#Market Snapshot: What will it take to dent this Teflon stock market? Here’s how to invest, meanwhile.

Table of Contents

“#Market Snapshot: What will it take to dent this Teflon stock market? Here’s how to invest, meanwhile.”

It’s the stock market of steel

What’s it going to take to knock the U.S. equity market off-kilter?

After the prospect of a collapse of a giant Chinese property developer saddled with some $300 billion in debt saw blue chips put in their worst one-day decline in two months on Monday and the Federal Reserve confirmed on Wednesday it will soon start tightening monetary policy, the Dow Jones Industrial Average

DJIA,

ended the week higher.

SPX,

booked its worst daily fall in four months and momentarily dipped below its 50-day moving average before closing out Friday with a respectable weekly gain, as did the Nasdaq Composite Index

COMP,

The week’s narrative included the Federal Reserve finally confirming it is going to wind down its bond purchase program, implemented during the worst of the coronavirus pandemic last year, now that the economy is recovering, and also signalling an eventual rise in interest rates, though Fed Chairman Jerome Powell pushed back against the idea that was a certainty next year.

We asked Michael Antonelli, market strategist at investment bank Robert W. Baird & Co. via email if the stock market was bulletproof:

After rephrasing our question and adding a smiley face for extra effect, here’s what Antonelli said:

Two things to remember: 1). There’s a ton of money sloshing around our system and when that happens it finds its way to risk assets like stocks. It has to go somewhere. 2) The stock market certainly thinks about and discounts all those things you mentioned, but it’s also looking at earnings and profits, both of which are expected to rise in 2022.

Based on earnings expectations and maintaining current multiples, Antonelli sees room for the S&P 500 to rally to 5,000 by the end of 2022.

Meanwhile, Morgan Stanley’s Michael Wilson is holding firm to a target of 4,000 for the broad-market benchmark by the end of 2021. In other words, Wilson is looking for a market correction in the order of about 10% from current levels.

It would seem that something has got to give?

Lindsey Bell, chief investment strategist for Ally Invest, described the start of the week’s action as a “storm” that “everybody saw coming, but nobody expected,” a reference to the potential default by China Evergrande

3333,

with some possibility of financial contagion in global markets.

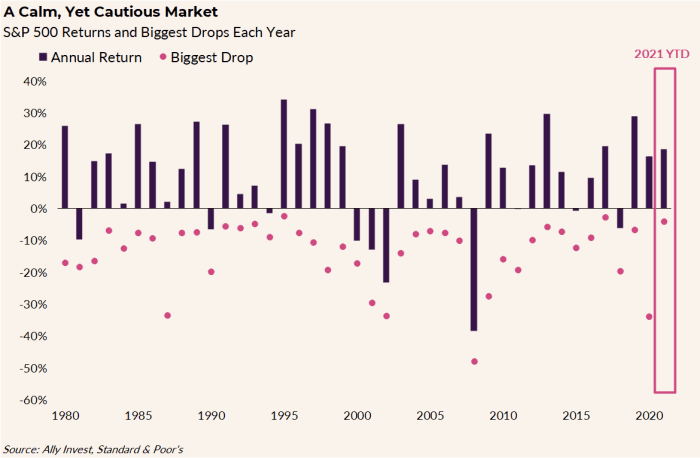

Bell said that what was expected to be good for the stock market’s bears, who have been long expecting a retreat in equities, given the S&P 500 hasn’t seen a drawdown of at least 5% on a closing basis for more than 220 days, turned out to be a nothingburger for this resilient market.

via Ally Invest

To be sure, it wasn’t just Evergrande that had the tongues of market participants wagging. MarketWatch outlined a list of items that were challenging investor optimism from a federal debt limit fight in Congress to complacency around monetary policy.

Bell, in a Friday research note, said that it’s “hard to disappoint a market that is bracing for a meltdown.”

She said that the current bout of fear emanating from Wall Street could be of the variety that keeps euphoric investors from doing anything rash.

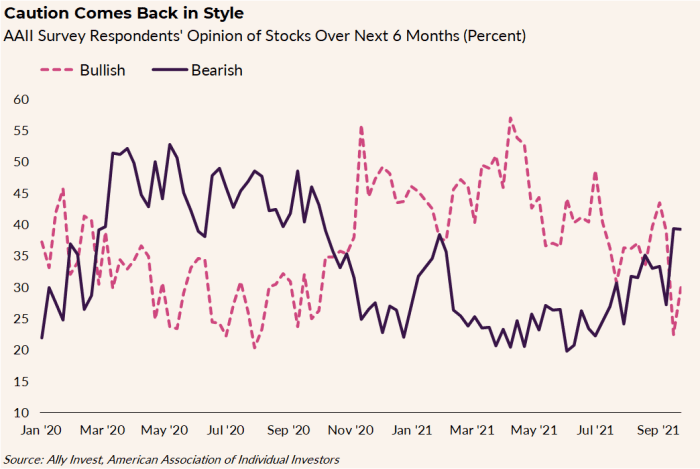

A survey from the American Association of Individual Investors shows that last week, the number of investors who were pessimistic or neutral on the market’s prospects rose to the highest level in 14 months.

via Ally Invest

Growing bearishness can be a contra-indicator.

“Cautious investors tend to pay more attention to risks and hedge their portfolios, which makes them less likely to sell in times of crisis. Fear can also lead to more cash on the sidelines that could flow back into the market if prices fall. Typically, the worst selloffs occur when the market is underestimating risks, not overestimating them,” Bell wrote.

A number of Wall Street traders and analysts, however, commented that Monday’s stock tumble was marked by a sort of matador, “get out of the way” trading strategy that saw liquidity dry up as markets hit the skids. That is far from the buy-the-dip sensibility that has characterized much of retail-driven regime in markets, lately.

So, sometimes fear can turn a run-of-the-mill correction into the sort of deer-in-headlights type of trade that can lead to a more definitive rout.

One thing that might be worth watching is bond yields. The 10-year Treasury note

TMUBMUSD10Y,

yield was climbing on Friday, touching around 1.45%, with yields for the benchmark registering the biggest weekly rise since March 19.

The rise in benchmark bond yields reflects the Fed’s decision to taper its bond purchases soon and expectations for higher interest rates next year, but they also may signal acceptance that the economic recovery will grind on despite the spread of the coronavirus delta variant.

Powell on Wednesday suggested that it might take a fairly weak labor-market report to derail the Fed’s monetary-policy plans.

However, as bond yields climb, borrowing costs for most businesses rise, potentially crimping profits. Higher yields also could prompt some risk-averse investors to sell stocks in exchange for the perception of safer yields from government debt.

It is worth noting that yields remain historically low and nowhere near the 2% levels that most analysts had predicted would be in force by this point in the economic recovery cycle. Many analysts are maintaining predictions for yields to approach 2% by the end of the year.

Bell provided a road map for if/when things go pear-shaped (edited for brevity):

- Exit plan. When you buy a stock or security, have an exit plan in mind. It will keep you from selling prematurely just because the market is dropping.

- Balance. The strongest portfolios have a good balance between aggressive and conservative assets.

- Cash is not trash: Cash gets a bad rap these days. Inflation is high, so that is understandable, but a small stash of cash could be one of your most stable holdings during a market breakdown.

- Play some defense: Sectors like utilities, healthcare and consumer staples tend to hold up better in selloffs because of their stability.

Key Fed speakers

Powell will be busy next week too. The Fed chairman testifies before the Senate Committee on Banking, Housing, and Urban Affairs on Tuesday at 10 a.m. ET, and follows that with a policy panel discussion with the European Central Bank on Wednesday at 11:45 a.m.

Separately, president of the New York Federal Reserve John Williams speaks at noon ET on Monday at the Economic Club of New York, with Fed. Gov. Lael Brainard also set to deliver remarks at the National Association for Business Economics at 12:50 p.m. on Monday.

The data

It is a busy week for U.S. economic data: A report on August durable goods orders is due at 8:30 a.m. ET Monday. On Tuesday, a reading of August international trade is due at 8:30 a.m., followed by a the July S&P Case-Shiller home price index at 9 a.m. and the Conference Board September consumer confidence index at 10 a.m.

On Wednesday, August pending homes sales will be released at 10 a.m., and on Thursday, weekly jobless benefit claims for the period ended Sept. 25, and the final reading of Q2 GDP are due at 8:30 a.m.

Concluding next week on Friday, are reports on August personal income and spending and core inflation at 8:30 a.m.; the September purchasing managers indices for the manufacturing sector from IHS Markit at 9:45 a.m. and the Institute for Supply Management at 10 a.m., along with August construction and September consumer sentiment from the University of Michigan.

What we read and wrote

- Biden acknowledges ‘stalemate’ over bills on infrastructure and social spending, while Pelosi aims for House votes next week (MarketWatch)

- Ten-year Treasury yield breaches 1.45% to hit the highest level since July (MarketWatch)

- How the U.S. Debt Ceiling Works and Why It Matters (WSJ)

- U.S. seen running out of cash between Oct. 15 and Nov. 4, as debt-limit drama continues (MarketWatch)

- Why the debt limit fight makes Washington a stock-market ‘wild card’ (MarketWatch)

- Why China’s Evergrande Has Global Markets on Edge (MarketWatch)

- Fed’s popular repo facility sees record demand of $1.35 trillion Thursday (MarketWatch)

- Supply-chain pain will probably get worse this year, BofA warns (MarketWatch)

- China’s crypto ban has almost achieved a ‘meme-like status,’ but here are the lingering impacts (MarketWatch)

- Some Vaccines Last a Lifetime. Here’s Why Covid-19 Shots Don’t. (WSJ)

By

Mark DeCambre

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.