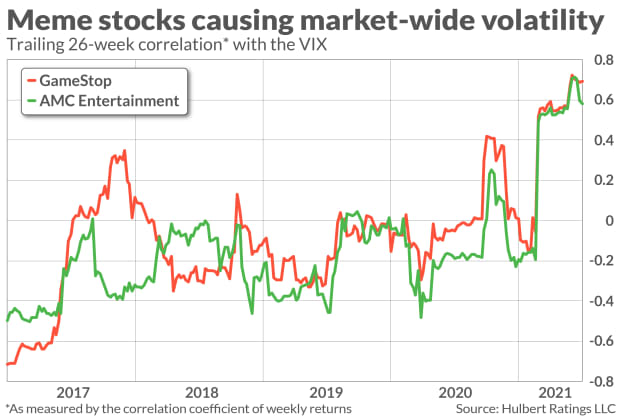

and the share-price movement of GameStop and AMC. As is evident from the chart below, these two stocks’ trailing 26-week correlation coefficients with the VIX have shot up in recent weeks.

Prior to the past few months, these stocks’ correlations with the VIX had been quite low, mostly bouncing between plus- and minus 0.2. Recently, they have jumped to the highest levels in at least five years — topping 0.7.

One reason for this increased correlation, though a relatively small one, is that some of the meme stocks have become big enough to represent more than a rounding error in the calculation of stock market benchmarks. For example, GameStop is now the largest stock holding in the iShares Core S&P Small Cap ETF

IJR,

+0.92%.

The bigger reason for higher correlations is psychological: Investors are increasingly taking their cues from the meme stocks. When they soar, investors suffer from “FOMO” — the fear of missing out — and speculative money rushes into the market.

FOMO of course has nothing to do with fundamentals. The U.S. stock market has become increasingly indifferent to earnings estimates, the latest projections for GDP growth and other economic news. Instead, the broad market’s gyrations are being dominated by retail investors’ speculations.

This was evident on June 10, following the U.S. government’s release of the May CPI report that showed inflation is worse than the analyst consensus had been expecting. You might have expected this to sink the stock market and for the VIX to rise. But just the opposite happened.

The tight correlation between the meme stocks and the broad market’s volatility is yet one more sign of how speculative the U.S. market has become. To emphasize the obvious, widespread speculation is a sign of an unhealthy stock market.

Indicators of speculative excess aren’t much help in pinpointing when stocks will actually stumble. Stocks can march higher in the face of bubble-like behavior for a long time. Nevertheless, the increased correlation between meme stocks and the market’s volatility is another sign that the U.S. market is now riskier.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: We put 6 more meme stocks’ numbers to the test and the differences are telling

Also read: Worried about inflation? How to position your retirement accounts