Rules are there to be broken. That may be a standard mantra for anarchists. But for traders such thinking may prove to be dangerously dismissive.

Investors therefore may like to consider the latest note from Bank of America’s Savita Subramanian in which the star analyst describes how “one rule with a perfect track record says the market hasn’t bottomed.”

Subramanian, head of U.S. equity and quantitative strategy, says that only 30% of the conditions required for a market bottom are currently triggered following this latest rebound that has taken the S&P 500

SPX,

-0.72%

up 16.6% from its mid-June low. Usually, at least 80% of the conditions must be registered before the all-clear can be called.

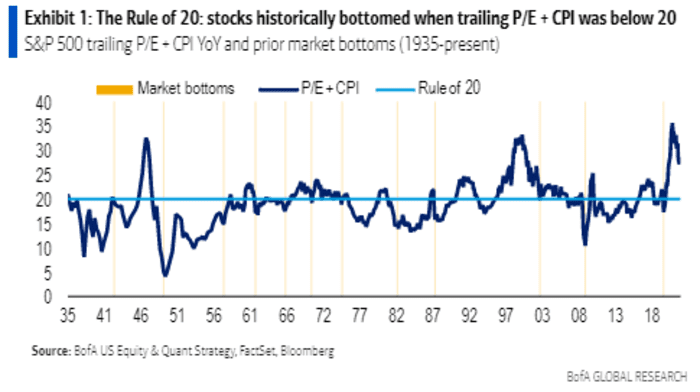

One of these signposts in particular is essential — the Rule of 20. That is when the sum of yearly consumer price inflation and the market’s trailing price-to-earnings ratio is lower than 20 when the market hits its trough.

Currently the market P/E is 20 and CPI is 8.5%, Surbramanian notes. That’s 28.5.

“Outside of inflation falling to 0%, or the S&P 500 falling to 2500, an earnings surprise of 50% would be required to satisfy the Rule of 20, while consensus is forecasting an aggressive and we think unachievable 8% growth rate in 2023 already,” she says.

Meanwhile, BofA also reckons stocks are not sufficiently cheap because the market is underestimating the chances of a contracting economy.

“A 20% likelihood of a recession is now priced in versus 36% in June. In March, stocks priced in a 75% probability of recession. Even on Enterprise Value to Sales, where sales should be elevated by the tailwind of 9% CPI, the market multiple is excessively elevated (+40%) relative to history — possibly because real sales growth ex-Energy is essentially flat.”

Other signposts that must be triggered to confirm a bottom, but currently are not, include: the Fed cutting rates; a 50 basis point or more decline in the 2-year Treasury yield

TMUBMUSD02Y,

3.274%

; a rising unemployment rate versus the 12-month low; a sell-side indicator buy signal.

Signals that are currently giving the green light to bulls include: Improving PMIs; and more bears than bulls.

Given all this, Subramanian favors the energy and industrial sectors and suggests selling consumer-focused stocks.

“Industrials could be lifted by already strong capex (it grew +19% YoY in 2Q) and with companies guiding still higher on capex during second-quarter earnings season. Capex may be more of a necessity amid a tight labor market warranting automation and de-globalization, and should hold up better than in prior recessions,” she writes.

The S&P 500 has dropped 10% this year. The Dow Jones Industrial Average

DJIA,

-0.50%

has declined by 6%, while the Nasdaq Composite

COMP,

-1.25%

has lost 17%.