#Market Extra: What’s next for the stock market after the worst 1st half since 1970? Here’s the history.

Table of Contents

“Market Extra: What’s next for the stock market after the worst 1st half since 1970? Here’s the history.”

Nasdaq set for worst first-half on record

A bear market that began on the first trading day of 2022 has the S&P 500 on track for its worst first half in 52 years. Investors looking ahead to the end of the year might have some reason for hope, though history is only a rough guide.

The S&P 500

SPX,

was down 19.9% year-to-date through Wednesday’s close, which would be its worst first half since 1970, according to Dow Jones Market Data. The large-cap benchmark is down 20.4% from its record finish on Jan. 3. The index earlier this month first ended more than 20% below that early January record, confirming that the pandemic bull market — as widely defined — had ended on Jan. 3, marking the start of a bear.

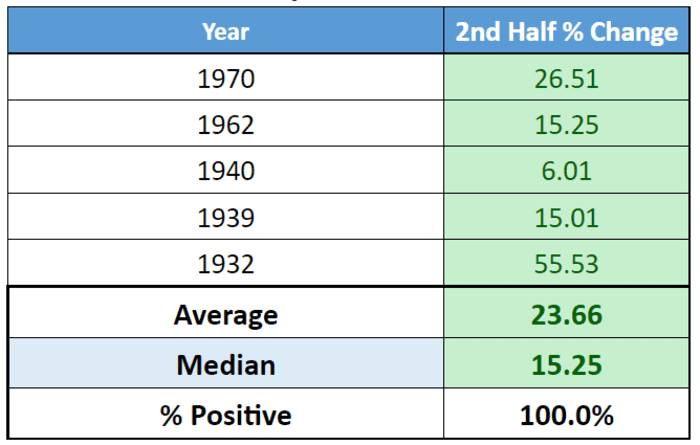

Data compiled by Dow Jones Market Data shows that the S&P 500 has bounced back after past first-half falls of 15% or more. The sample size, however, is small, with only five instances going back to 1932 (see table below).

S&P 500 second-half performance after a first-half fall of 15% or more

Dow Jones Market Data

The S&P 500 did rise in each of those instances, with an average rise of 23.66% and a median rise of 15.25%.

Read: Stagflation, reflation, soft landing or a slump: What Wall Street expects in the second half of 2022

Investors, however, may also want to pay attention to metrics around bear markets, particularly with the will-it-or-won’t-it speculation around whether the Federal Reserve’s aggressive tightening agenda will sink the economy into recession.

Indeed, an analysis by Wells Fargo Investment Institute found that recessions accompanied by a recession, on average, lasted 20 months and produced a negative 37.8% return. Bear markets outside a recession lasted 6 months on average — nearly the length of the current episode — and saw an average return of -28.9%. Taken together, the average bear market lasted an average of 16 month and produced a -35.1% return.

See: Presidential election cycle shows that stock market may bottom in the third quarter before rally in the fourth, analyst says

Other major indexes are also set to log historic first-half declines. The Dow Jones Industrial Average

DJIA,

was down 14.6% in the year to date through Wednesday, which would be its biggest first-half fall since 2008.

Deep Dive: Wall Street’s favorite stock sector has potential upside of 43% as we enter the second half of 2022

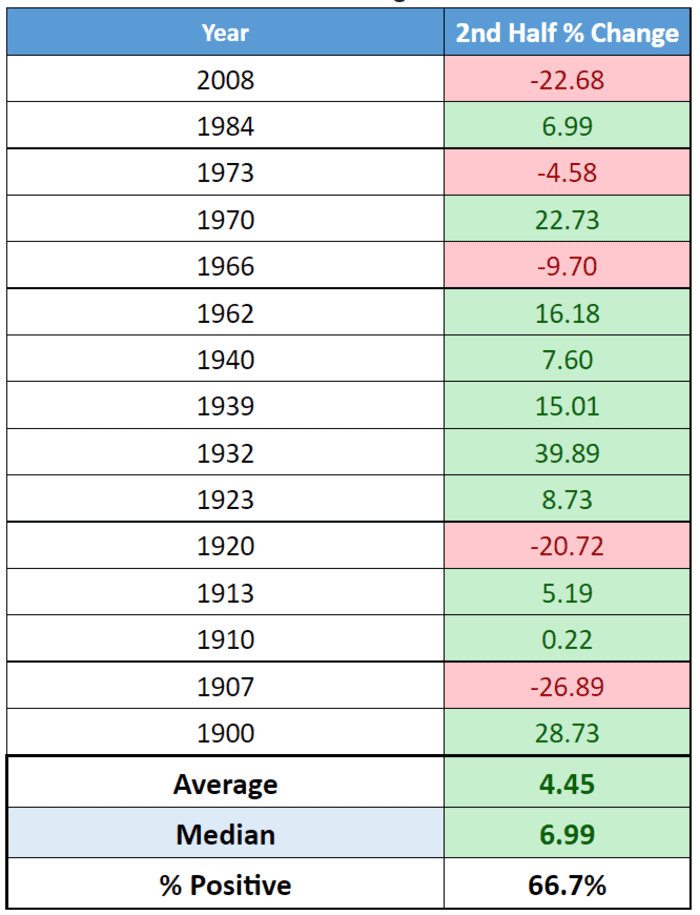

As the table below shows, the second-half performance for the blue-chip gauge after first-half declines of 10% or more are variable. The most recent incident, in 2008 during the worst of the financial crisis, saw the Dow drop another 22.68% in the second half of the year.

DJIA second-half performance after 10% fall in first half

Dow Jones Market Data

In the 15 instances, the Dow rallied in the second half two-thirds of the time, producing an average second-half rise of 4.45% and a median gain just shy of 7%.

Check out: Financial markets seen unprepared for risk that inflation resists Fed rate hikes in second half of 2022

The tech-heavy Nasdaq Composite

COMP,

was down 28.6% year-to-date through Tuesday’s finish, but there was little to go on when Dow Jones Market Data looked back at first-half drops of at least 20% for the gauge.

There were only two instances — 2002 and 1973 — and both saw the Nasdaq keep sliding over the remainder of the year, falling around 8.7% over the second half in both instances.

Also see: Major bond ETFs on pace for worst first half to a year on record

By

William Watts

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.

![#NBA issues memo warning discipline for Damian Lillard if his camp keeps saying he’ll only play for the Heat [Video]](https://s.yimg.com/ny/api/res/1.2/QWqRT.na_LvRNidL72nIiA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/aol_yahoo_sports_800/c86c1ba2dec79a284f31bbb8f2cce62a)