#Need to Know: This superbull at JPMorgan who called the summer rally sees a soft landing ahead. Here’s his advice on stocks and oil.

Table of Contents

“Need to Know: This superbull at JPMorgan who called the summer rally sees a soft landing ahead. Here’s his advice on stocks and oil.”

Critical information for the U.S. trading day

A fifth-straight win could be on the cards for stocks Tuesday, but the market must first face down August CPI numbers.

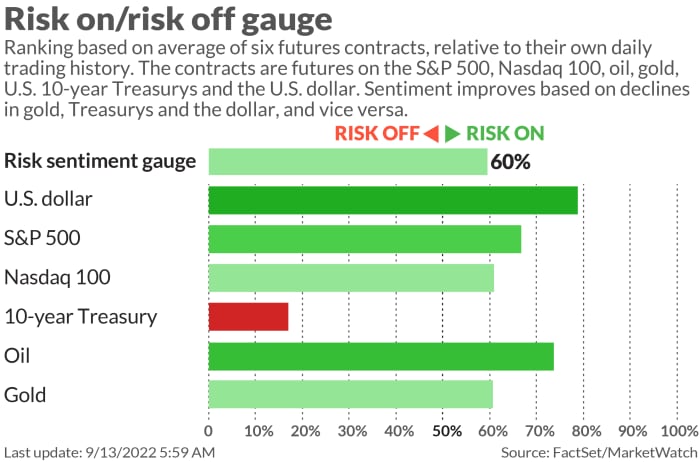

Economists see inflation slowing to 8% from 8.5%, though not likely altering a 75-basis-point Fed hik this month. Still, if it looks anything like a peak for CPI, you’ll want to consult our chart of the day below.

For starters, investors need to trust the data more and obsess over central banks less, he says.

“We maintain that economic data and investor positioning are more important factors for risky asset performance than central bank rhetoric. And the data appear to be increasingly supportive of a soft landing (rather than global recession), given moderating inflation and wage pressures, rebounding growth indicators, and stabilizing consumer confidence,” Kolanovic told clients in a new note.

He sees a global recession as avoidable owing to expectations China and Europe will support their needy economies. Low investor positioning and sentiment should also “continue to provide tailwinds for risky assets, despite the more hawkish central bank rhetoric recently.”

Among those assets, JPM is keeping an “aggressive overweight” in commodities and commodity-sensitive assets, due to a supercycle thesis and to hedge for inflation and geopolitical risks.

Kolanovic suggests buying the dip on energy as there is no solution to Europe’s current crisis in sight and markets are yet to price in weaker prospects for an Iran nuclear deal or G-7 progress on Russian oil price caps.

He is also staying bullish on equities, specifically cyclicals, small-caps and EM/China over expensive defensives.

Unlike energy, “defensive industries have outperformed on multiple expansion and are trading at near record premium vs. the market,” said the strategist who adds that central bank tightening and labor resiliency may keep rates higher for longer, capping multiples for long-duration growth and tech.

Midterms are also weighing into the bank’s equation for riskier assets. “Given the lag it takes for rate hikes to work through the system, and with just one month before very important US elections, we believe it would be a mistake for the Fed to increase risk of a hawkish policy error and endanger market stability,” said Kolanovic.

The markets

Uncredited

Stock futures

ES00,

YM00,

NQ00,

are higher and Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

lower as a dollar

DXY,

pullback continues. Oil prices

CL.1,

are also perking up, while gold prices

GC00,

head the other way.

The buzz

Ahead of crucial CPI data, the latest small-business sentiment index showed a rise in confidence. The Federal budget is due later.

Oracle

ORCL,

disappointed on earnings and its profit forecast, thanks to a stronger dollar. The stock is up slghtly.

Peloton

PTON,

stock is down after co-founders John Foley and Hisao Kushi said they are stepping down.

HBO had a big night at the Emmy’s sweeping past Netflix

NFLX,

with big awards for “Succession” and “Euphoria.” Meanwhile, interest has been high in Netflix’s “The Crown,” since the death of Queen Elizabeth II.

Twitter

TWTR,

shareholders are reportedly expected to approve the $44 billion takeover that Tesla’s

TSLA,

Elon Musk has been trying to ditch in a meeting early Tuesday. The fate of the deal, though, could end up in court. And a Twitter whistleblower will testify to Congress.

A Russian unit designed as a front-line defense against a NATO attack has apparently been badly damaged in the latest Ukraine advance.

Best of the web

An easy daily habit to prevent dementia.

Escaping poverty, one generation at a time.

The chart

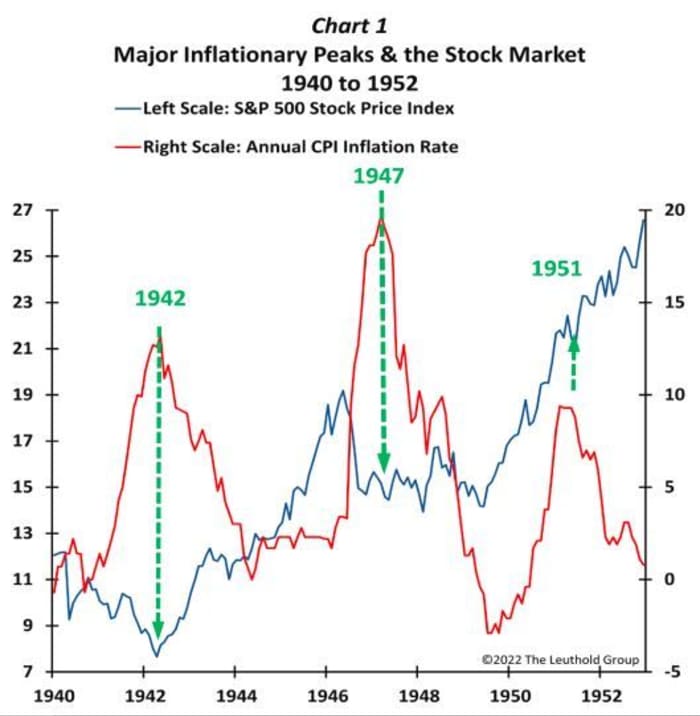

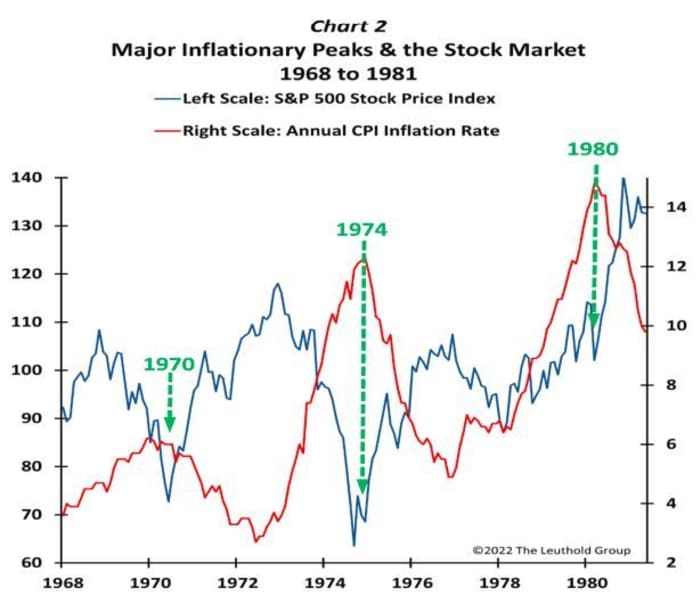

In five of seven historical inflationary surges, “the S&P 500 either bottomed coincident with or in advance of the ultimate inflation peak,” says Jim Paulson, chief investment strategist of The Leuthold Group.

Leuthold Group

Among the exceptions, in one instance the stock market moved sideways for months after that peak, though didn’t see big moves lower. And in 1970, stocks moved south even after that inflation high, though downswing was brief and the S&P 500 fully recovered after a few months, notes the strategist.

Leuthold Group

The tickers

These were the top searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

BBBY, |

Bed Bath & Beyond |

|

NIO, |

NIO |

|

APE, |

AMC Entertainment preferred shares |

|

AAPL, |

Apple |

|

NOK, |

Nokia |

|

CHPT, |

Chargepoint |

|

AMZN, |

Amazon |

Random reads

Coffee vigilantes come to the aid of Goldman employees.

Another mysterious death hits Russian Pres. Vladimir Putin’s inner circle.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

By

Barbara Kollmeyer

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.